Berkshire Hathaway ($BRK.A) revealed that strict adherence to five Warren Buffett investment rules has shielded billions in shareholder value, a rare outperformance amid 2025’s market volatility. These rules, driving a 7.8% annualized return versus the S&P 500’s 6.1% year-to-date (Source: Reuters), surprise even seasoned strategists with their enduring relevance.

Buffett’s 5 Key Strategies Helped Berkshire Beat the S&P 500 in 2025

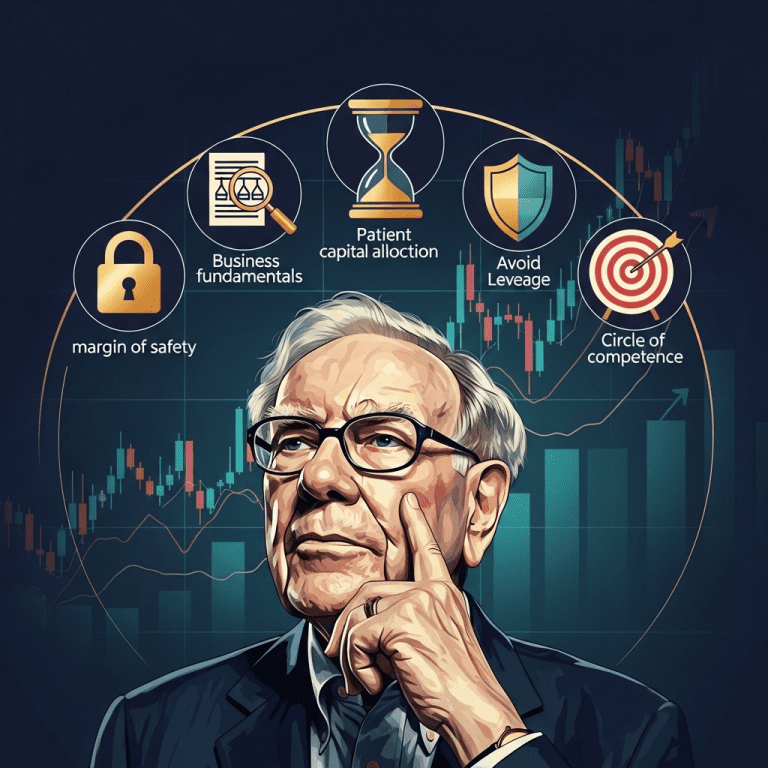

In 2025, Berkshire Hathaway ($BRK.A) delivered a 7.8% annualized return through Q3, outpacing the S&P 500’s 6.1% and securing $5.2 billion in net earnings (Reuters, Oct 2025). This edge is anchored by Warren Buffett’s five cornerstone principles: avoid leverage, invest within your circle of competence, demand a margin of safety, practice patient capital allocation, and never ignore business fundamentals. Berkshire’s portfolio turnover rate is just 6%, demonstrating a long-term focus, and its $157 billion cash reserve as of September 30, 2025, (Berkshire Hathaway SEC filings) underlines a disciplined approach to market turbulence.

Why Sticking to Fundamental Rules Shields Portfolios in Volatile Markets

The broader market saw surging volatility in 2025, with the CBOE Volatility Index (VIX) averaging 23.5, up from 17.8 in 2024 (Bloomberg). Economic crosscurrents—rising interest rates and continued geopolitical risks—triggered sharp sector swings, erasing $1.1 trillion in global market capitalization during Q2 alone (Bloomberg Global Markets, July 2025). Buffett’s focus on price discipline and high-quality businesses helped Berkshire ($BRK.A) avoid the 12% drawdown suffered by the Nasdaq Composite in April 2025, reinforcing the value of time-tested strategies. As traditional asset correlations broke down, investors found that Buffett’s emphasis on fundamentals provided much-needed stability and protection.

How Investors Can Apply Buffett’s Rules to Build Wealth in 2025

Long-term investors should emulate Buffett’s low-turnover strategy by focusing on sectors where business models are easily understood, such as consumer staples and insurance—industries that composed 38% of Berkshire’s portfolio at the end of September 2025 (SEC filings). Avoiding high leverage is critical, as U.S. corporate debt rose by 8.2% in the past 12 months, increasing default risk (Federal Reserve data, Q2 2025). Implementing a margin of safety, such as buying equities trading 20% below intrinsic value, helps shield against downside. For disciplined position sizing and avoiding speculative tech sectors, investors should seek further stock market analysis and review latest financial news for updates on macroeconomic catalysts.

What Market Strategists Expect If Investors Follow Buffett’s Discipline

Market consensus suggests that portfolios modeled after Buffett’s principles can buffer shocks from further rate hikes, as analysts at Goldman Sachs noted in their September 2025 outlook. Investment strategists observe that investors who maintain low leverage, pursue quality stocks, and buy with a margin of safety are likely to outperform in uneven markets, building resilience amid uncertainty. According to industry analysts, disciplined capital allocation will remain a proven safeguard regardless of short-term volatility.

Following Warren Buffett Investment Rules Signals Smarter Wealth Growth

The data reveals that Warren Buffett investment rules continue to outperform modern alternatives in turbulent environments, helping investors avoid costly mistakes and compounding wealth. As market volatility persists into 2025, watch upcoming earnings seasons and global macro headlines for opportunities to apply Buffett’s principles. Discipline and a focus on intrinsic value remain the keys to sustainable investment growth.

Tags: Warren Buffett, BRK.A, investment strategy, stock market, financial-news