Major U.S. consumer lenders including Discover Financial Services ($DFS) revealed that consumer loan delinquencies have soared, with rates nearing their highest level since 2020. New data on consumer loan delinquencies in 2025 exposes a sharp rise, fueling concern and raising urgent questions for debt-holders and investors alike.

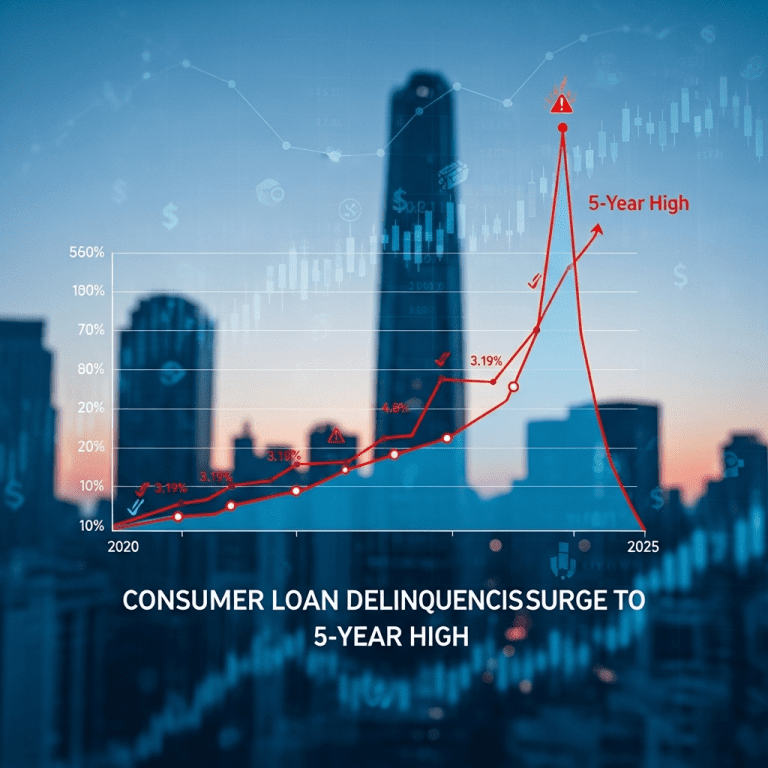

Consumer Loan Delinquencies Hit 3.19%—Highest Since 2020

U.S. banks report consumer loan delinquencies at 3.19% for Q3 2025, a level not seen since late 2020, according to the Federal Reserve Bank of New York’s October 2025 Household Debt and Credit Report. Discover Financial Services ($DFS) stated that credit card charge-off rates reached 4.8%—up from 3.2% a year earlier. Ally Financial ($ALLY) noted auto loan delinquencies hit 3.0%, compared to 2.2% in Q3 2024. This surge represents a nearly 30% annual increase across major consumer loan categories. The trend comes as real disposable incomes stagnate and household savings rates fall to 3.8%, the lowest since 2014 (BEA data, September 2025).

Rising Delinquencies Affect Consumer Credit and Banking Sector Stability

Escalating consumer loan delinquencies in 2025 present new challenges for lenders, credit card issuers, and the broader financial system. Banks are tightening underwriting standards as net charge-offs reach their highest level in five years, per the American Bankers Association’s September 2025 Credit Conditions Report. Consumer credit growth has slowed to an annualized pace of 2.4% versus 5.6% in 2023, signaling reduced access to loans for many households. Historically, higher delinquency rates have preceded contractions in consumer spending, pressuring retail, auto, and financial services sectors. Fitch Ratings warned in August 2025 that a prolonged spike in delinquencies could pressure capital ratios and increase provisioning costs across regional banks.

Investor Strategies: Managing Risk as Loan Defaults Rise in 2025

As consumer loan delinquencies climb, investors are reassessing their exposure to U.S. banks, specialty lenders, and retail-backed credit portfolios. Financial stocks, especially regional lenders such as Regions Financial ($RF) and consumer finance companies like Synchrony Financial ($SYF), have lagged the S&P 500 by nearly 6 percentage points year-to-date (FactSet data, October 2025). Defensive sectors—such as utilities and health care—have outperformed as market volatility rises. Investors may consider reducing overweight positions in credit-card-heavy banks and increasing diversification toward less cyclical sectors. Stock market analysis from September highlighted increased short interest in subprime lenders, while latest financial news points to cautious guidance from consumer credit issuers for Q4.

Expert Outlook: Why Analysts Expect Delinquency Pressures to Persist

Industry analysts at Moody’s Analytics forecast that elevated consumer loan delinquencies will persist into early 2026 as real wage growth remains muted and borrowing costs stay high. Market consensus suggests that only a significant easing in lending rates or a rebound in labor markets could meaningfully reverse the delinquency trend. Investment strategists note that investors should closely monitor upcoming employment and inflation reports, which will inform the Federal Reserve’s next moves on interest rates and, in turn, impact loan performance going forward.

Consumer Loan Delinquencies 2025 Signals New Priorities for Investors

Rapidly rising consumer loan delinquencies in 2025 signal a pivotal shift in retail credit risk. Investors tracking consumer loan delinquencies 2025 should prioritize risk management and active monitoring of banking sector health as household finances weaken. Focusing on balance sheet quality and loan portfolio composition is critical as credit conditions evolve in the coming quarters.

Tags: consumer loan delinquencies, $DFS, credit risk, banking sector, investor strategy