The surge in digital real estate transactions has made it critical to identify robust ways title companies can combat seller impersonation fraud. As fraudsters use increasingly sophisticated tactics, title companies must stay ahead to protect buyers, sellers, and the integrity of property transactions.

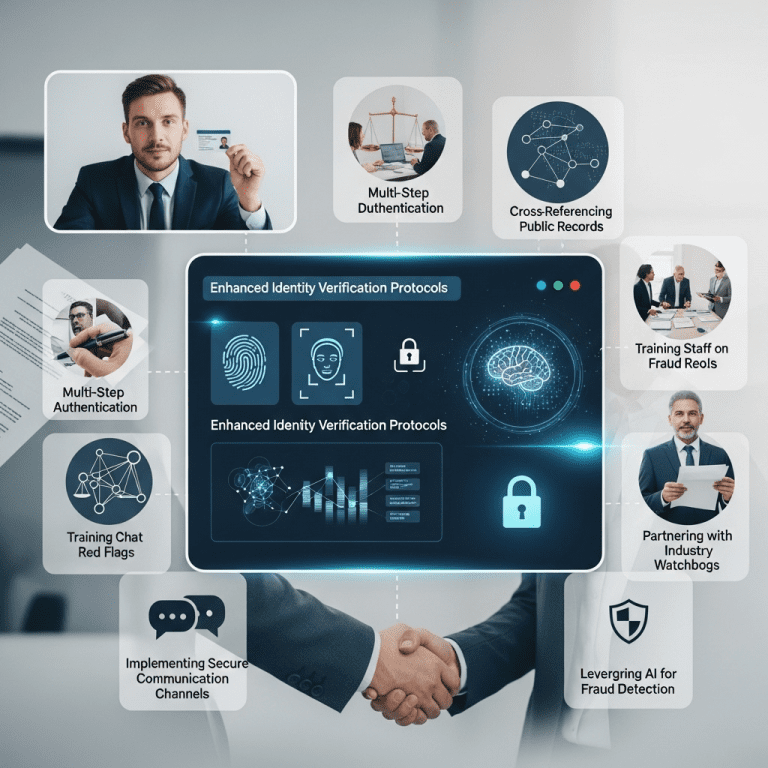

7 Proven Ways Title Companies Can Combat Seller Impersonation Fraud

Seller impersonation fraud threatens the very foundation of trust in real estate transactions. Here are seven actionable strategies title companies should implement to mitigate this rising risk in 2025.

1. Enhanced Identity Verification Protocols

Traditional ID checks are no longer sufficient. Title companies should invest in advanced digital ID verification solutions, such as biometric authentication, AI-driven ID matching, and remote video notary services. Utilizing government-grade verification technologies helps confirm that sellers are, in fact, who they claim to be.

2. Multi-Step Document Authentication

Careful scrutiny of documents is key. Employing multi-factor checks—such as verifying digital signatures, cross-referencing notary records, and examining document metadata—can catch discrepancies early. Leveraging automation, while maintaining human oversight, adds an extra layer of security against forged paperwork.

3. Training Staff on Fraud Red Flags

Regular staff training is essential for spotting emerging threats. Title company employees should be educated on the latest social engineering tactics and red flags, including mismatched signatures, sudden changes in transaction details, and reluctance to provide standard identification. Ongoing workshops and simulated fraud scenarios can strengthen awareness and response times.

4. Cross-Referencing with Public Records

Before processing a transaction, title agents should rigorously review public land and tax records. Comparing seller information to official county and government databases helps reveal mismatches that may suggest fraud. Automated integrations with public records can further streamline this due diligence process.

5. Implementing Secure Communication Channels

Fraudsters frequently exploit insecure emails and phone calls to manipulate transactions. Title companies must adopt encrypted communication platforms for sharing sensitive information and wire transfer instructions. Verifying seller requests via multiple contact methods further reduces the risk of fraudulent redirects or wire fraud.

6. Partnering with Industry Watchdogs

Collaboration with real estate associations and fraud prevention coalitions enhances vigilance. By participating in industry alerts and sharing information about recent scams, title companies help build a united front against evolving fraud techniques. These partnerships also allow access to collective data insights that refine fraud detection.

7. Leveraging AI for Fraud Detection

Artificial intelligence and machine learning can analyze transaction patterns, flag inconsistencies, and predict potential fraud attempts. Implementing AI-driven tools enables real-time risk scoring and proactive alerts. As AI technology evolves, these solutions offer scalable and adaptive ways to combat seller impersonation fraud in today’s dynamic real estate market.

Building Trust While Preventing Fraud

Employing diverse ways title companies can combat seller impersonation fraud not only reduces risk but also enhances trust among clients and stakeholders. Title companies that remain proactive and invest in secure, cutting-edge solutions are better positioned to thrive in an era of increasing digital transactions.

Stay Ahead With Strategic Partnerships

As the landscape of real estate finance changes, aligning with trusted partners and staying updated on fraud trends are crucial. Title companies can benefit from continuous industry education and sharing knowledge across firms. For deeper insights on financial technology and safeguarding investments, explore our investment insights and regularly updated market analysis.

Conclusion: Secure Real Estate Transactions in 2025

The challenge of seller impersonation fraud requires multilayered, data-driven strategies. By integrating innovative technology, comprehensive training, and robust network collaboration, title companies can significantly reduce their exposure to fraudulent activities in 2025. Staying vigilant and informed is key—read more on strategy development for resilient real estate operations.