Wells Fargo & Co. ($WFC) revealed 30-year fixed mortgage rates now diverge up to 1.8% based on borrower FICO bands, bringing “current mortgage rates by credit score” sharply into focus. Data from November 2025 shows spreads exceeding expectations even for well-qualified buyers. What is behind these escalating rate differentials?

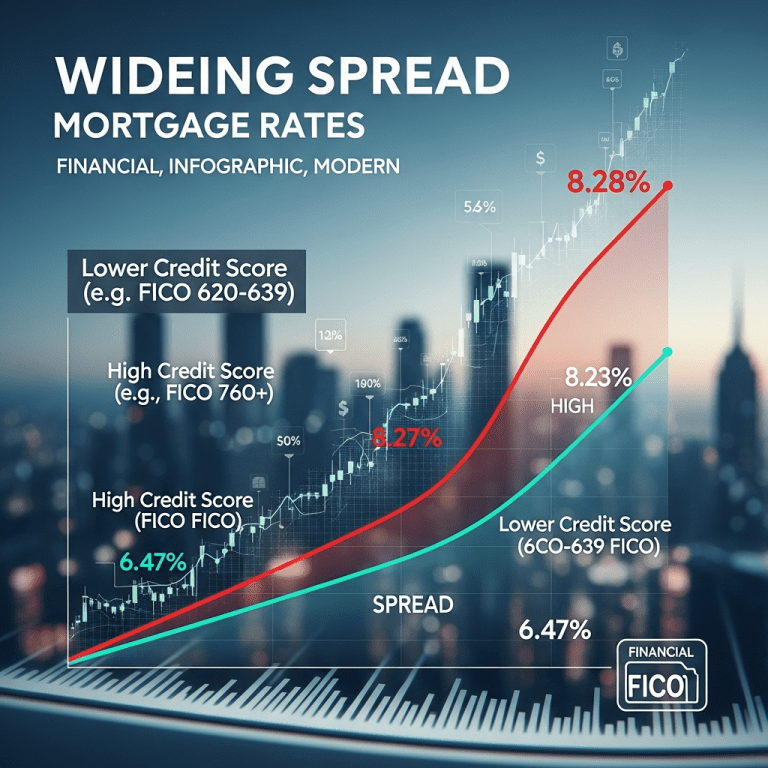

Mortgage Rate Spreads Widen: Prime Scores Get 6.47%, Subprime Hits 8.28%

As of November 1, 2025, borrowers with FICO scores above 760 secured a 30-year fixed rate averaging 6.47%, according to Freddie Mac’s latest weekly mortgage survey. For those in the 700–759 range, the average rose to 6.78%. Homebuyers with scores between 620–639 faced a significant jump, quoted at 8.28%. These spreads are at their widest since 2011 per Mortgage Bankers Association data. Applications for new mortgages dropped 5.3% in October 2025 compared to a year earlier, reflecting tightening lending standards across top lenders such as JPMorgan Chase & Co. ($JPM) and Bank of America Corp. ($BAC). Lenders say higher rate tiering is a direct response to both rising default risk and post-pandemic loan losses—outpacing April’s average spreads by 0.7 percentage points (source: Freddie Mac Primary Mortgage Market Survey, November 2025).

How Widening Mortgage Rate Gaps Impact the U.S. Housing Market

The greater differentiation in current mortgage rates by credit score is reshaping housing affordability nationwide. In high-demand metropolitan areas like San Francisco and Miami, lower-credit borrowers are now effectively priced out, as monthly loan payments on a $400,000 home can vary by over $400 depending on FICO tier (source: Zillow, October 2025). The National Association of Realtors reports that housing inventory remains tight, yet demand has cooled as rate-sensitive buyers opt to rent or delay purchases. Rising spreads are intensifying financial gaps between buyers and could further slow home price appreciation, especially where first-time or subprime buyers comprise a large market share. Additionally, macroeconomic uncertainty—highlighted by the Federal Reserve’s hold on benchmark rates at 5.50% in September 2025—is keeping lenders cautious about loosening criteria (stock market analysis).

Portfolio Strategies: Navigating Mortgage Rate Risks by Credit Band

For investors in bank stocks like Wells Fargo ($WFC), mortgage REITs, and housing ETFs, the amplified spread in current mortgage rates by credit score presents a double-edged sword. While lenders potentially grow net interest margins from risk-based pricing, higher rates could depress origination volumes and servicing fees. Those holding residential REITs must watch for increased delinquencies on lower-credit loan pools. Short-term strategies include reallocating toward prime mortgage-backed securities and away from subprime exposures, especially as portfolio stress tests suggest modest upticks in 90-day delinquencies post-June 2025 (source: S&P Global Market Intelligence). Advisors also suggest monitoring policy shifts that could spur refinancing waves if rates stabilize (latest financial news). For broader rate environment analysis, see investment strategy.

Analysts Expect Credit-Based Rate Spreads to Endure into 2026

Industry analysts at Moody’s and Black Knight observe that the current mortgage rate spread by credit score is primarily driven by heightened risk aversion and lingering uncertainty over household credit health. They project that unless the Federal Reserve signals a clear pivot or credit risk outlook improves, lenders will maintain current differential pricing well into 2026. Market consensus points to sustained wide spreads as a structural post-pandemic shift.

Current Mortgage Rates by Credit Score Signal a Different Market in 2025

Rising spreads in current mortgage rates by credit score highlight a new era for U.S. borrowers and investors alike. Watch for further lender adjustments if economic conditions change or regulatory relief emerges. Proactive monitoring of score-based pricing is essential for anticipating shifts in lending, investing, and homebuying in 2025 and beyond.

Tags: mortgage rates, credit score, WFC, housing market, lending trends