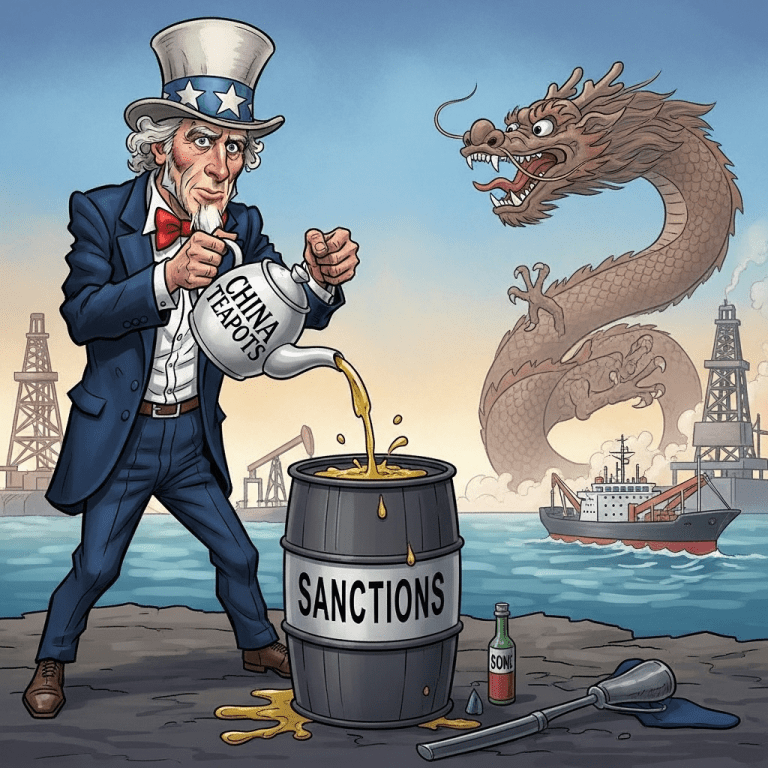

In a significant policy shift, Washington targets China’s teapots in new oil crackdown, heightening tensions in the global energy markets as we head into 2025. This strategic move is poised to affect trade flows, commodity prices, and investment decisions across the energy sector.

Why Washington Targets China’s Teapots in New Oil Crackdown

China’s independent refineries, colloquially known as “teapots,” have long operated with a degree of flexibility that state-owned giants do not enjoy. Over recent years, these teapots have ramped up their crude imports, sometimes taking advantage of regulatory loopholes. By targeting these entities, the U.S. aims to disrupt channels that have helped China circumvent sanctions on sanctioned oil nations—particularly Russia, Iran, and Venezuela.

In the current geopolitical climate, Washington’s focus on teapots is twofold: to strengthen enforcement of existing sanctions and to increase pressure on Beijing to align with Western energy security norms. The new crackdown leverages financial, logistical, and insurance oversight to limit teapot access to global crude markets, particularly restricting their dealings in grey-market barrels.

The Impact on Global Oil Flows

This new policy sends shockwaves through global oil supply chains. Chinese teapots, which account for up to 30% of the nation’s refining capacity, play a vital role in importing oil, especially from sanctioned countries. By disrupting these flows, the U.S. seeks not only to curtail sanctioned regimes’ revenues but also to rebalance the competitive landscape among global energy exporters.

For global commodity traders and investors looking for market volatility analysis, the crackdown may drive short-term price spikes, especially if Chinese teapots reduce imports from sanctioned countries and turn to legitimate markets—tightening global supply.

Strategic Implications for Energy Investors

The ramifications of the Washington targets China’s teapots in new oil crackdown policy extend beyond immediate trade impacts. Investors in oil futures, midstream infrastructure, and refining sectors must recalibrate outlooks as regulatory scrutiny intensifies. Chinese refining margins are likely to come under pressure, possibly prompting consolidation or shutdowns among less efficient teapots.

Risks and Opportunities in the Oil Market

Energy equities, especially multinational oil majors and marine transporters, may experience increased volatility. For portfolio managers seeking energy sector diversification, monitoring these policy shifts is crucial. With diminished “grey market” flows, legitimate sources of crude stand to benefit, potentially lifting prices and margins for compliant producers.

Conversely, heightened scrutiny and trade frictions may lead to softened demand in China’s downstream markets, affecting global product flows and investment in expansion projects. Asian spot prices—such as Dubai and Oman benchmarks—might see dislocation if teapot demand wanes or shifts abruptly.

Washington’s New Oil Crackdown: What’s Next?

Washington’s move is a clear signal to global markets that enforcement around energy sanctions will become stricter in 2025. Analysts anticipate that the scrutiny will evolve beyond the initial crackdown, embracing digital tracking, tighter ship-to-ship monitoring, and enhanced financial compliance. This broader enforcement regime will pressure market participants to adhere to lawful trading or risk reputational and financial penalties.

Key Takeaways for 2025 Energy Investors

As Washington targets China’s teapots in new oil crackdown, investors and market participants must prepare for heightened regulatory risk and shifting trade flows. Maintaining robust compliance and monitoring emerging policies will be vital in navigating the opportunities and pitfalls this crackdown generates. For those looking for deeper investment insights, the evolving situation offers potential rewards to proactive and knowledgeable players in the energy sector.