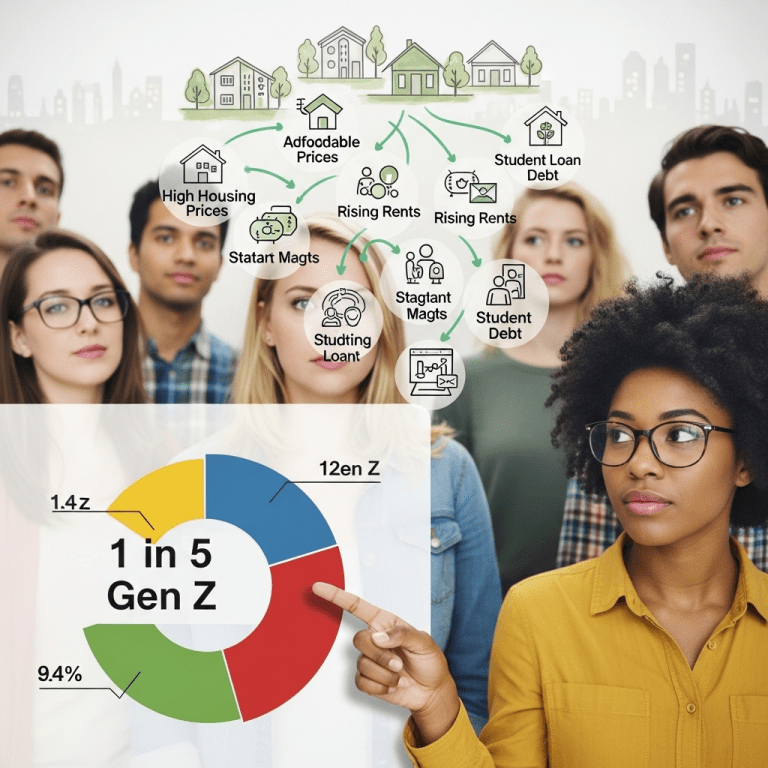

As the real estate market continues to evolve, 1 in 5 Gen Z adults say housing affordability is top life concern, spotlighting a challenge that could redefine property trends for years to come. This growing unease underscores the importance of understanding how younger adults perceive homeownership, rental prices, and their financial futures. In 2025, the housing affordability debate is not only about real estate—it’s about the broader hopes and anxieties of a generation.

Why 1 in 5 Gen Z Adults Say Housing Affordability Is Top Life Concern

Recent surveys indicate that roughly 20% of Gen Z adults—those born between 1997 and 2012—name housing affordability as their number-one concern. This figure signals a significant shift in priorities compared to previous generations at similar life stages. For many Gen Zers, high home prices, record rents, stagnating wages, and mounting student loan debt are converging into a perfect storm, making the prospect of owning or even renting a home increasingly elusive.

Industry experts point to several factors fueling this anxiety. First, post-pandemic housing shortages and investor activity have driven prices upward. Second, inflation has eroded purchasing power, affecting both renters and prospective buyers. Third, as Gen Z enters the workforce and family formation years, their struggle to find affordable housing directly impacts their ability to save, invest, and achieve financial independence. A recent National Association of Realtors report supports this sentiment, showing first-time homebuyer rates for Gen Z are at historic lows, despite their expressed desire for homeownership.

The Impact on Real Estate Market Dynamics

This pronounced focus on affordability is influencing both housing demand and market strategies. Many Gen Z adults are delaying major life milestones—marriage, starting families, and home purchases—until they feel more financially secure. Such trends are prompting developers to pivot toward building more multi-family units, co-living spaces, and starter homes to accommodate Gen Z’s unique needs. In high-cost metros, Gen Zers are leading the charge in urban exodus, prioritizing affordability and remote work flexibility over traditional city living.

How Rising Prices and Rent Burdens Shape Gen Z Decisions

The monthly rent burden for many Gen Zers exceeds the recommended 30% of income, with some paying upwards of 40% on shelter. Simultaneously, mortgage rates remain elevated compared to historic lows, keeping monthly payments out of reach for first-time buyers. This scenario has forced many young adults to stay at home longer, opt for roommates, or seek secondary jobs. Resourceful Gen Zers are also leveraging financial literacy strategies and gig economy opportunities to bridge housing affordability gaps.

The Role of Policy and Innovation in Addressing Gen Z’s Housing Concerns

Policymakers and industry leaders are closely monitoring how 1 in 5 Gen Z adults say housing affordability is top life concern could influence the next wave of real estate legislation and incentives. Expanding affordable housing initiatives, introducing rent stabilizations, and offering down payment assistance programs are all under consideration in an effort to balance supply and demand. Moreover, PropTech startups are innovating with online platforms that streamline rental applications, credit-building solutions, and even shared ownership models, giving Gen Zers more flexible entry points into the housing market.

The Investment Angle: Opportunities in an Uncertain Market

For investors and real estate professionals, understanding Gen Z’s heightened concern for housing affordability opens up new avenues for capital deployment. There is growing interest in backing projects that target affordable housing, green renovations, and build-for-rent developments. Industry analysts suggest that companies and REITs focused on workforce housing could see sustained demand in the coming years. For readers seeking further investment insights, diverse portfolios including these real estate subsectors may offer resilience amid market volatility.

What Does the Future Hold as 1 in 5 Gen Z Adults Say Housing Affordability Is Top Life Concern?

If current trends persist, the generational challenge of housing affordability will require collaborative solutions across the public and private sector. Gen Z’s preferences for flexible, tech-enabled, and cost-conscious living solutions could push the real estate industry toward more inclusive, innovative, and sustainable development. As financial markets adapt, it’s crucial for aspiring homeowners, investors, and policymakers alike to monitor and respond to the signals sent by Gen Z. For comprehensive coverage of real estate, finance, and emerging trends, explore our latest analysis.