The Czech central bank ($CZCB) announced it will hold its benchmark rate steady at 5.25%, defying market bets for a cut and diverging from Poland’s central bank, which lowered rates to 5.5%. Investors eye this Czech central bank rate decision for clear signals amid regional policy shifts.

Czech Central Bank Keeps Rates at 5.25% Despite Inflation Drop

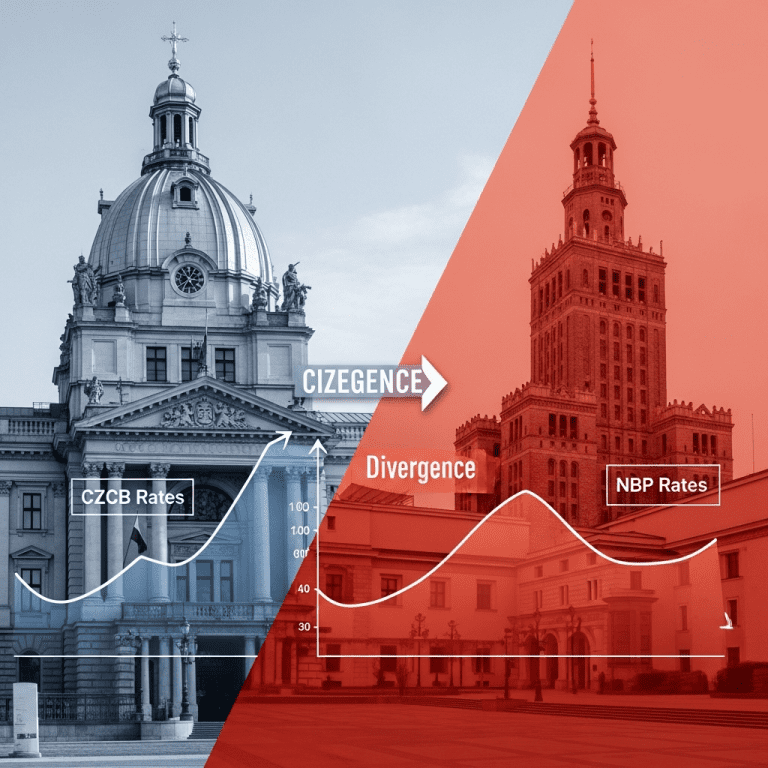

The Czech National Bank ($CZCB) revealed on November 6 that it is maintaining its key interest rate at 5.25%, extending the pause since May 2024. This static stance comes as headline inflation in the Czech Republic eased to 2.8% in October, the lowest level since early 2022, according to the Czech Statistical Office. Despite consumer price growth stabilizing below the central bank’s 3% target, policymakers cited persistent wage pressures and continued upside risks to inflation. By contrast, the Polish National Bank ($NBP) trimmed its policy rate by 25 basis points to 5.5% just a day earlier, underscoring a growing divergence in monetary stances across Central and Eastern Europe. (Sources: Czech National Bank, Polish National Bank, Czech Statistical Office, Bloomberg data).

Poland’s Rate Cut Spurs Divergence in Central European Monetary Policy

Poland’s surprise rate cut has intensified the contrast with the Czech Republic and Hungary, both of which now lean toward a more cautious approach. While Hungary maintained its base rate at 6.75% in its October meeting, Poland’s move followed its earlier aggressive cut of 75 basis points in September. Regional currencies responded with volatility: the Czech koruna slipped 0.4% against the euro to 25.30 on Wednesday, whereas Poland’s zloty fell 0.6%. According to ING Group analysts, this divergence reflects different trajectories in inflation, wage growth, and fiscal policy. Broader Central European stock indices underperformed Western peers, with Prague’s PX index down 1.2% week-to-date, per Reuters as of November 5, 2025.

How Investors Should Position After Czech Central Bank Rate Decision

For portfolio managers focused on emerging Europe, the Czech central bank rate decision adds weight to defensive positioning. Local fixed-income investors may see Czech government bonds outperform Polish peers as rate stability anchors yields, attracting international buyers seeking predictable policy. At the same time, rate-sensitive Czech equities, especially banks and real estate firms, could experience muted gains while lending rates remain elevated. Currency traders focused on the koruna versus the zloty are adjusting exposure as interest rate differentials widen. For macro investors tracking forex trading insights and stock market analysis, the policy split introduces new volatility and arbitrage opportunities across the CEE region. Stay attuned to latest financial news for further signals.

What Analysts Expect Next for Czech and Polish Monetary Policy

Market consensus suggests the Czech National Bank will maintain a cautious bias, awaiting further confirmation that inflation is sustainably anchored. Economists at Erste Group and Raiffeisen Research argue that wage growth and delayed government spending could trigger a renewed hawkish tone in Prague, even as most peers move toward easing. By contrast, analysts see Poland’s monetary trajectory as more sensitive to political factors and external risks, making the CEE region’s interest rate outlook highly fluid for Q4 2025.

Czech Central Bank Rate Decision Signals Volatile Path for CEE Investors

This Czech central bank rate decision underscores a pivotal divergence within Central Europe, forcing investors to reassess country-specific risks and positioning. With inflation, political cycles, and global factors in flux, traders and long-term investors should closely monitor upcoming CPI releases, central bank minutes, and fiscal policy updates. The region’s monetary splits in 2025 mean agility and vigilance will be critical for preserving returns.

Tags: CzechNationalBank,CZCB,rate-decision,CentralEurope,emerging-markets