Traders are positioning for major volatility in Meta stock move after earnings this week. Options markets signal a potential double-digit swing, suggesting investors are preparing for a pivotal report that could shape tech sector sentiment for the rest of 2025.

What Happened

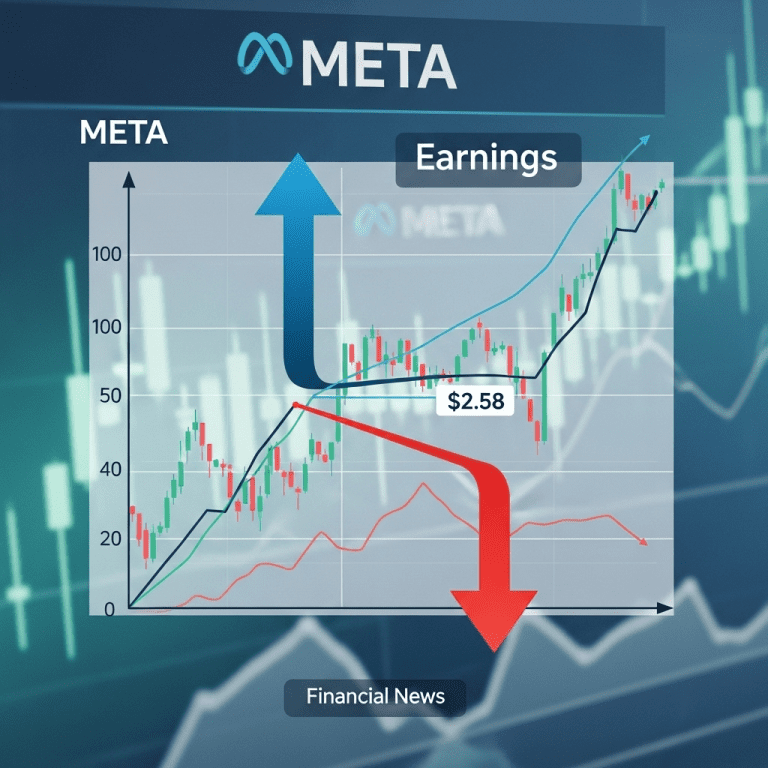

Meta Platforms, Inc. (NASDAQ: META) will report Q2 2025 earnings after the market closes this Thursday. The options market is forecasting a sharp Meta stock move after earnings, reflecting growing uncertainty around the company’s outlook. Bloomberg data shows that options premiums imply a potential post-earnings move of about 10.2%—well above the eight-quarter average of 7.5%.

This heightened volatility reflects investor debate over Meta’s advertising resilience and growing investments in artificial intelligence. The stock has gained more than 30% year-to-date, outperforming both the S&P 500 and Nasdaq indices, further raising expectations ahead of results.

Why It Matters

The anticipated Meta stock move after earnings highlights the company’s influence across the broader technology and communications sectors. Meta’s results often set the tone for digital advertising peers and megacap tech names. Its performance will likely impact competitors such as Alphabet (GOOG, GOOGL) and Snap (SNAP), as well as sector ETFs like the Communication Services Select Sector SPDR Fund (XLC).

Elevated volatility also reflects investor caution around tech valuations. Despite ongoing macroeconomic uncertainty, multiples remain stretched. In a year marked by fragile recovery, Meta’s report could become a key indicator of investor confidence and risk appetite. Historical market analysis shows that Meta’s earnings often ripple across large-cap tech and shape rotation trends in growth portfolios.

Impact on Investors

For investors, the expected Meta stock move after earnings brings both risk and opportunity. Option traders may benefit from rich premiums, but holding shares into earnings carries uncertainty. “The bar for Big Tech is high, but so are the stakes—Meta’s report will drive sentiment across ad-tech and AI exposure,” said David Holt, tech strategist at Evercore ISI, in a comment to Reuters.

Portfolio managers are watching for commentary on ad demand and AI monetization progress—two major factors shaping 2025 forecasts. Volatility-sensitive investors might consider hedging or short-term event trades. Long-term holders may view a post-earnings dip as a potential buying opportunity if Meta’s fundamentals remain strong. Broader market implications extend to indices such as the S&P 500 (SPX) and Nasdaq Composite (IXIC), given Meta’s sizable index weighting. Explore additional insights on our investment insights page.

Expert Take

Analysts stress that the Meta stock move after earnings won’t hinge solely on the numbers. Forward guidance and AI monetization milestones will be critical. A move beyond the implied range could spark sector rotation, especially if Meta’s tone or strategy shifts significantly.

The Bottom Line

Elevated options pricing shows that markets expect a larger-than-normal Meta stock move after earnings this week. For investors, careful risk management is essential, as either a positive or negative surprise could trigger wider reactions across tech stocks. The report’s outcome may define market sentiment for the rest of 2025. Stay tuned for updates and strategic commentary on our latest analysis page.

Tags: Meta stock, tech earnings, options volatility, market expectations, AI investment.