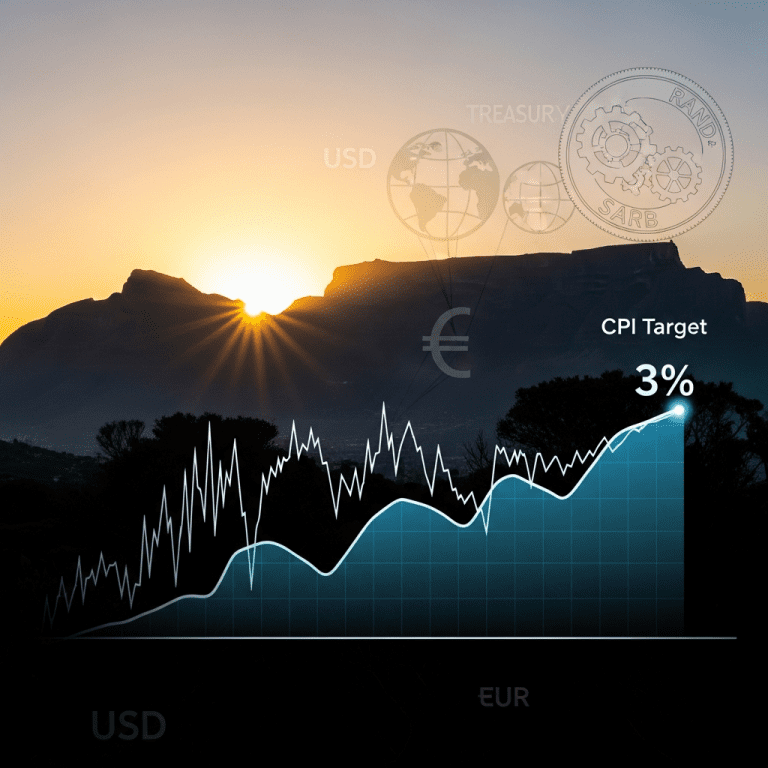

South African Treasury ($ZA-TREAS) endorsed a 3% CPI target in its latest budget, shaking up expectations for inflation policy. The South African Treasury 3% CPI target move signals tighter alignment with global best practices—will this alter the investment landscape?

South African Treasury Sets 3% CPI Target Amid Budget Unveiling

The South African Treasury ($ZA-TREAS) has publicly set its sights on a 3% annual Consumer Price Index (CPI) inflation goal, according to its 2025 budget statement released on November 11. This explicit policy target drops from the historical midpoint of the 3%-6% range, narrowing flexibility for the South African Reserve Bank (SARB). Treasury data reveals average CPI inflation of 5.2% for the 12 months ending September 2025, down from 7.8% in 2022. The SARB has held rates steady at 8.25% since May 2024, but fiscal authorities now expect headline inflation to revisit the 3% mark by late 2026, per Bloomberg reporting (2025-11-10). The formalization of this 3% benchmark marks a pivotal shift in official policy coordination between Treasury and SARB.

Why a Lower CPI Inflation Target Reshapes South African Markets

Targeting a lower, clear 3% CPI inflation figure pushes South Africa closer to global central bank norms—such as the U.S. Federal Reserve and European Central Bank, both of which operate near 2%. According to Reuters (2025-11-08), South African government bond yields have dropped 35 basis points since early October in anticipation of a more disciplined inflation regime. The rand (ZAR) firmed from 19.2 to 18.6 per dollar in the last four weeks, reflecting renewed investor confidence. Market observers note that structural reforms and credible inflation targeting have historically correlated with lower risk premiums and higher foreign direct investment inflows in emerging economies.

How Investors Can Adjust Portfolios for the New South African CPI Target

For global and domestic investors, the South African Treasury 3% CPI target introduces both risks and opportunities. Sovereign debt markets could benefit from falling inflation expectations, potentially boosting prices for medium- to long-dated bonds such as the R2030 and R2048 series. Equity investors may see banks and consumer staples—traditionally sensitive to interest rate moves—outperform in a stable inflation context. On the other hand, sectors dependent on price flexibility, like mining and energy, could feel margin pressure if real rates rise. According to latest financial news, asset managers are reweighting portfolios to favor rate-sensitive instruments. For more comprehensive stock market analysis tied to monetary policy, regular monitoring of the upcoming SARB statements is advised.

What Analysts Expect Next for South African Inflation Strategy

Industry analysts suggest the Treasury’s move cements expectations for tighter monetary-fiscal alignment. PwC South Africa’s October 2025 economic outlook argued that greater clarity in inflation targets could unlock 0.5-1.0% additional GDP growth by 2027, contingent on policy execution. Meanwhile, market consensus points to at least one 50 basis point rate cut by SARB before mid-2026, assuming global energy and food price volatility remain contained. Investment strategists note that clear inflation commitments often precede improved ratings outlooks from major agencies.

South African Treasury 3% CPI Target Signals Policy Era Shift for 2026

The South African Treasury 3% CPI target sets a new anchor for inflation expectations and monetary policymaking. If effectively implemented, this target could draw further investment inflows, lower local borrowing costs, and reshape risk-reward calculations for equity and bond investors. Stakeholders should monitor Treasury and SARB communications for early signals of how this policy anchor will translate to rate decisions and credit outlooks in 2026 and beyond.

Tags: South African Treasury, CPI target, SARB, inflation, economic policy