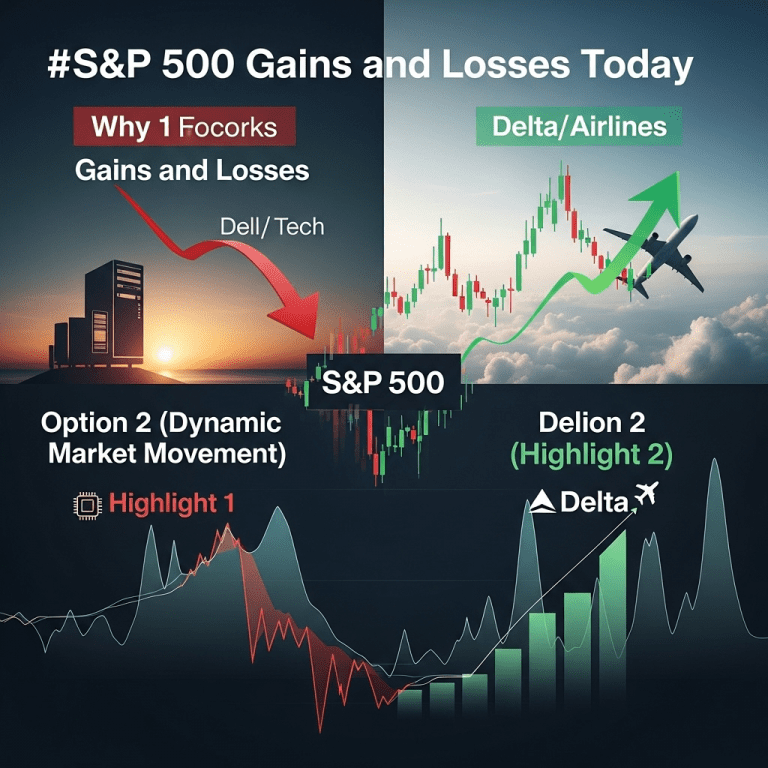

Investors are closely tracking S&P 500 gains and losses today as the market responds to shifting sector dynamics. With tech stocks like Dell pulling back and airlines, led by Delta, surging ahead, traders are seeking clarity on what’s next for the broader index.

S&P 500 Gains and Losses Today: Key Movers in Focus

The S&P 500 posted mixed results in today’s trading session, reflecting the ongoing tug-of-war between different sectors. Technology giant Dell Technologies retreated substantially after its recent earnings report fell short of Wall Street’s high expectations. Meanwhile, airline stocks soared with Delta Air Lines at the helm, underpinning a broader rally in the travel sector.

Dell Retreats Amid Tech Sector Weakness

Dell Technologies saw its share price decline by over 7% during today’s market hours, erasing some of its year-to-date gains. The fall came as investors reacted to the company’s Q2 forecast, which highlighted slower growth in enterprise spending. This sell-off weighed on the overall technology sector, one of the S&P 500’s largest components. Despite recent momentum, other big names such as HP Inc. and Lenovo also dipped, signaling broader concerns about hardware demand in an uncertain economic environment.

Airlines Rally: Delta Air Lines Leads the Way

In sharp contrast to tech, the airline sector powered higher. Delta Air Lines shares climbed nearly 5% after the carrier raised its full-year profit guidance, citing robust summer travel bookings and improved fuel cost management. United Airlines and American Airlines followed suit, each posting solid gains. The positive sentiment extended to smaller carriers and associated service companies, reflecting investor optimism for continued recovery in global travel demand. For more background on travel sector performance, explore market trends shaping this industry.

Sector Insights: What’s Driving S&P 500 Gains and Losses Today?

The divergence in sector performance underlines the importance of diversification within the S&P 500 index. While technology stocks remain sensitive to macroeconomic developments and changing enterprise budgets, cyclical sectors such as airlines are benefiting from pent-up demand and consumer resilience. Analysts recommend watching upcoming economic data, which could influence both interest rate expectations and consumer behavior in the coming weeks.

Broader Market Overview and Investor Reaction

The mixed performance of the S&P 500 today mirrors a market grappling with macro uncertainties. Economic data released this morning painted a nuanced picture: inflation moderated slightly, but consumer confidence came in below forecasts. Financials and healthcare sectors saw modest gains as investors rebalanced portfolios. For those interested in identifying future opportunities, reviewing investment research may help strategize around sectors reacting most dynamically to economic reports.

What’s Next for the S&P 500?

With S&P 500 gains and losses today highlighting both sector strengths and vulnerabilities, analysts are cautious but not bearish. Many expect volatility to persist as companies update forecasts for the remainder of 2025. Continued monitoring of earnings, interest rates, and geopolitical developments will be crucial as investors look for signals on sustained index performance. Those new to navigating sector plays can consult portfolio strategy guides to further refine their approach.

Conclusion: Navigating S&P 500 Gains and Losses Today

S&P 500 gains and losses today demonstrate the significance of sector leadership shifts in shaping overall market direction. As Dell retreats and Delta leads airlines higher, investors are reminded of the importance of staying informed and responsive to changing market drivers. Keeping a close eye on company guidance, macroeconomic indicators, and sector rotation will help position portfolios for potential opportunities in the volatile but opportunity-rich 2025 investing landscape.