When discussing rising consumer prices, the conversation often focuses on international trade and government policies, yet inflation is more than tariffs. As we head into 2025, a deeper analysis reveals that multiple intertwined factors drive inflation—stretching far beyond customs duties and cross-border taxes. A holistic understanding of these influences allows investors, policymakers, and everyday consumers to better navigate today’s evolving economic environment.

Why Inflation Is More Than Tariffs in Today’s Economy

Tariffs—taxes imposed on imported goods—are frequently cited as a primary culprit behind inflation. While tariffs can raise prices for specific categories of goods, global price pressures are rarely dictated by trade policy alone. The economic story of inflation is shaped by a fusion of supply chain dynamics, labor market shifts, energy pricing, and even shifting patterns in consumer behavior.

The Multifaceted Causes of Inflation

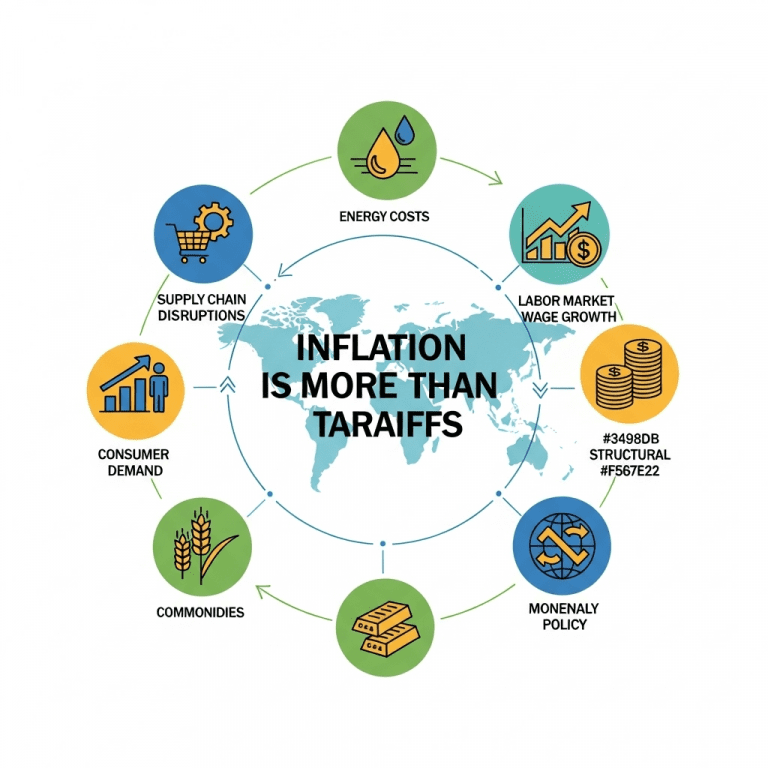

To understand why inflation is more than tariffs, it’s crucial to look at the broader array of inflationary forces at work:

- Supply Chain Disruptions: The COVID-19 pandemic and other global crises exposed vulnerabilities in supply networks. Shortages of raw materials or halted logistics can create shortages—leading to higher prices independent of any trade dispute or tariff.

- Energy Costs: Fluctuating oil and gas prices have ripple effects on the costs of transportation, manufacturing, and food. These impacts can become inflationary regardless of border taxes.

- Labor Market Dynamics: Wage growth, labor shortages, and changes in workforce participation all influence production costs. As businesses increase wages to attract talent, they often pass higher costs to consumers.

- Monetary Policy: Central bank decisions on interest rates and quantitative easing can stimulate or dampen inflation. Loose monetary policy increases money supply, often contributing to rising prices across sectors.

How Consumer Demand and Behavioral Shifts Contribute to Inflation

The narrative that inflation is more than tariffs becomes even clearer when analyzing demand-driven inflation. After periods of economic uncertainty, pent-up consumer demand commonly leads to price increases. When more people compete for the same goods and services, producers often raise prices to balance supply and demand.

Changing Spending Habits in 2025

In 2025, evolving consumer priorities—favoring technology, home improvement, health, and sustainable products—are recalibrating price pressures in various industry sectors. This demonstrates that inflation responds not only to policy moves but also to shifts in what, how, and when consumers choose to spend.

Energy and Commodities: The Global Price Engine

The global energy market frequently acts as an engine for inflation. Recent volatility in fuel prices, driven by geopolitical issues and the ongoing transition to renewable energy, has broad repercussions. As businesses and transportation companies contend with higher input costs, the overall price of goods climbs—not simply because of tariffs, but because foundational resources are more expensive.

Commodities Beyond Borders

Inflation surges can also result from sharp increases in the value of key commodities like wheat, copper, or semiconductor chips. These items play pivotal roles in manufacturing and consumption globally. Unlike tariffs, which are targeted and political, commodity price surges usually reflect global supply and demand imbalances, sometimes exacerbated by unpredictable events.

Globalization, De-Globalization, and Structural Changes

The structure of the global economy is in constant flux. In recent years, evolving attitudes toward globalization, localized production, and reshoring strategies have transformed supply networks. These shifts can both mitigate and intensify inflationary pressures, based on how efficiently and cost-effectively goods can now be produced and distributed.

For investors or businesses tracking inflation drivers, monitoring these macroeconomic changes is just as essential as analyzing trade policies. Detailed economic analysis, like that found at trusted investment resources, can help identify whether inflation trends are tariff-driven or part of larger structural cycles.

Inflation Expectations and Psychological Factors

It is often said that inflation can be “self-fulfilling.” If businesses and consumers expect prices to rise, they may alter pricing strategies or spending patterns, reinforcing inflation. This psychological component operates independently from concrete policies like tariffs and is shaped by news, sentiment, and anticipated future events.

Building Resilience in an Era of Persistent Inflation

Since inflation is more than tariffs, strategies to hedge against inflation must also be multidisciplinary. This includes diversified investments, proactive supply chain management, and policy advocacy to address systemic root causes—not just trade practices.

Furthermore, staying informed through expert analysis and resources like independent economic thought leaders can help individuals and organizations adapt to the realities of a changing inflationary landscape.

Conclusion: Embracing a Comprehensive View of Inflation

In 2025, facing inflation requires more than tracking headlines about tariffs and trade wars. From energy transitions to global supply chain tactics and evolving consumer behaviors, inflation is a complex, multifaceted phenomenon. Recognizing that inflation is more than tariffs empowers economic decision makers to develop well-rounded responses, anticipate disruptive trends, and safeguard their financial future against the unexpected.