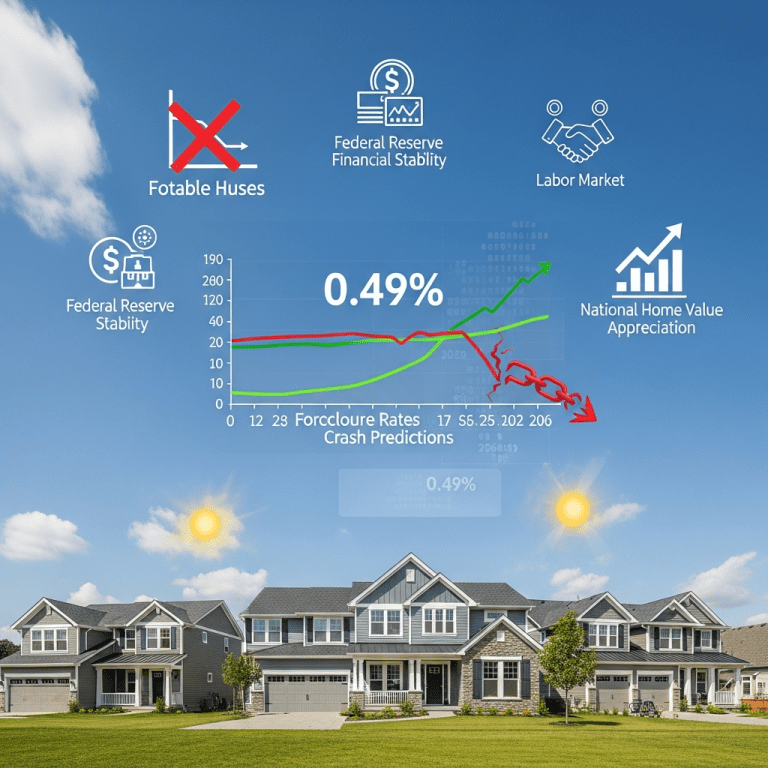

The Federal Reserve ($FED) revealed foreclosure rates held steady at 0.49% for Q3 2025—defying predictions of a housing crash and putting Fed foreclosure data 2025 in the spotlight. Investors now question what’s really driving today’s real estate trajectory.

Foreclosure Rates Remain Near Record Lows, Defying Crisis Fears

At a time when housing affordability concerns are mounting, the Federal Reserve’s most recent data shows the national mortgage foreclosure rate is just 0.49% as of September 2025. This figure is virtually unchanged from 0.48% in Q2, and well below the historical average of 1.35% seen over the past two decades (source: Federal Reserve, Mortgage Bankers Association Q3 2025 report). In raw numbers, approximately 237,000 mortgages entered foreclosure in the twelve months ending September 2025—a modest uptick from 2024’s 222,000 but not reflective of an accelerated crisis. By contrast, the peak foreclosure rate during the 2008 financial crisis exceeded 2.2% (MBA, annual data).

Why the Housing Market Remains Resilient in 2025

This sustained stability in foreclosure rates has surprised many market participants, especially considering the sharp rise in average 30-year mortgage rates to 7.1% (Freddie Mac, September 2025). Although home prices cooled in several overheated markets—San Francisco and Austin saw year-over-year declines of 2.4% and 1.8% respectively, per Zillow—national home values are still up 3.2% from a year ago. Labor market resilience also plays a role: the U.S. unemployment rate stood at just 4.1% in October 2025, down from 4.3% at mid-year (BLS). Tighter lending standards since 2010 and high homeowner equity (average loan-to-value ratio now 53%, according to Black Knight, August 2025) provide structural support to the sector. For more comprehensive financial news insights, these interactions are crucial to understanding housing’s relative strength.

Investor Strategies for Navigating Stable Foreclosure Trends

For real estate investors, subdued foreclosure rates mean fewer distressed buying opportunities, especially compared to post-2008 cycles. Value-oriented investors may shift focus to regional markets where foreclosure activity modestly exceeds the average—for example, Cleveland (0.69%) and New Orleans (0.62%), per RealtyTrac September 2025 data. Yet the lack of widespread distress sales keeps housing supply constrained, supportive of price stability in most regions. REITs with exposure to single-family homes (e.g., Invitation Homes $INVH, American Homes 4 Rent $AMH) report steady occupancy and low default volumes as of their August 2025 filings. Investors are also watching Federal Reserve rate policy, as further tightening could raise refinancing stress. For those monitoring opportunities beyond real estate, reviewing broader stock market analysis and investment strategy updates can diversify risk perspectives.

What Analysts Expect Next for U.S. Foreclosure Metrics

Analysts at Moody’s and JP Morgan observe that continued labor market strength and cautious lending are likely to keep foreclosure rates near historic lows through mid-2026, barring a deep recession. Market consensus suggests any uptick will be gradual rather than a sudden spike, as seen in the subprime downturn. However, industry observers note that pockets of higher risk persist, particularly among recent first-time buyers with minimal equity buffers.

Fed Foreclosure Data 2025 Points to Measured Housing Outlook

With Fed foreclosure data 2025 indicating no imminent crisis, attention shifts to monitoring economic catalysts such as further rate hikes or localized job losses. Investors should remain attentive to changes in mortgage rates, local market dynamics, and evolving regulatory measures. The data-driven reality offers assurance that a widespread foreclosure wave remains unlikely in the near term yet warrants ongoing vigilance.

Tags: foreclosure, Fed, real estate, housing market, $INVH