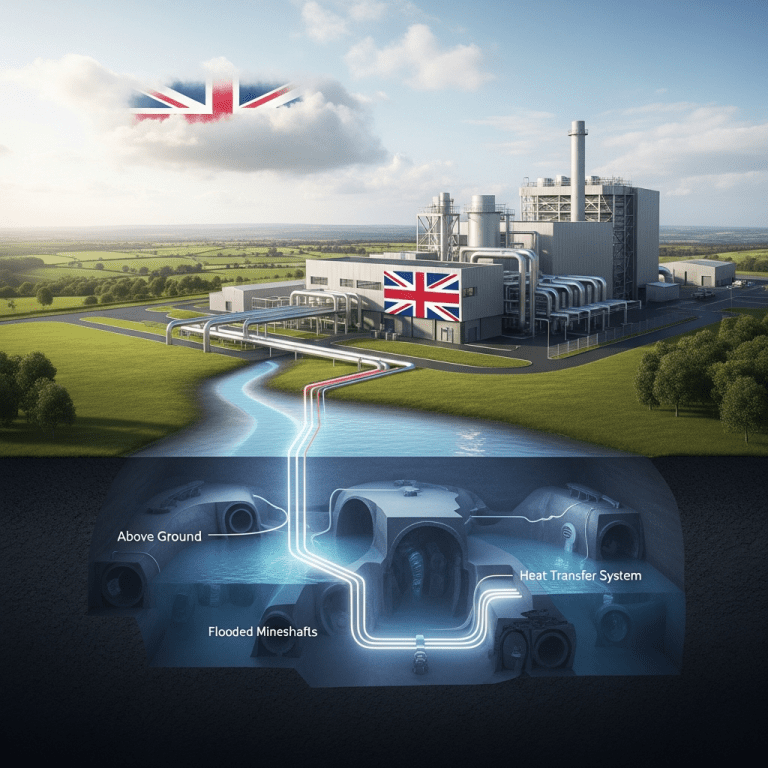

UK government officials revealed that flooded UK coalmines could provide low-carbon cheap heat for generations, with the Mines Energy Company ($MEC) planning megawatt-scale projects by 2026. The focus keyphrase flooded UK coalmines low-carbon heat drives investor interest amid soaring traditional energy prices.

UK Coalmines Offer 2.2TWh of Low-Carbon Heat by 2030: MEC Plans

On 6 November 2025, Mines Energy Company ($MEC) announced it secured regulatory approval to tap into the extensive network of flooded UK coalmines, unlocking access to an estimated 2.2 terawatt-hours (TWh) of geothermal heat annually by 2030. Early pilot schemes in Gateshead delivered heating at £35 per MWh—around 30% below 2024’s average UK gas price, according to the Department for Energy Security and Net Zero.1 The Coal Authority estimates roughly 25% of UK homes sit above redundant mineworks filled with water at up to 20°C, representing a total potential heating value above £400 million per year at current prices.2

How Repurposed Coalmines Signal a Shift in UK Energy Sector

The UK’s push to reuse abandoned coal infrastructure highlights broader energy transition trends, as renewables covered 47.2% of national electricity in H1 2025 (Ofgem data). With North Sea gas output down 12% compared to H1 2022 and energy import costs exceeding £60 billion in 2024 (ONS figures), stakeholders see domestic, low-carbon minewater heat as a critical buffer.3 Historic coal regions, including Yorkshire and Wales, are expected to gain both employment and investment, accelerating the government’s net-zero 2050 targets. The European Commission also noted in its 2025 report the strategic importance of local energy resilience.4

Investors Eye Minewater Projects as Utilities Expand Green Portfolios

Institutional investors are ramping up exposure to minewater heat schemes, with Aviva Investors’ (£5.2bn AUM) infrastructure fund and ScottishPower ($IBDRY) allocating over £150 million to pilot sites since 2024. As utilities face rising obligations under the UK Clean Heat Market Mechanism, adding minewater-sourced heat to portfolios could deliver long-term cost savings and diversify supply risks. Analysts expect asset-backed securities based on minewater heat to emerge by late 2025, broadening appeal to income-focused investors. For those seeking sustainable diversification, investment strategy increasingly centers on energy assets tied to local resources. To track broader developments in transition fuels and novel utilities, visit latest financial news and stock market analysis.

Analysts Predict Minewater Heating to Transform Regional Energy Mix

According to UBS research, minewater district heating could provide up to 10% of UK low-temperature heat needs by 2040 if deployment persists at current growth rates. Industry analysts observe that the technology is less vulnerable to commodity price shocks and can cut household heating emissions by up to 60%. Market consensus suggests regulatory clarity and local authority buy-in are crucial for scaling pilot projects into viable regional networks.

Flooded UK Coalmines Low-Carbon Heat Opens New Investment Era

The potential for flooded UK coalmines low-carbon heat reflects a paradigm shift in energy investment—pairing historical infrastructure with climate resilience. Watch for project delivery milestones and utility sector earnings as catalysts. Investors should assess regional exposure and regulatory signals as flood-mine energy gains traction across portfolios.

Tags: minewater heating, MEC, UK energy transition, low-carbon heat, renewables