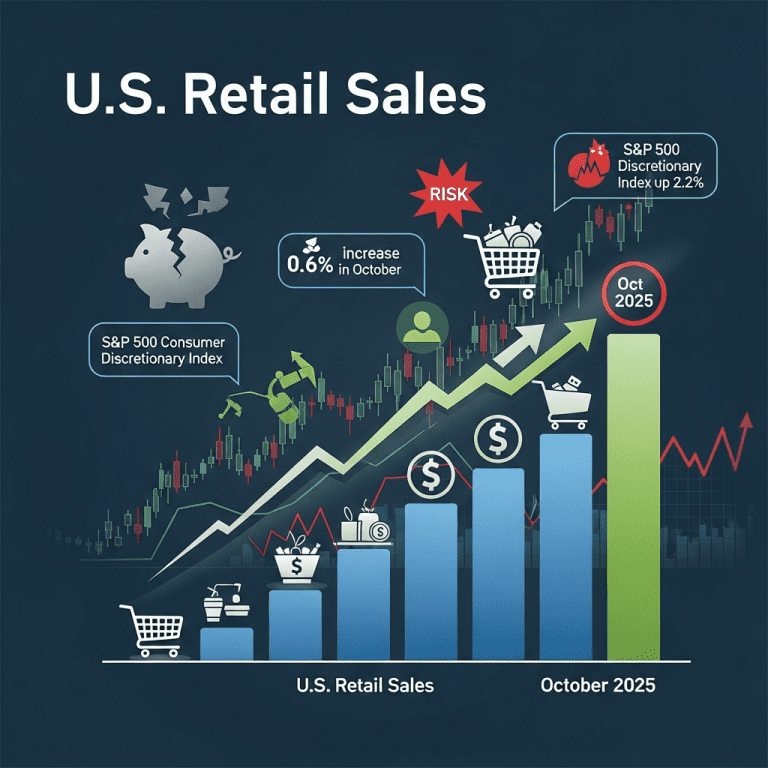

US retail sales climbed 0.6% in October, surprising markets and pushing consumer-sector ETFs like SPDR S&P Retail ETF ($XRT) up 1.9%. Despite mounting headwinds, US retail sales resilient trends are defying economist forecasts. Analysts are scrutinizing whether this robust spending can outlast growing macroeconomic and geopolitical risks.

US Retail Sales Surge 0.6% in October Despite Economic Risks

US retail sales reached $707.5 billion in October 2025, up 0.6% month-over-month and 3.2% year-over-year, according to the US Census Bureau. Core retail sales—excluding automobiles, gasoline, building materials, and food services—rose 0.5% month-on-month.

Key gainers included nonstore retailers, up 9.1% year-over-year, and health and personal care stores, up 6.3%. Department store sales continued their recovery, posting 2.4% annual gains. SPDR S&P Retail ETF ($XRT) closed 1.9% higher after the data release, while Amazon ($AMZN) gained 1.6% and Walmart ($WMT) rose 2.0% in intraday trading (Bloomberg, 2025-11-15).

Analysts at Goldman Sachs noted that the acceleration in October marks the strongest single-month increase since May 2024. This follows a weak September, when retail sales fell 0.1%. The October surprise has prompted upward revisions in Q4 GDP estimates across several Wall Street banks (Reuters, 2025-11-16).

Consumer Spending Fuels Broader Market Sentiment in Q4 2025

The resilience in US retail sales has had a substantial effect on broader market sentiment. The S&P 500 Consumer Discretionary Index rose 2.2% the week of the October report, outpacing the benchmark S&P 500, which gained 0.8% (Bloomberg data).

Consumer spending, which comprises roughly 68% of US GDP (BEA data), remains a crucial driver as the Federal Reserve maintains a cautious monetary stance. Low unemployment at 3.7% (BLS, October 2025) and persistent nominal wage growth—up 4.2% year-over-year—have supported household budgets against high interest rates.

However, headwinds are building: average credit card debt reached a record $7,135 per household (Federal Reserve Bank of New York, Q3 2025), and delinquencies on auto loans have risen to 2.8%, the highest since 2012. Inflation, while cooling to 2.6% in October per CPI data, continues to bite at household purchasing power.

Market analysts emphasize the potential for holiday sales to drive Q4 earnings, especially for major retailers like Target ($TGT), Costco ($COST), and Macy’s ($M). Successful earnings beats in this sector could buoy broad indices into year-end. Yet, the specter of weakening consumer sentiment, as evidenced by the University of Michigan’s Consumer Sentiment Index dipping to 70.1 in November, lingers over the outlook.

Investor Strategies: Navigating Volatility in Consumer Stocks

For investors weighing exposure to the consumer sector, the recent surge in US retail sales resilience presents both opportunities and risks. Active managers have cited solid October data as a catalyst for selective overweighting in discount retailers and e-commerce giants. Analysts at JP Morgan advise a focus on companies with strong pricing power and robust balance sheets, noting outperformance in stocks like Walmart ($WMT) and Dollar General ($DG).

Meanwhile, several large-cap retailers are facing margin pressures as promotional activity intensifies for the holiday season. Investors should be wary of companies with high inventory levels and exposure to lower-income consumers, as rising debt servicing costs could dampen spending. Growth-oriented investors may seek plays in the e-commerce segment, given the 9.1% year-over-year uptick in nonstore retailer sales. Value seekers, on the other hand, might consider beaten-down department store chains showing signs of recovery.

Sector ETFs like SPDR S&P Retail ETF ($XRT) and Vanguard Consumer Discretionary ETF ($VCR) offer diversified exposure but remain sensitive to headline retail sales data and Fed policy moves.

For detailed sector rotation analysis, review ThinkInvest’s recent stock market analysis. To track broader economic and policy shifts, visit financial news and macro trends updates. Crypto-focused investors: see how consumer spending links to cryptocurrency market trends as digital assets gain retail adoption.

Analysts Warn of Persistent Risks as Retail Growth Continues

Despite resilient data, expert commentary cautions that risks are escalating for the consumer sector. Morgan Stanley’s October 2025 sector outlook highlights softening consumer sentiment and uncertainties around Federal Reserve policy. Deutsche Bank strategists note growing headwinds from student loan repayments, resumed in September 2025, which could pressure discretionary spending through year-end.

Oxford Economics points to emerging risks from geopolitical tensions, including Middle East disruptions affecting global energy prices and US consumer confidence. Inflation, while moderating, remains a concern for low- and middle-income households. The National Retail Federation’s holiday forecast expects 2025 holiday sales growth of 2.8%—well below the five-year pre-pandemic average of 4.2%.

Key indicators to watch include quarterly earnings from Walmart ($WMT), Target ($TGT), and Costco ($COST); CPI and personal consumption data; and potential shifts in Fed commentary. Investors are urged to maintain vigilance as valuations appear stretched in top-performing retail names. With consumer debt at unprecedented levels, minor macro shocks could trigger abrupt sentiment shifts and retail pullbacks.

US Retail Sales Resilient Trend: Opportunities and Caution Ahead

Looking forward, the US retail sales resilient narrative is both a signal of underlying economic strength and a warning of fragility in consumer-driven equities. If job markets and wage growth persist, further upside in leading retail and e-commerce stocks is plausible. Yet, with consumer debt and macro headwinds mounting, selective positioning and risk management are crucial.

For investors, ongoing diligence around quarterly data and central bank signaling will be critical. The persistent US retail sales resilience may offer tactical upside, but prudent allocation is required as 2025 closes. Explore real-time market updates and expert views at ThinkInvest.org for actionable intelligence aligned with evolving retail trends.

Tags: retail sales, consumer stocks, US economy, XRT, market analysis