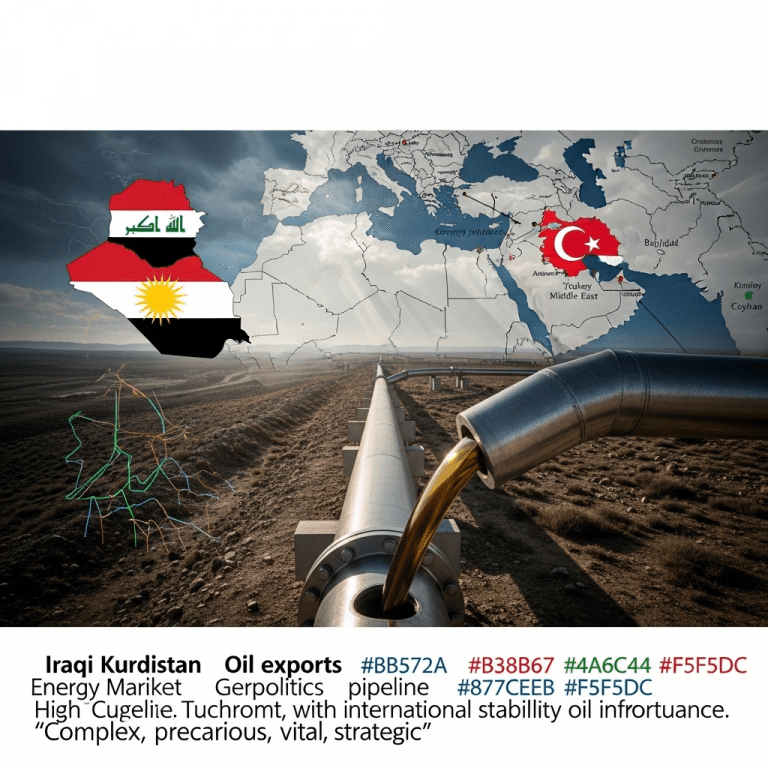

The news that Iraqi Kurdistan oil exports resume to Turkey has sent ripples through energy markets and regional political circles. As the region’s lifeline pipeline comes back online in 2025, questions linger about the sustainability of this trade route, the geopolitical factors behind its reopening, and what the future holds for Kurdistan’s economic ambitions.

Background: The Significance of Iraqi Kurdistan Oil Exports Resume to Turkey

For over a decade, the semi-autonomous Kurdish region of northern Iraq has relied on its ability to export oil through Turkey as a primary economic driver. The pipeline stretching from Kurdistan’s oil fields to the Mediterranean port of Ceyhan has been central to Kurdish financial autonomy. With approximately 400,000 barrels of oil per day previously exported via Turkey, any disruption has major economic and political consequences for Erbil, Baghdad, and Ankara alike.

The 2023-2024 Disruption: Causes and Consequences

Exports ground to a halt in early 2023 amid disputes over revenue sharing between Iraq’s central government and the Kurdistan Regional Government (KRG), compounded by Turkey’s concerns about international arbitration decisions. The resulting year-long closure cost Kurdistan billions in lost revenue and strained political ties both within Iraq and with Turkey.

Domestic Economic Impact in Kurdistan

The stoppage placed enormous pressure on Kurdistan’s economy. Public sector salaries faced delays, foreign investment waned, and economic growth stagnated. The pause underscored the vulnerability of a region still seeking diversified growth and renewed energy investment.

Why Have Iraqi Kurdistan Oil Exports Resume to Turkey Now?

The resumption of oil exports in 2025 is the product of painstaking negotiations between the KRG, Baghdad, and Ankara. Several critical factors contributed:

- Revenue Sharing Agreements: Fresh understandings on how oil revenues are split, with guarantees for both Baghdad and Erbil.

- International Arbitration: Movement towards resolving or deferring arbitration claims between Turkey and Iraq, lessening Ankara’s legal risks.

- Regional Stability: Both Iraq and Turkey seeking economic stability in an increasingly turbulent Middle East landscape.

Pipeline Infrastructure and Security

Substantial repairs and upgraded security protocols, especially along vulnerable sections of the pipeline, have helped restore confidence among stakeholders. Nevertheless, ongoing security risks remain a concern for the uninterrupted flow of crude oil.

How Sustainable Is the New Export Arrangement?

Despite the positive momentum as Iraqi Kurdistan oil exports resume to Turkey, sustainability is far from guaranteed. Three core challenges could threaten the arrangement:

- Political Volatility: Disagreements between Baghdad and Erbil over oil policy, revenue disbursement, and the future of Kurdistan’s autonomy have not been fully resolved.

- Legal Gray Zones: Ongoing international legal cases could re-ignite uncertainty, especially if verdicts pressure Ankara or Baghdad to change course.

- Regional Turbulence: The threat of militant attacks, shifting alliances, or broader disruptions in the region’s energy security cannot be ignored.

Potential Alternatives and Strategic Diversification

Recognizing these risks, the KRG has begun exploring alternative strategies, including new pipeline routes and deeper engagement with global energy partners. However, Turkey remains the most viable export corridor for the foreseeable future, as highlighted in recent energy sector reports.

The Stakes for Energy Markets and Regional Actors

The return of Iraqi Kurdistan’s crude to international markets is significant. Oil traders are watching closely, as even minor disruptions can impact global supply balances and price stability. Neighboring countries are also monitoring the evolving relationship between Iraq, the KRG, and Turkey for signs of long-term cooperation—or renewed friction.

Implications for Turkey

Turkey stands to regain millions in pipeline transit fees and reinforce its strategic role as an east-west energy corridor. However, Ankara’s balancing act between Baghdad, Erbil, and international legal obligations will remain delicate.

Outlook: How Long Will Iraqi Kurdistan Oil Exports Resume to Turkey?

Ultimately, as Iraqi Kurdistan oil exports resume to Turkey, analysts project cautious optimism. If outstanding political and legal disputes remain contained, Kurdistan’s exports could be sustained for several years. Yet, the inherent unpredictability of the region demands contingency planning and an emphasis on economic diversification for the KRG.

Energy sector stakeholders should stay alert to developments in revenue-sharing agreements, diplomatic negotiations, and potential legal outcomes. Vigilance will be key as the situation remains fluid well into 2025 and beyond.