Total pending home sales surged to their highest point since 2021, defying expectations as mortgage rates hovered near 6%. Economists noted the robust 7.4% year-on-year increase surprised many, with buyers adjusting to elevated borrowing costs. The market momentum signals fresh trends for $Z and sector peers.

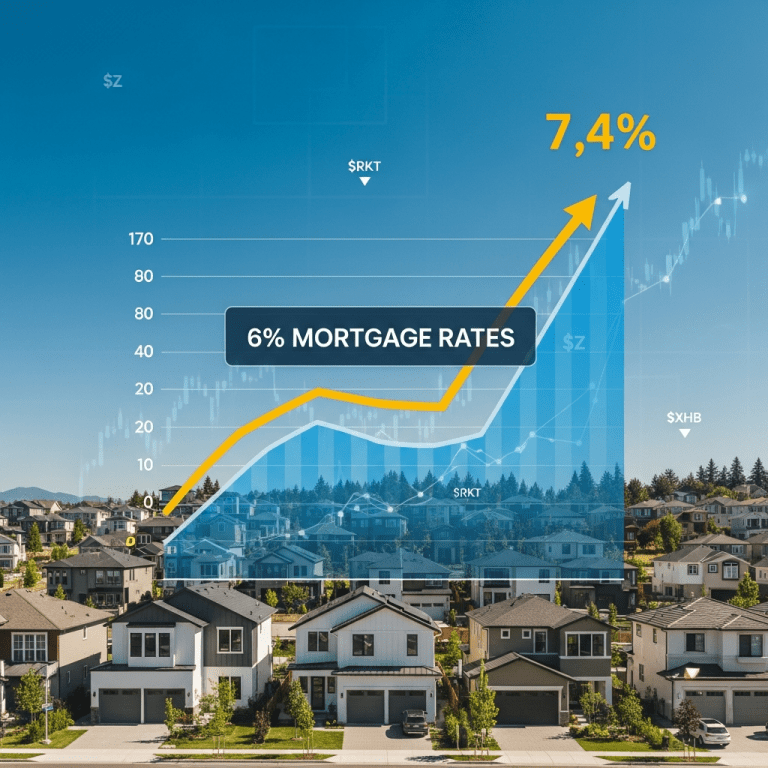

Total Pending Home Sales Soar: 7.4% Jump With 6% Mortgage Rates

Pending home sales in the U.S. surged 7.4% year-over-year in October 2025, reaching their highest level since June 2021, according to the National Association of Realtors (NAR). The Pending Home Sales Index climbed to 121.8, up from 113.5 a year earlier (Reuters).

Despite the average 30-year fixed mortgage rate stabilizing at 5.97% this month—the highest fall lending rate since 2006—buyer activity accelerated. According to Freddie Mac, the rate has hovered between 5.82% and 6.08% over the past two quarters. Transaction volume also ticked higher: 467,000 pending contracts were signed nationally in October (

Bloomberg), up from 434,000 in October 2024.

Key metro areas led gains. In the South, pending sales jumped 8.9%, while the Western U.S. posted a 6.5% rise. The Midwest saw modest 4.1% growth. Analysts attributed the rebound to increased inventory—up nearly 11% year-on-year—and greater buyer comfort with stabilized lending rates. Zillow Group ($Z) shares climbed 4.3% on the report, reflecting renewed confidence in the residential property market.

Mortgage Rate Stabilization Sparks Real Estate Recovery Momentum

The stronger-than-expected surge in pending home sales is reshaping the housing sector’s 2025 outlook. The multiyear high comes as mortgage rates appear to have peaked, after rising rapidly in 2022–2024. According to the Mortgage Bankers Association, purchase loan application volume rose 6.2% sequentially in October—breaking a six-month decline—amid predictions that rates would remain near or slightly below the current 6% threshold into 2026.

Affordability remains a challenge. Median home prices reached $424,500 in October, up 4.8% annually as tight supply pushed values higher. Still, much of the demand has shifted to less expensive regions, with the South and Midwest posting gains as coastal markets stabilize.

This activity is rippling outward. Homebuilder stocks, tracked by the S&P Homebuilders ETF ($XHB), advanced 3.8% this month. Major mortgage lenders like Rocket Companies ($RKT) and banks exposed to home lending have seen increased application pipelines. The broader stock market has responded with sector rotations favoring residential REITs and home improvement retailers, signaling greater confidence in sustained market liquidity.

Investor Positioning: Navigating High Rates and Housing Upside

For real estate investors and market participants, the rise in total pending home sales presents both opportunity and caution. Value investors are favoring homebuilders and suppliers benefiting from pent-up demand and a gradual normalization of mortgage conditions. Exchange data shows notable flows into residential REITs—such as AvalonBay Communities ($AVB) and Equity Residential ($EQR)—with sector indices up 5.2% since September.

Short-term traders are focusing on volatility in mortgage originators and property tech platforms. With the Federal Reserve signaling a hold on further rate hikes, yield-sensitive segments like mortgage-backed securities and housing ETFs ($VNQ) have seen a moderate rebound. Still, risk remains—if mortgage rates unexpectedly spike above the 6–6.5% channel, buyer activity could stall.

For those following financial sector news, the pivot is also affecting bank earnings forecasts, with large mortgage lenders guiding for higher origination volume in Q4. Ultra-long-term investors may explore regional homebuilders and secondary market suppliers to tap into sustained demographic demand. Learn more about stock market analysis for related trends and deeper sector research.

Expert Analysis: What’s Next for the Housing Market in 2025–2026

Heading into 2026, industry analysts remain cautiously optimistic. NAR forecasts project a 3–4% rise in closed sales volume for the next twelve months if rates hold near 6%. Goldman Sachs and Moody’s Analytics suggest further relief in mortgage rates—potentially dipping toward 5.5%—could reignite demand at higher price points (Bloomberg).

However, lingering inflation and wage growth present constraints on future affordability. Federal Reserve commentary through Q4 2025 underscores a “data-dependent” stance, keeping upward pressure on longer-term borrowing costs. Supply chain normalization and labor force recovery are expected to bolster construction, broadening the pool of inventory into 2026.

Market strategists recommend focusing on adaptable companies, especially those leveraging technology to streamline transactions and lower buyer costs. The overall outlook for pending home sales leans positive—barring a sharp macroeconomic shock.

Total Pending Home Sales Trends: Investor Watchpoints for 2026

As total pending home sales bridge to a multiyear high, investors are monitoring interest rate trends and regional demand shifts. The focus keyphrase warrants attention, as continued resilience in buyer activity suggests further upside for well-capitalized homebuilders, lenders, and real estate platforms. Monitoring inflation data and mortgage spread movements will be critical for investors anticipating swings in transaction volumes.

Those positioned for sector rotation should balance cyclical risk with exposure to market leaders in the residential space. With affordability under the microscope, nimble allocation and targeted research are key for outperforming the evolving real estate landscape in 2026 and beyond.

Tags: real estate, mortgage rates, pending home sales, housing market, stock market