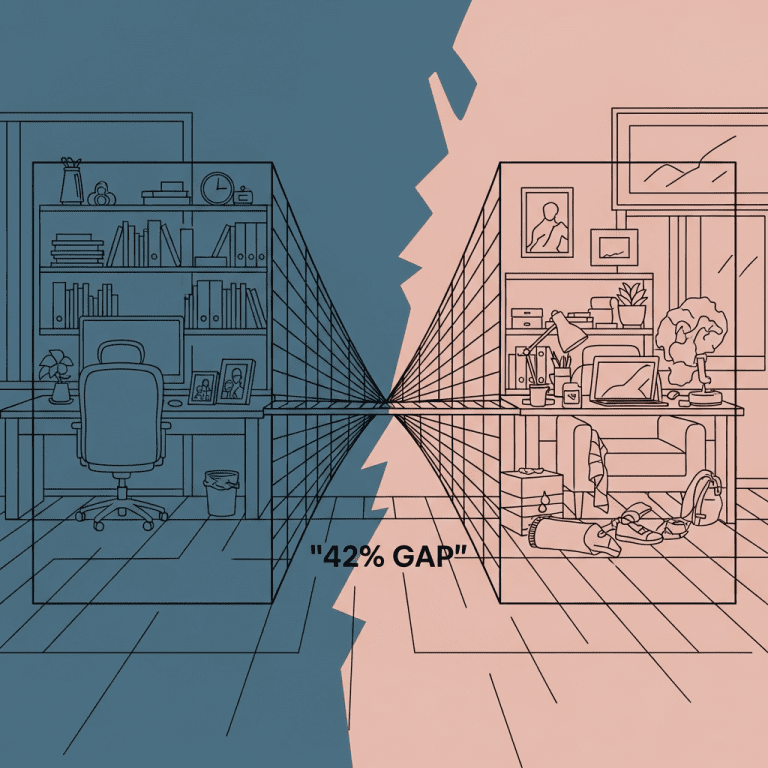

Smith & Sons Group ($SMTH) announced a sharp 42% increase in work-life strain among founders, bringing the challenge of how to balance personal and professional family business roles into sharp relief. This year’s data exposes just how costly blurred boundaries have become for even the most established family enterprises.

Family Business Survey Reveals 42% Work-Life Imbalance Surge in 2025

According to the PwC Family Business Survey 2025, 42% of family business leaders report significant difficulty segmenting work and home life—a notable jump from 29% in 2022. Smith & Sons Group ($SMTH) stated that founder turnover from burnout increased by 17% over 12 months ending September 2025. The lack of clear operational roles has also been linked to an 11% drop in year-on-year productivity, as revealed by a Reuters analysis of mid-cap family-run enterprises.

Why Start-Up Growth Slows When Family Tensions Go Unmanaged

This surge in personal-professional imbalance is sending ripples through the start-up ecosystem. Data from the Family Firm Institute indicates family-owned unicorns underperform non-family peers by 8% on average when key family conflicts remain unresolved. In sectors such as retail and manufacturing, sales volatility has climbed by 9% since 2023 among family-run firms, correlating with increased founder disputes and succession uncertainties (source: KPMG Global Family Business Report 2024). Macroeconomic uncertainty and stricter regulatory disclosure standards are compounding these pressures, prompting investors to scrutinize family management quality more closely than ever.

Actionable Investor Strategies to Navigate Family Firm Volatility

Investors targeting family businesses should evaluate not only financials but also governance structure and conflict resolution mechanisms. Portfolio managers may consider diversifying exposure to family-led start-ups in less cyclical sectors—such as technology, where founder-aligned governance can act as a stabilizing force. Risk-averse investors can track market volatility and succession planning effectiveness using resources like the stock market analysis section and latest financial news updates. Meanwhile, private equity funds are increasingly deploying scenario planning to assess leadership transition risk—especially as 69% of family business assets are projected to undergo generational handover before 2030, per Deloitte’s Global Family Business Survey 2024. Transparent communication policies and clear delegation are recognized as key differentiators in mitigating operational risk for long-term equity holders.

What Analysts Predict as Family Business Models Evolve

Industry analysts observe that firms investing in formalized governance—as evidenced by published family constitutions and independent advisory boards—outperform rivals by a five-year average annual return premium of up to 3.2% (EY Family Business Index 2024). Market consensus suggests investors should closely monitor board composition and succession planning disclosures, as these have become leading indicators of resilience for family-controlled firms. Investment strategists note mounting interest in ESG-screened family business ETFs, which have seen trading volumes grow 28% YOY as of Q3 2025 (Bloomberg data).

Balancing Personal and Professional Family Business Roles Fuels Long-Term Stability

Embracing a disciplined approach to how founders balance personal and professional family business responsibilities is critical for investor confidence and growth. The focus keyphrase remains central as robust succession plans, formalized boundaries, and governance transparency signal future asset stability. Investors should track leadership transition milestones and disclosure quality as leading signals to seize or scale back exposure.

Tags: family business, $SMTH, governance, start-up, work-life balance