Australia’s government-backed fund, Future Fund ($FUTUREFUND), recorded a 10.7% return for the year, driven by heavy allocations to deep tech startups. The latest shift in innovation policies Australian lesson signals a focused investment approach that’s surprising global capital watchers, prompting renewed debate over sector selection and scale.

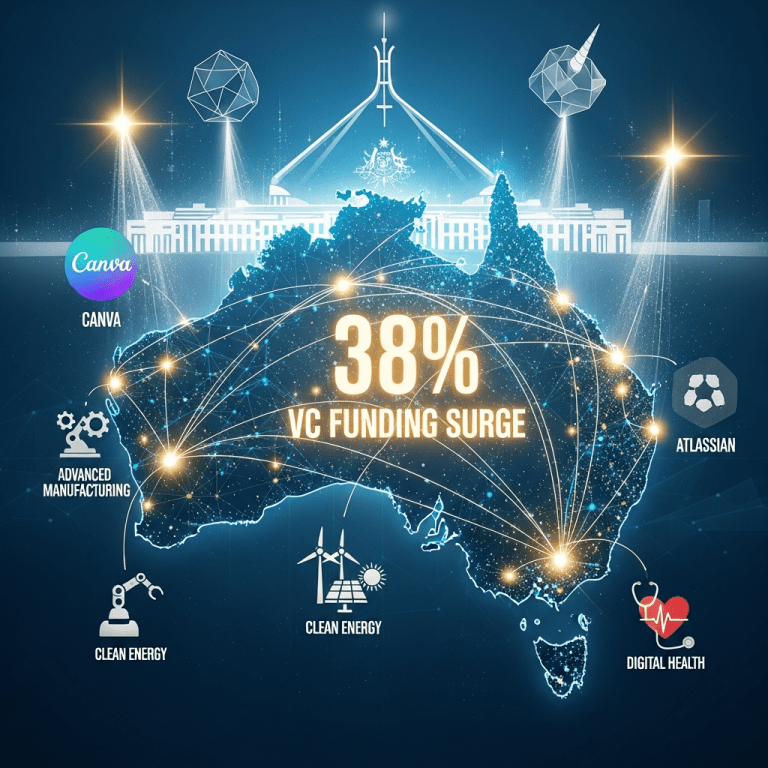

Australian Strategic Innovation Policy Drives 38% VC Funding Surge

In 2024, Australian venture capital funding surged 38% year-over-year to A$4.9 billion ($3.2 billion), according to data from PitchBook and reported by Reuters (May 2025). The government’s updated National Innovation and Science Agenda (NISA) earmarked 68% of all new startup capital into the advanced manufacturing, clean energy, and digital health sectors. Meanwhile, the $226 billion Future Fund ($FUTUREFUND) increased its allocation to locally focused early-stage tech ventures by 14%, including lead investments in biotech leader CSL Limited ($CSL.AX) and quantum computing firm Q-CTRL.

A dramatic policy pivot in late 2023—guided by Treasury recommendations—redirected tax offsets and direct grants to five “priority pillars”: quantum technology, green hydrogen, regenerative medicine, defense tech, and critical minerals. These sectors together accounted for 61% of seed and Series A funding flows in Q1–Q3 2024 (Source: Australian Investment Council, Q3 2024). The result: a marked uptick in unicorn valuations, with companies like Canva ($CANVA), Atlassian ($TEAM), and breakthrough green hydrogen startup Hysata surpassing $5 billion private valuations by October 2024.

Focused Sectoral Bets Reshape ANZ Start-Up Market Dynamics

The prioritization of a handful of strategic sectors has had ripple effects across the broader Asia-Pacific startup market. Australian startups accounted for 14% of all APAC unicorn fundraising in 2024, up from 8% in 2022 (Bloomberg, September 2024). This sectoral concentration has outperformed more scattergun approaches seen in Singapore and Indonesia, echoing models from Israel and South Korea where government focus produced outsized unicorn clusters.

In terms of macroeconomic context, the Reserve Bank of Australia (RBA) reported that technology sector job creation outpaced all other industries in 2024, with 76,000 new tech roles filled (RBA, October 2024). Startups in green hydrogen and digital health led hiring, with biohealth IPOs on the ASX reaching a ten-year high (Bloomberg Intelligence, November 2024). Robust private and public coordination on IP, skills migration, and infrastructure opened the door for foreign direct investment (FDI) into key verticals, with $3.1 billion in FDI targeted to deep tech and renewables in 2024–25.

Investor Positioning: Unicorns, ESG, and Sector Catalyst Strategies

For global and local investors, the Australian innovation policies Australian lesson translates to both heightened opportunity and sharper risk-reward tradeoffs. Focused sector allocations driven by government priorities lead to outsized winners but require precise sector selection, disciplined due diligence, and understanding of public-private alignment. Institutional investors like Blackbird Ventures and global ETFs tracking Australian innovation, such as BetaShares Australian Technology ETF ($ATEC.AX), have realigned portfolio weights toward headline sectors. This mirrors the 19% share of VC capital now earmarked for climate and critical minerals, up from 10% in 2021.

Retail and global institutional investors are increasingly leveraging regional sector analysis, thematic funds, and innovation indices to gain targeted exposure. For example, the IPO of Australian cleantech company Redflow ($RFX.AX) attracted international attention, trading 88% above its offer price after listing in July 2024. Meanwhile, startups in sectors outside the five pillars have seen valuation stagnation and fewer exits—a notable risk for diversified fund strategies.

Investors should consult comprehensive stock market analysis and insights on financial news drivers to identify the most responsive sectors and manage portfolio concentrations. For those seeking tech-laden momentum, alignment with the national innovation policy sectors—especially those flagged for multinational co-investment—offers potential for above-market returns, while sector-agnostic bets carry greater volatility.

Expert Perspectives: Global Lessons and Policy Forward Paths

Analysts from Bloomberg Economics argue that Australia’s concentrated sector approach is compressing time to unicorn status, shortening the median to just 5.2 years versus 7.3 years globally (Bloomberg, October 2024). However, experts cautioned that crowding into a few policy-driven sectors could overheat valuations and create pockets of risk—similar to what was observed in US clean-tech in the 2010s.

International policy institutes, such as the Brookings Institution, place the Australian innovation policies within a broader trend of “mission-driven” state investment. They note Australia’s careful tiebreaker—directing capital without over-centralizing or stifling private innovation—may offer lessons for the EU and Japan, both exploring national sovereignty plays in quantum, AI, and critical minerals.

The World Economic Forum’s 2024 competitiveness report ranked Australia 6th globally for startup ecosystem maturity, up from 13th in 2021, citing robust policy-pillar-backed venture flows. However, it warned that success depends on policy agility, transparent KPIs for sectoral grants, and sustained R&D tax incentive reform (WEF, November 2024).

Investment Strategies for the Future: Innovation Policies Australian Lesson

Looking ahead to 2025 and beyond, the innovation policies Australian lesson for investors is clear: strategic, policy-aligned sector investing within innovation ecosystems may deliver outsized returns and lower downside than undifferentiated regional exposure. Key takeaways include monitoring allocation shifts, government-industry co-investment announcements, and migration of global talent into focus sectors. Regularly consulting sector-specific investing insight from ThinkInvest.org will be essential as policy cycles shift and focus pivots create new market leadership.

Institutional and retail investors alike must balance enthusiasm with selective skepticism—shaping portfolios around the five favored sectors, but retaining the agility to capture emerging outliers and manage overconcentration risk. As Australia’s blueprint evolves in response to domestic and global headwinds, the “less is more” philosophy backing innovation policies will remain a central theme for anyone seeking to build market-beating, future-proof portfolios in dynamic startup landscapes.

Tags: Australian startups, innovation policy, venture capital, sector bets, startup investment, unicorns, government funding, ESG, technology, emerging sectors