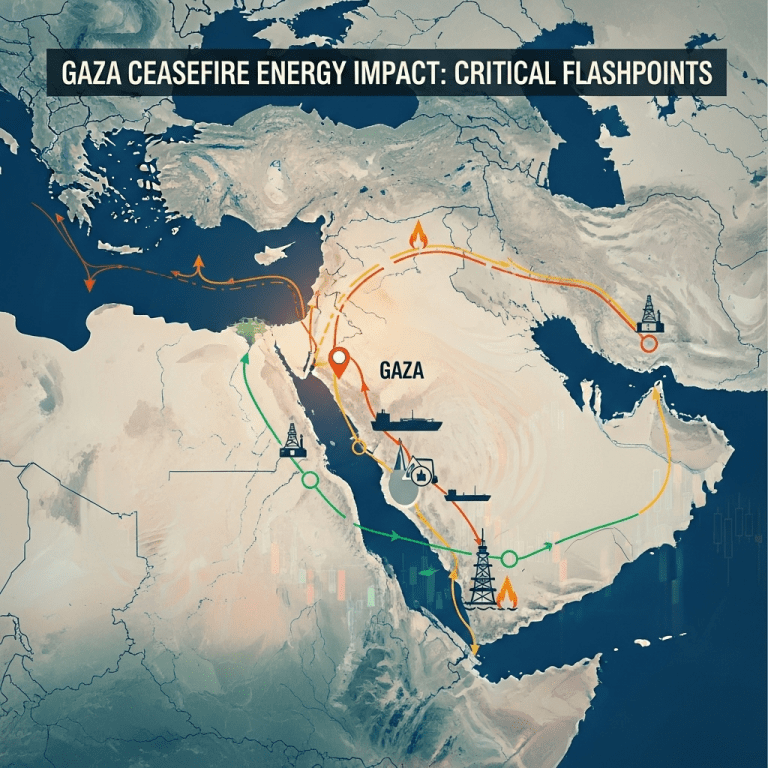

The Gaza ceasefire energy impact is a crucial focus for investors as the ongoing conflict and attempts at peace in the region send ripples through global energy markets. As 2025 unfolds, understanding the vital flashpoints that shape this scenario is paramount for making informed energy and investment decisions.

Gaza Ceasefire Energy Impact: Five Critical Flashpoints

Tensions in Gaza don’t just raise humanitarian concerns—they also influence oil and gas supply, shipping routes, investor confidence, and broader Middle East geopolitics. Here are five flashpoints investors should watch to gauge the Gaza ceasefire energy impact this year.

1. Stability of Egyptian Energy Transit Routes

Egypt plays a pivotal role as a conduit for energy supplies, notably through the Suez Canal and SUMED pipeline. Any escalation or renewed disruptions stemming from Gaza could threaten the uninterrupted flow of LNG and oil to Europe and Asia. Investors monitoring these routes should pay close attention to regional security updates, as any blockages or attacks could spike global energy prices and reroute maritime traffic. For further context on how such supply chain threats shape strategies, explore investment insights by leading analysts.

2. Risk of Broader Regional Escalation

The potential for the Gaza conflict to spill over into neighboring countries, including Lebanon and Iran, remains. Should the ceasefire falter, increased military activities could put vital Persian Gulf infrastructure and production facilities at risk, destabilizing a region responsible for a significant share of the world’s oil exports. Traders and companies need to evaluate their exposure and contingency plans for such black swan developments.

3. Shifting LNG Demand and European Energy Security

Europe’s reliance on LNG imports has deepened since the Russia-Ukraine crisis. The Gaza ceasefire’s durability will influence risk premiums in LNG markets. Should the truce hold, the risk of sudden LNG shortfalls recedes, offering some stability to energy pricing and supply. Conversely, renewed hostilities could squeeze availability, prompting European governments and suppliers to revisit their procurement strategies.

4. Recovery Prospects for Gaza’s Energy Infrastructure

The long-term Gaza ceasefire energy impact also hinges on reconstruction. Damage to local power plants, pipelines, and grids has crippled Gaza’s domestic energy security, with potential knock-on effects for neighboring markets. Redevelopment, supported by international donors, could stimulate regional demand for fuels, renewables, and technology. Tracking which firms win reconstruction contracts can offer clues for emerging market opportunities.

5. Evolving Investor Sentiment and Geopolitical Premiums

Energy markets are acutely sensitive to geopolitical developments. Ceasefire agreements that fail to deliver lasting peace tend to maintain or elevate the so-called “risk premium” in oil and gas prices. On the flip side, if key security guarantees hold, heightened investor confidence can reduce volatility and foster long-term investment in infrastructure and renewables. Assessing sentiment, as highlighted in recent market outlook reports, is essential to forward-leaning strategy.

Broader Implications for Energy Risk Strategy

The interplay between peace prospects and energy dynamics in Gaza extends well beyond headlines. Investors will be watching how each flashpoint contributes to the Gaza ceasefire energy impact—not just for short-term trading gains, but also to shape strategic asset allocation in anticipation of shifting supply and demand fundamentals. Staying informed and agile is critical as these events continue to unfold in 2025.