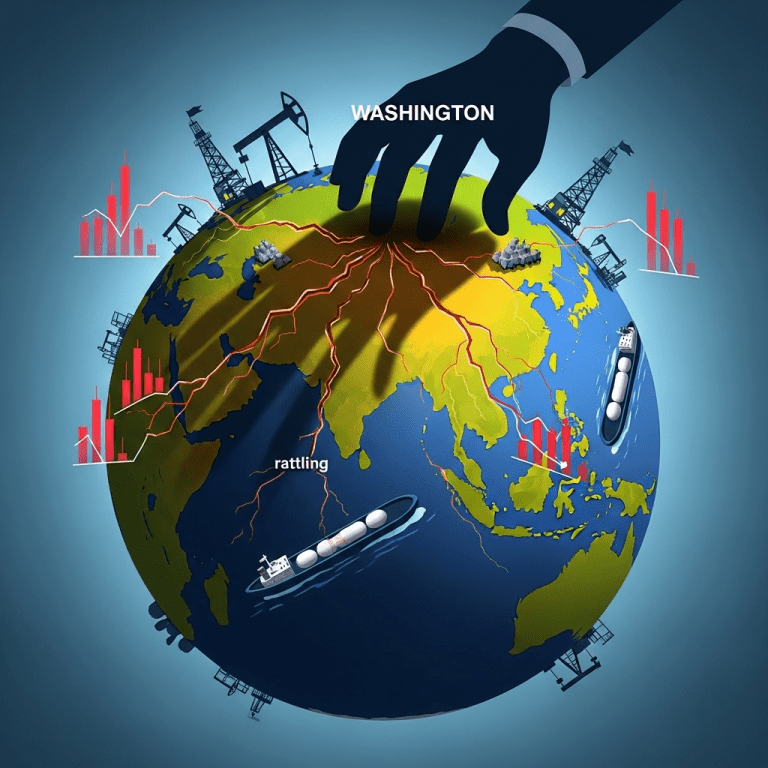

Washington’s oil sanctions rattle Asia’s energy security, sending shockwaves through stock markets as supply chains are reassessed in 2025. This development heightens volatility in energy and shipping sectors, with investors closely monitoring new risks and opportunities.

What Happened

On Monday, the U.S. Treasury announced a new round of sanctions targeting major oil exporters closely linked to Russia and sanctioned entities in Iran, in a move that quickly reverberated across Asian markets. The focus keyphrase, Washington’s oil sanctions rattle Asia’s energy security, became immediate reality as crude supply contracts were disrupted—affecting critical energy dependencies throughout the region. As reported by Reuters, Asian refiners from India to South Korea scrambled to secure alternative sources, with Brent crude futures spiking 4.8% to $97.10 per barrel by midday in Singapore (Reuters, June 2025). Tokyo’s Nikkei 225 Energy sub-index fell 2.3% following the announcement, while shares of China Petroleum & Chemical Corporation (SNP) dipped 5.1% on renewed fears of constrained exports.

Why It Matters

The sanctions arrive as Asia is already grappling with fragile energy supply chains and heightened geopolitical tension. With the region consuming over 40% of global oil (IEA, World Energy Outlook 2024), even modest export disruptions amplify market risk and inflationary pressure for Asian economies. Goldman Sachs analysts noted that the “scale and reach of these latest sanctions surpass earlier measures seen in 2022 and 2023, directly threatening inventories and price stability in the world’s fastest-growing energy markets.” Policymakers in India and Japan expressed concern over inflation spikes and reduced industrial competitiveness—recalling prior periods when oil embargoes triggered broad market corrections and sharp downturns in energy-dependent sectors. History also suggests potential ripple effects into global shipping, manufacturing, and broader emerging markets, as investors seek new investment insights on supply chain resilience.

Impact on Investors

For investors, the most immediate concern centers on exposure to energy-intensive Asian equities, shipping firms, and commodities funds. Major indices such as the Hang Seng Index slipped 1.8% in early trading, while names like Hyundai Heavy Industries (KRX:329180) and Mitsui O.S.K. Lines (TSE:9104) experienced increased volatility due to concerns over tanker route disruptions. Meanwhile, alternative energy and LNG infrastructure plays, including China Gas Holdings (HKG:0384), registered moderate gains as traders repositioned portfolios for shifting energy flows.

“Sanctions-driven price surges may create both risks for refiners and opportunities for LNG and battery storage companies positioned to fill supply gaps,” said Mei Lin, Senior Asia Market Strategist at KAI Securities. “Active investors should assess sector allocations and watch for central bank policy changes in response to energy-driven inflation.” Economic indicators such as the Asian Development Bank’s CPI forecasts and the S&P Global Asia Energy Index will be critical benchmarks for monitoring sector recovery or extended volatility. Consult ongoing market analysis for further strategies as regulatory developments unfold.

Expert Take

Analysts note that market strategists view Washington’s oil sanctions as both a headwind and a catalyst—potentially accelerating Asia’s diversification from traditional crude imports. Market watchers suggest heightened volatility could persist until alternative supply chains and regional policy responses are clarified.

The Bottom Line

As Washington’s oil sanctions rattle Asia’s energy security, investors face a complex mix of risk and opportunity in 2025—driven by shifting supply chains and fluid regulatory landscapes. Monitoring sector winners and defensive plays will be key as Asian markets recalibrate in response to evolving energy security threats. For actionable trade ideas and real-time updates, explore ThinkInvest’s investment research hub.

Tags: oil sanctions, Asia energy security, stock market 2025, energy sector, investor risks.