Asian Development Bank ($ADB) has approved a $470 million loan to bolster Indonesia’s clean energy transition, surprising market observers. The financing aims to help Jakarta meet ambitious 2025 renewable energy targets, with sector analysts noting the programme’s scale and urgency.

ADB Approves $470M Loan for Indonesia’s 34% Renewables Drive

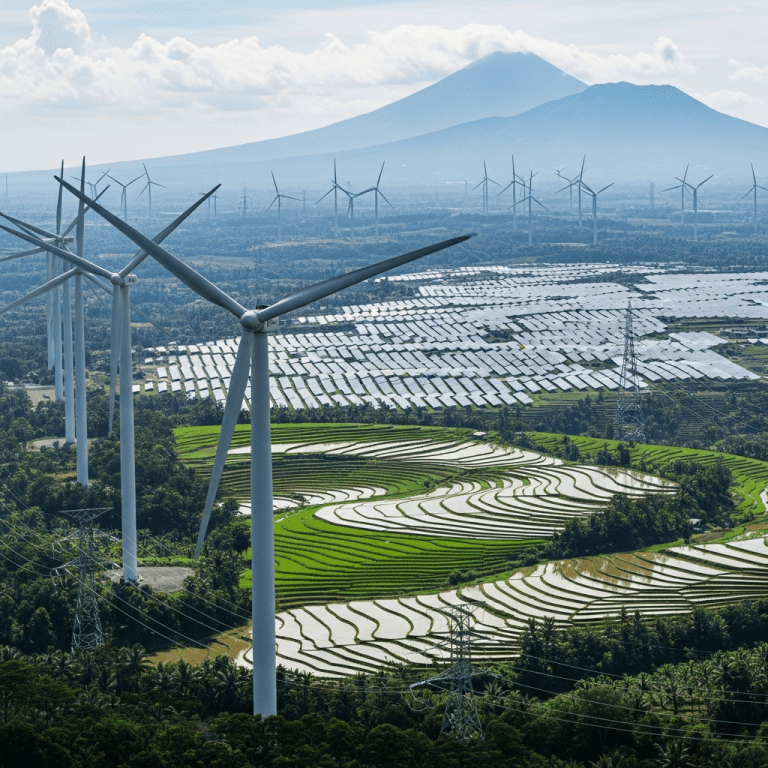

The Asian Development Bank ($ADB) on November 23, 2025, announced the approval of a $470 million loan to support Indonesia’s efforts to transition to clean energy sources and reduce carbon emissions.[1] This substantial financing is tied to the Clean Energy Transition Programme (CETP), a flagship initiative under Indonesia’s Ministry of Energy and Mineral Resources. The programme seeks to accelerate the deployment of renewable energy, with Indonesia targeting a 34% renewables share in its national electricity mix by 2025—a significant leap from the 19.1% reported in 2023, according to official government statistics.[2]

The loan will finance large utility-scale solar and wind installations, grid modernization, and technical capacity building. Energy ministry data reveal that Indonesia added 2.6 GW of renewable capacity in 2024, up 18% year-on-year. The country’s state utility, Perusahaan Listrik Negara (PLN), estimates an additional 4.2 GW of renewable projects are in the pipeline through 2026.[3]

ADB’s support is structured to leverage up to $2 billion in co-financing from other development agencies and private investors—a multiplier effect that can further expand clean energy investment, notes BloombergNEF.[4]

Renewable Energy Surge Reshapes Southeast Asia Power Market

The ADB’s decisive intervention is expected to accelerate Indonesia’s role as a clean energy leader in Southeast Asia, a region long dominated by coal and fossil fuel reliance. Before this funding announcement, Indonesia’s power sector relied on coal for more than 61% of generation as of end-2023.[5] However, international pressure and local policy reforms have spurred a shift: investment in Indonesian renewables rose to $3.1 billion in 2024, a 27% increase from 2022.[6]

This pivot carries region-wide implications. ASEAN policy frameworks—such as the ASEAN Plan of Action for Energy Cooperation (APAEC)—increase the urgency for clean energy adoption, especially as regional demand surges (projected 5.2% annual growth through 2028, per IEA).

Moreover, Indonesia’s move aligns with global decarbonization efforts post-COP28, which called for tripling renewable energy implementation by 2030. As the world’s eighth-largest greenhouse gas emitter, Indonesia’s clean energy acceleration is watched closely by global investors, affecting energy transition ETFs and Asia Pacific-focused green funds.[7]

Investor Strategies: Navigating Indonesia’s Clean Energy Push

Investors now face an evolving risk-reward calculus as Indonesia amplifies its clean energy ambitions. Opportunity abounds in listed companies with high exposure to renewables, such as PT Pertamina Geothermal Energy ($PGEO.JK), whose share price rose 14% in Q3 2025, and PT Semen Indonesia ($SMGR.JK), aggressively investing in solar-powered cement production.

Index-tracked Asian utilities also stand to benefit from ADB’s program, particularly those included in MSCI Emerging Markets indices. Yet, investors must weigh regulatory, currency, and project delay risks. Moody’s warns that policy inconsistency could slow project commissioning, with 40% of announced clean energy projects in Indonesia experiencing three- to six-month delays in 2024.[8]

Green bond issuance tied to Indonesian infrastructure—now at $2.8 billion outstanding—presents another asset class for portfolio diversification. For broader sector exposure, ETF investors monitor funds such as iShares MSCI Indonesia ETF ($EIDO) and the emerging market energy ETF segment. For the latest market movements and ETF trends surrounding the energy sector, see stock market analysis and detailed insights on financial news in Asian emerging markets.

Institutional capital inflows, foreign direct investment frameworks, and sovereign green sukuk (Islamic bonds) issuances will further broaden the spectrum of investable options across Indonesia’s energy value chain.

Analyst Insights: Energy Transition Seen Accelerating in Indonesia

Before the ADB loan announcement, numerous analysts and institutions highlighted Indonesia’s pivotal clean energy trajectory. In Q2 2025, Fitch Ratings predicted Indonesia’s renewable capacity could reach 18 GW by 2026 if regulatory bottlenecks eased.[9] S&P Global similarly noted Indonesia’s significant underutilization of solar and hydro resources, suggesting room for “double-digit annual capacity growth through 2028.”

World Bank policy notes underscore Indonesia’s role as a bellwether for Southeast Asian energy transition, given its vast population (285 million in 2025 per Reuters) and critical access to global capital. The IEA’s Southeast Asia Energy Outlook 2024 concluded that, with sufficient policy support and project financing, Indonesia could become the region’s clean energy anchor market, drawing $8 billion–$10 billion in aggregate investment by 2030. Still, local currency volatility, project execution risk, and evolving political landscapes remain key challenges cited by fund managers and sector strategists.

Investment Takeaways: ADB Supports Indonesian Clean Energy Transition

The ADB supports Indonesian clean energy transition through this $470 million loan, intensifying investor focus on the region’s renewables pivot. As Indonesia advances toward its 34% renewables target for 2025 and unlocks up to $2 billion in co-financing, market participants gain access to diversified opportunities amid global energy transition tailwinds. Investors should monitor regulatory developments and leverage green bonds or energy ETFs to capitalize on Indonesia’s evolving role in Asia’s net zero drive. For ongoing coverage of emerging market energy finance and actionable insights, follow ThinkInvest’s sector coverage on ThinkInvest.org.

Tags: clean energy, Indonesia, ADB, renewables, emerging markets, energy transition, green finance, Southeast Asia, institutional investment, energy policy