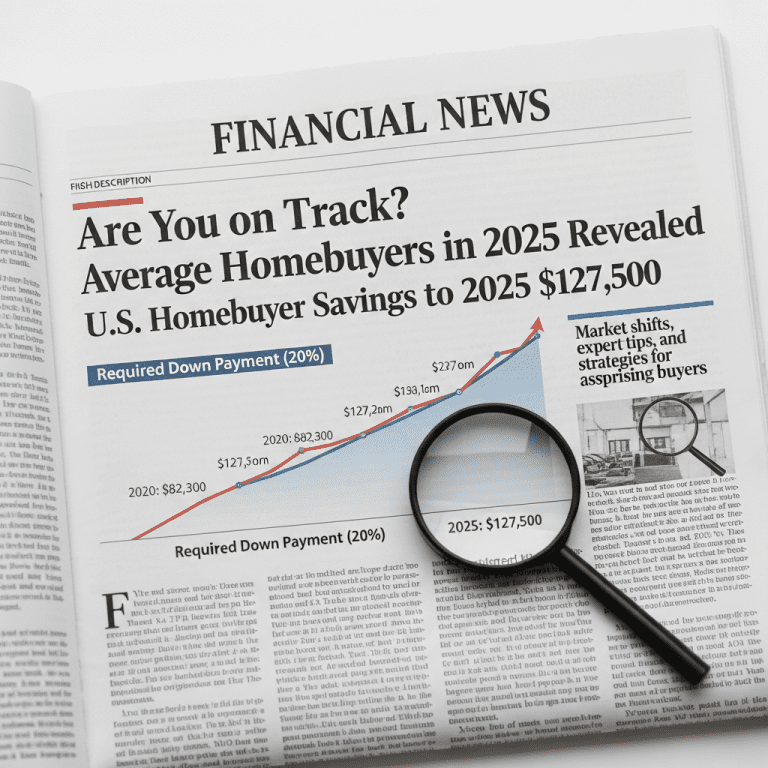

Redfin Corp. ($RDFN) revealed the median U.S. homebuyer in 2025 now needs $127,500 in savings for a 20% down payment—sharply higher than five years ago. For aspiring buyers, knowing the average homebuyer savings 2025 is more critical than ever. What do these numbers say about your path to homeownership?

Average U.S. Homebuyer Savings Surges to $127,500 in 2025

The median U.S. home price reached $637,800 in Q3 2025, requiring nearly $127,500 for a 20% down payment, according to National Association of Realtors (NAR) data published October 2025. That figure climbed 55% from $82,300 in January 2020, tracking the surge in home values and inflation over the past five years. Despite slower price growth since late 2024, monthly Zillow ($Z) reports still show median savings requirements rising faster than personal income. In addition, Bankrate’s August 2025 survey found just 37% of Americans in their 30s reported savings above $25,000, underscoring the widening gap between income and required down payment.

How Rising Homebuyer Savings Levels Affect the Housing Market

This surge in average homebuyer savings 2025 is fueling a shift in the U.S. housing market. Federal Reserve data from Q2 2025 shows first-time buyer participation has dropped to 28%, the lowest since 2006, as high savings requirements squeeze out younger and middle-income earners. Mortgage Bankers Association (MBA) reports from September 2025 indicate demand for FHA loans—popular among lower-savings buyers—has fallen 18% year-over-year. With credit conditions tightening and the average 30-year fixed mortgage rate hovering above 7.1%, affordability challenges have redefined market entry for many. These dynamics mirror the larger trend of wealth consolidation among established homeowners and all-cash buyers, especially in high-cost metros such as San Francisco and New York.

Strategies for Aspiring Homebuyers Facing Larger Savings Needs

Given rising savings thresholds, investors and would-be homeowners are taking a more analytical approach. Certified Financial Planners suggest automating savings, maximizing 401(k) loans for down payments, and exploring state-level first-time buyer programs with grants up to $20,000. The U.S. Treasury’s 2025 Home Ownership Initiative also allocates $8 billion in new assistance—detailed on latest financial news updates. For investment strategy, those with brokerage accounts are increasingly leveraging Roth IRA withdrawals and laddering CDs. However, experts warn that prioritizing liquidity—such as high-return savings accounts or money market funds—remains key due to uncertain market timing. As highlighted in stock market analysis, asset declines can quickly erode down payment hopes amid volatile conditions.

What Analysts Expect as Housing Affordability Remains a Challenge

Industry analysts and economists widely observe that housing affordability will stay pressured into 2026, barring a sharp drop in mortgage rates or a slowdown in price growth. Goldman Sachs’ housing outlook from September 2025 notes that only increases in household income or new policy interventions are likely to narrow the savings gap for young buyers. Market consensus suggests many will continue postponing purchase plans, focusing instead on renting or co-investing with family as interim steps.

Tracking Average Homebuyer Savings 2025 for Market Signals Ahead

As average homebuyer savings 2025 continues climbing, buyers and investors alike should monitor housing policy debates and income trends for potential relief. Key catalysts—such as next year’s federal budget and evolving lending standards—will shape affordability. With pressure mounting, acting early or diversifying savings vehicles may offer a critical advantage toward meeting future down payment targets.

Tags: homebuyer-savings, housing-market, $RDFN, mortgages, financial-planning