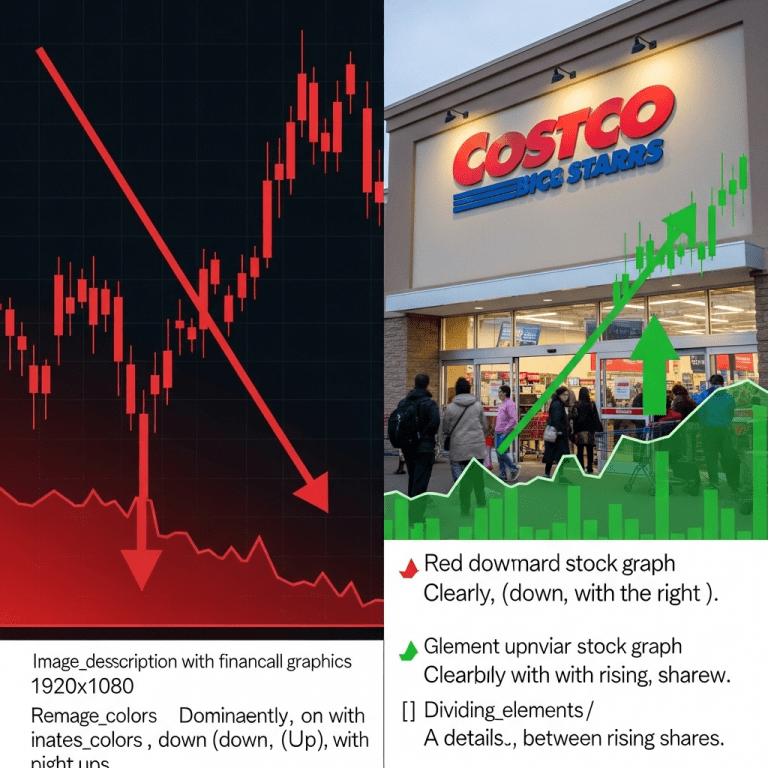

The phrase “stocks fell today Costco’s shares rose” perfectly captures the market dichotomy that played out in today’s trading session. While the broader indices experienced a downturn due to macroeconomic headwinds, Costco managed to defy the overall trend with a notable gain. This divergence piqued the interest of investors and analysts alike, prompting a closer examination of what set Costco apart from its peers.

Stocks Fell Today Costco’s Shares Rose: Market Dynamics Explained

Today’s market session saw the S&P 500 and Nasdaq both log declines as concerns over persistent inflation, interest rate uncertainty, and global economic growth stoked investor caution. However, amid these broader losses, shares of Costco Wholesale Corporation (COST) closed higher, standing out as a rare success story on a turbulent day for equities.

While high growth tech stocks were especially vulnerable to profit-taking, stable retail and consumer staple names attracted risk-averse capital. For Costco, this pattern was particularly pronounced as the company reported stronger-than-expected same-store sales numbers for the prior quarter, underscoring its reputation as a defensive stock during volatile periods.

Costco’s Earnings Drive Outperformance

The key catalyst behind Costco’s climb was its latest earnings report. The retail giant revealed that both revenue and net income surpassed analyst expectations, driven by robust membership renewals and resilient consumer demand for value-oriented shopping. In contrast to many discretionary retailers struggling with softening foot traffic, Costco has continued to see strong basket sizes and memberships, reflecting consumers’ push for savings in an inflationary environment.

Industry analysts highlighted the company’s unique membership model, which provides a recurring revenue stream and helps buffer margins—key factors that appeal to long-term investors seeking stability. This membership-driven approach has given Costco a competitive edge amid pressures facing the broader retail sector.

Analyzing Broader Market Weakness

While Costco’s success story is notable, it’s essential to contextualize it within broader market weakness. Today, stocks fell as investors digested cautious statements from the Federal Reserve regarding the timeline for potential interest rate reductions. Renewed concerns over sticky core inflation and mixed economic data added pressure, with profit-taking intensifying in high-valuation sectors and cyclical industries.

Defensive Stocks Attract Investors

In times of market turbulence, defensive sectors such as utilities, healthcare, and consumer staples tend to outperform. Costco, with its scale and pricing power, has become a ‘go-to’ for capital rotating out of riskier assets. Many market participants turned to diversifying portfolios by adding exposure to companies like Costco during declines in risk sentiment.

Why Costco Bucks the Trend When Stocks Fall

The resilience of Costco’s shares in the face of a market selloff is driven by several operational advantages. Its buying scale allows it to pass cost savings to customers, which increases loyalty amid economic headwinds. Furthermore, a large portion of revenues come from recurring membership fees, helping smooth out earnings even as retail competition heats up.

Costco’s international expansion has also delivered growth despite global market instability, providing additional diversification. As consumers remain cost-conscious in 2025, Costco is well-positioned to capture value-hungry shoppers looking to maximize every dollar—a sentiment echoed by many analysts covering retail sector trends.

What This Means for Investors

For market participants monitoring daily moves, today’s action reinforces the importance of portfolio diversity. While growth and technology stocks can outperform in bullish markets, adding stable, defensive companies like Costco can help balance risk during uncertain times. Investors who favor a mix of cyclical and non-cyclical opportunities may take guidance from Costco’s ability to thrive amid broader declines.

Looking Ahead: Will Costco Maintain Momentum?

The key question for the coming quarters is whether Costco can sustain its outperformance as economic uncertainties persist. The company’s financial discipline, membership growth, and optimization of supply chains suggest continued resilience. However, ongoing shifts in consumer preferences and potential changes in monetary policy could impact sector rotations and valuation multiples across retail stocks.

For now, the narrative of “stocks fell today Costco’s shares rose” highlights the value of fundamental strength and business model flexibility. As the 2025 landscape evolves, such attributes may determine which stocks become investors’ preferred havens during market storms.