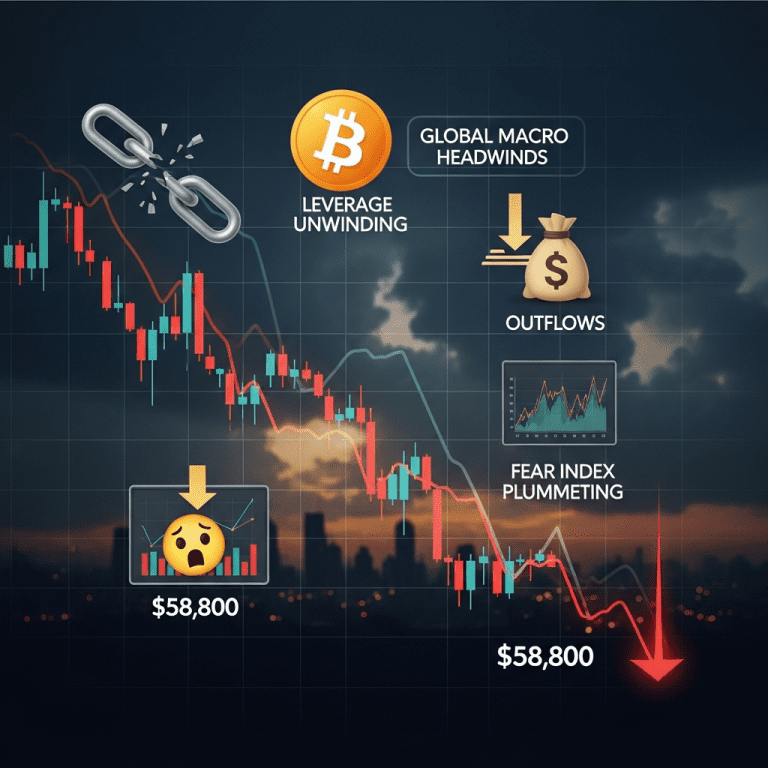

Bitcoin ($BTC) plunged 7.2% to $58,800, catching traders off guard and raising the question: is the crypto bull cycle over, or is this just a deep correction? CryptoQuant’s latest report surprises with net outflow and leverage data signaling uncertainty.

Bitcoin Dives 7.2%: Leverage Unwinds While Outflows Spike

The cryptocurrency market witnessed a sharp jolt as Bitcoin ($BTC) declined 7.2% to a seven-week low of $58,800 in early trading, erasing over $97 billion in aggregate market cap within 48 hours (CoinMarketCap, 2025-11-24). Ethereum ($ETH) followed suit, retreating 8.4% toward $2,930, while altcoins including Solana ($SOL) and Avalanche ($AVAX) plummeted over 13% and 17% respectively (Reuters).

According to CryptoQuant’s dashboards, over $1.2 billion in aggregated long positions were liquidated across major exchanges—Binance, OKX, and Bybit—within a single session. Notably, the funding rate for Bitcoin perpetuals slipped to -0.03%, marking its most negative print since February 2024, signaling a rash unwinding of bullish leverage.

The selloff was underscored by abrupt net outflows from centralized exchanges. Glassnode data confirms over 43,000 Bitcoin—worth $2.5 billion—were withdrawn from exchanges in the past three days, suggesting whales moved holdings to cold storage even as prices dropped. “The combination of negative funding and exchange outflows implies that both leveraged bulls and spot holders are reducing risk,” CryptoQuant’s market update noted (CryptoQuant, 2025-11-23).

Crypto Market Sentiment Sours Amid Global Macro Headwinds

This drawdown resonated across digital asset markets, catching both retail and institutional investors by surprise. The Crypto Fear & Greed Index plummeted from 72 (‘Greed’) to 34 (‘Fear’), its largest single-week swing in 2025 (Alternative.me).

Broader risk sentiment turned negative as the U.S. Federal Reserve signaled its hiking pause could extend into mid-2026, pressuring risk assets (Bloomberg). Simultaneously, U.S. Treasury yields climbed above 5.1% for the first time since mid-2024, dampening appetite for speculative assets—including cryptocurrencies—as the dollar index reached a six-month high (Reuters).

Regulatory pressures also amplified anxiety. The U.S. Securities and Exchange Commission (SEC) postponed spot Ethereum ETF decisions until Q1 2026, stalling fresh institutional inflows. CoinShares data highlighted $154 million in crypto fund outflows for the third consecutive week, underscoring deteriorating sentiment.

CryptoQuant noted on-chain profit-taking in Bitcoin was near all-time highs, with ‘Spent Output Profit Ratio’ (SOPR) at 1.12, showing participants realized substantial gains despite the correction. “The vicious profit-taking cycle, in tandem with macro headwinds and ETF delays, reshapes investor positioning,” market strategist James Lee wrote in a recent sector review.

Investor Reactions: Portfolio Strategies Amid Crypto Volatility

For investors navigating the turbulence, the correction forced rapid portfolio adjustments. Short-term traders sustained heavy losses; Binance saw over 342,000 liquidations, with aggregate losses topping $715 million in a 24-hour window (Binance Research).

Long-term Bitcoin holders, on the other hand, showed resilience. Glassnode data revealed ‘HODL waves’ indicated over 68% of supply remains untouched for six months or more, suggesting strong conviction among whales.

Professionals and institutional desks trimmed leveraged long positions and rotated into higher-quality majors like Bitcoin and Ethereum, reducing exposure to high-beta altcoins. Some large traders utilized options to hedge volatility—Deribit open interest in Bitcoin puts jumped 28% from the previous week (Deribit Insights).

Amid uncertainty, many retail investors turned to stablecoins such as USDC and USDT, with on-chain stablecoin balances rising 9.7% to $134 billion (Santiment). This “flight to stability” mirrors market behavior during past crypto corrections, as seen in May 2022 and November 2023.

For more in-depth analysis of sector moves, explore ThinkInvest’s recent cryptocurrency market trends and expert financial news coverage.

Analysts Debate Bull Cycle Outlook After Steep Pullback

Expert sentiment remains divided on whether the crypto bull cycle has ended, or if this is another deep, healthy correction. Bloomberg analysts highlight that, historically, Bitcoin experiences 20–30% drawdowns multiple times during long-term bull markets—a pattern reaffirmed by this year’s volatility.

Several on-chain metrics support a cautious long-term view. CryptoQuant’s ‘Whale Ratio’ indicator rose above 0.53, consistent with previous cycle tops. However, the ‘Realized Cap HODL Waves’—which tracks coins held long-term—have not seen a major drawdown, signaling room for further upside made possible by persistent patient holders.

Meanwhile, ETF inflows remain a critical catalyst. The next phase of the cycle could hinge on the SEC’s spot Ethereum ETF decision, and whether global macro trends moderate. As of November 2025, the market’s posture is defensive but not panicked; both technical and on-chain indicators suggest that, while caution is warranted, the long-term structural thesis for digital assets remains intact.

For the latest perspectives, see ThinkInvest’s ongoing stock market analysis and digital asset coverage.

Is the Crypto Bull Cycle Over? Key Insights for 2025 and Beyond

So, is the crypto bull cycle over—or is this deep correction a familiar part of the digital asset journey? Data suggests that while leverage and speculative excess have unwound sharply, long-term holders and stablecoin inflows continue to support constructive fundamentals.

CryptoQuant’s on-chain indicators, alongside regulatory and macro factors, point to continued volatility, but not necessarily a full-blown cycle top. Investors should remain nimble, use disciplined risk management, and closely monitor both macro signals and blockchain data. As the focus keyphrase ‘is the crypto bull cycle over’ captures, 2025 may ultimately be defined not by boom or bust, but by a maturing, more resilient digital asset market prepared for its next phase.

Tags: crypto bull cycle, Bitcoin, CryptoQuant, crypto correction, digital assets, blockchain, investor strategy, macroeconomic outlook, altcoins, crypto market 2025