Nigeria ($NGA) announced an 18% drop in oil revenue for 2025 as climate initiatives accelerate and global demand wanes—fueling debate around Nigeria oil revenue 2025 and reopening wounds from Ken Saro-Wiwa’s struggle. Can Africa’s energy giant break free from fossil dependence after decades spent defending environmental rights?

Nigeria Oil Revenue Drops 18% in 2025 as Demand and Policy Shift

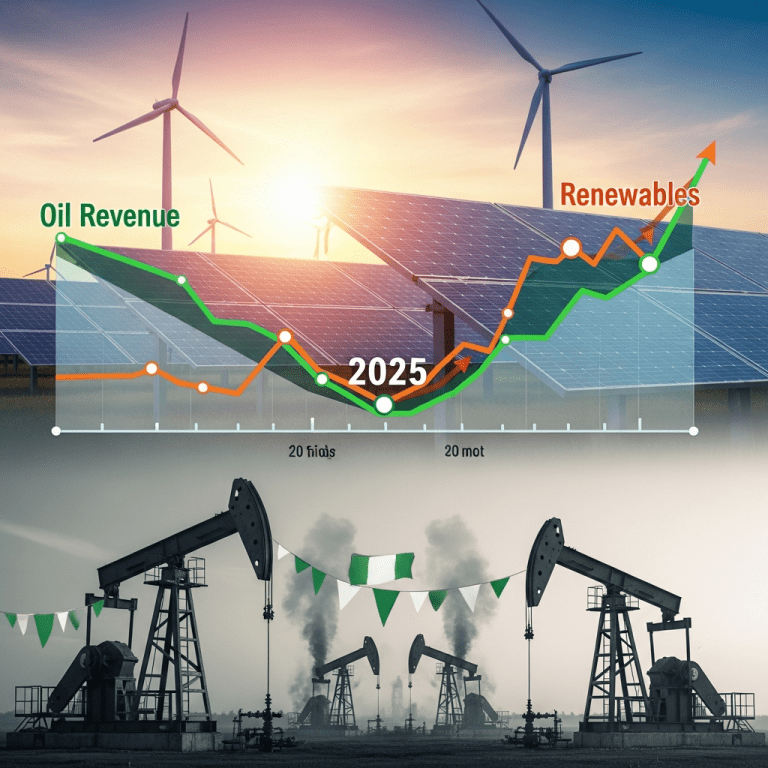

Nigeria ($NGA), Africa’s top oil exporter, reported a decline in oil receipts to $26.7 billion for the first nine months of 2025, an 18% drop compared to $32.6 billion year-over-year, per official data from the Central Bank of Nigeria (CBN, September 2025). Exports averaged 1.24 million barrels per day in Q3 2025, down from 1.45 million in Q3 2024, as OPEC+ cuts tightened supply and Europe’s imports fell 21% amid new climate measures (OPEC Monthly Oil Market Report, October 2025; European Commission trade data). The Nigerian Stock Exchange Oil & Gas Index ($NGSXOGI) slid 7.5% year-to-date, reflecting weak sentiment on fossil fuel earnings potential.

Why Global Energy Transition Is Forcing Nigeria to Rethink Oil

The dramatic slump in Nigeria’s oil receipts underscores structural energy transition risks for all hydrocarbon economies. Global oil prices averaged $74.62 per barrel in the first nine months of 2025, down from $84.53 in 2024 (Bloomberg, October 2025). International policy shifts—including the EU’s carbon border tax, effective January 2025, and China’s 2024 renewable quotas—compressed traditional markets for Nigerian oil. Locally, oil contributes over 80% of Nigeria’s export revenues, according to the National Bureau of Statistics, yet pollution and regulatory risk have depressed longer-term foreign investment—Shell Plc ($SHEL) offloaded remaining onshore assets in August 2025, citing ESG liabilities (company statement, Aug. 2025).

How Investors Should Position Amid Nigeria’s Fossil Fuel Uncertainty

For investors focused on frontier and emerging markets, Nigeria’s oil downturn spotlights sectoral risks and green transition opportunities. The Oil & Gas Index’s ($NGSXOGI) underperformance has triggered fund rebalancing toward renewables, agritech, and digital infrastructure equities listed on the Nigerian Exchange. Portfolio managers increasingly weight ESG compliance over hydrocarbon exposure, as local institutional allocations to oil assets have dropped 11% year-over-year (Nigerian Pension Commission Q2 2025 report). Investors tracking global climate policy or Africa’s ‘just transition’ agenda can access recent financial news updates and Nigeria’s ongoing stock market analysis for strategic signals. Meanwhile, rising regulation—such as the 2025 Petroleum Industry Act amendments—remains a key catalyst to monitor.

What Analysts Expect Next for Nigerian Oil and Energy Stocks

Industry analysts observe that 2025 marks an inflection point for Nigeria’s energy sector, with persistent production bottlenecks and ESG scrutiny curbing near-term oil output. Fitch Ratings, in their July 2025 sectoral outlook, flagged the potential for further asset divestitures by multinationals if regulatory and environmental risks escalate. Market consensus suggests that, without a scale-up in renewable energy investments, Nigeria could see oil revenue slip below $30 billion annually by 2026.

Nigeria Oil Revenue 2025 Signals Pivot to Sustainable Investment

Nigeria oil revenue 2025 data reinforces the urgency for energy and portfolio diversification in Africa’s largest economy. As global investors and Nigerian stakeholders track policy reforms and ESG trends, the coming quarters could determine whether Nigeria finally transitions from oil dependency to a sustainable growth path pioneered by Ken Saro-Wiwa’s vision. Investors should watch for regulatory updates and green investment flows as catalysts for this structural pivot.

Tags: Nigeria, oil revenue, $SHEL, ESG investing, energy transition