Laffer Associates ($PRIVATE) revealed new analysis showing how the Laffer curve could nudge UK tax revenues higher amid stagnant economic growth. The famous economist argues the UK’s current top tax rate may be choking investment — but can the focus keyphrase Laffer curve UK economy finally unlock fiscal upside in 2025?

Laffer Curve Data Points to 45% UK Tax Rate Dragging Growth

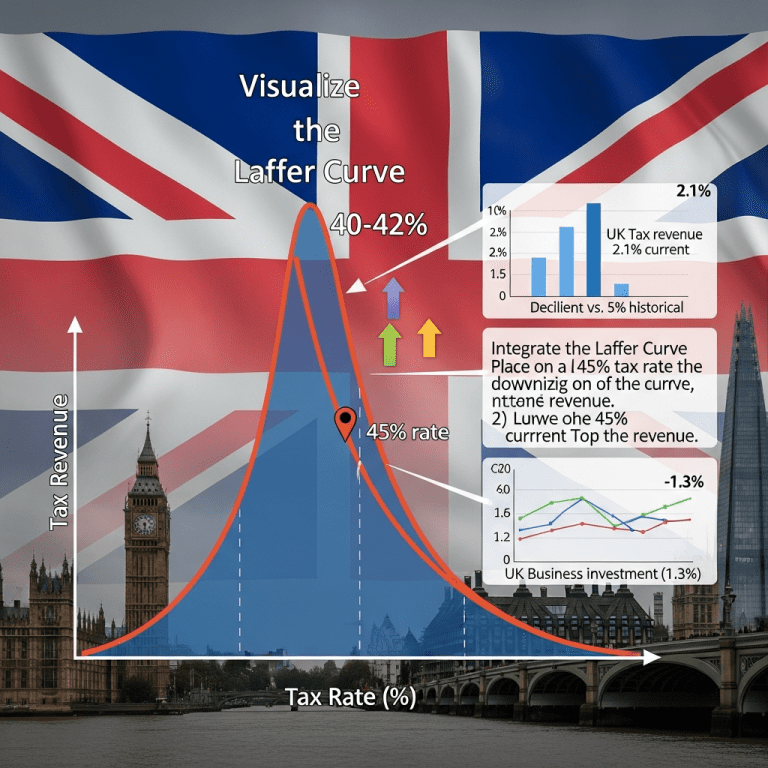

UK Chancellor’s spring budget kept the top marginal income tax at 45% for earnings above £125,140, a level unchanged since 2023. Laffer Associates research, published September 2025, indicates UK tax receipts rose just 2.1% year-on-year in FY 2024/25 versus 5% in 2022/23 (HMRC data). Arthur Laffer warned in London in October 2025 that “rates above the revenue-maximizing point lead to diminishing returns.” The UK economy expanded only 0.5% in the 12 months to August 2025 (ONS), sparking debate on the optimal tax rate for sustainable growth.

Why UK Fiscal Policy Is at a Crossroads After Revenue Stagnation

The muted 2.1% tax revenue growth lags behind both inflation, which averaged 3.5% in Q2 2025 (ONS), and GDP expansion at 0.5%. The Institute for Fiscal Studies (IFS) reports that total tax-to-GDP hit a postwar high of 37.7% in 2024, the largest since 1948. Meanwhile, business investment fell 1.3% in Q2 2025 compared to the prior quarter, per ONS data. These trends raise risks for the UK’s sovereign credit outlook and depress sentiment in equity markets. With government borrowing forecast to reach £92.8 billion in 2025/26 (Office for Budget Responsibility), pressure on fiscal policy is mounting. Investors are closely monitoring the tax framework’s impact on the UK stock market and overall economic activity.

How Investors Should Position as UK Tax Policy Faces Laffer Test

Investors holding UK-focused assets—such as iShares MSCI United Kingdom ETF ($EWU)—face crosscurrents. Persistent high tax rates erode after-tax corporate profits, weighing on FTSE 100 ($UKX) dividend growth, which slowed to 1.2% y/y in Q3 2025 (Link Group). Small caps, which rely more on domestic revenues, are especially sensitive to business investment trends. Fixed income markets reflect uncertainty, with the 10-year gilt yield rising from 4.12% to 4.37% since August (Bloomberg). Institutional strategists suggest hedging UK equity exposure for the time being while keeping a close eye on fiscal policy announcements and latest financial news. Medium-term, a shift toward revenue-optimizing rates could benefit growth proxies like construction and retail, as well as boost confidence in the UK asset class more broadly. For broader investment strategy, sector diversification is encouraged until policy direction clarifies.

What Analysts Expect Next for UK Growth and Tax Framework

Industry analysts observe that the UK’s sluggish tax receipt growth, coupled with weak business investment, puts pressure on policymakers to revisit the income tax regime. Market consensus suggests any movement toward the Laffer curve’s “optimal rate”—estimated around 40-42% in developed nations—would be scrutinized by both credit agencies and global investors. In the interim, persistent fiscal drag keeps expectations for UK GDP growth muted heading into 2026.

Laffer Curve UK Economy Signals New Era for British Investors

Laffer curve UK economy analysis suggests that optimizing tax rates is not just theoretical: it is gathering urgent relevance in the UK’s 2025 policy debate. Investors should remain alert to upcoming budget reviews and government consultations, as these could shift sentiment and strategy. A data-driven approach to monitoring tax reforms will be essential for navigating the next phase of UK market performance.

Tags: Laffer curve, UK economy, tax policy, $EWU, fiscal strategy