The Kurdistan oil exports surge after pipeline restart marks a pivotal moment for the region’s energy sector and global oil markets in early 2025. This development follows prolonged negotiations and technical upgrades, setting the stage for increased stability and prosperity in both Iraqi Kurdistan and the wider Middle East.

Background: Kurdistan’s Oil Sector and Export Infrastructure

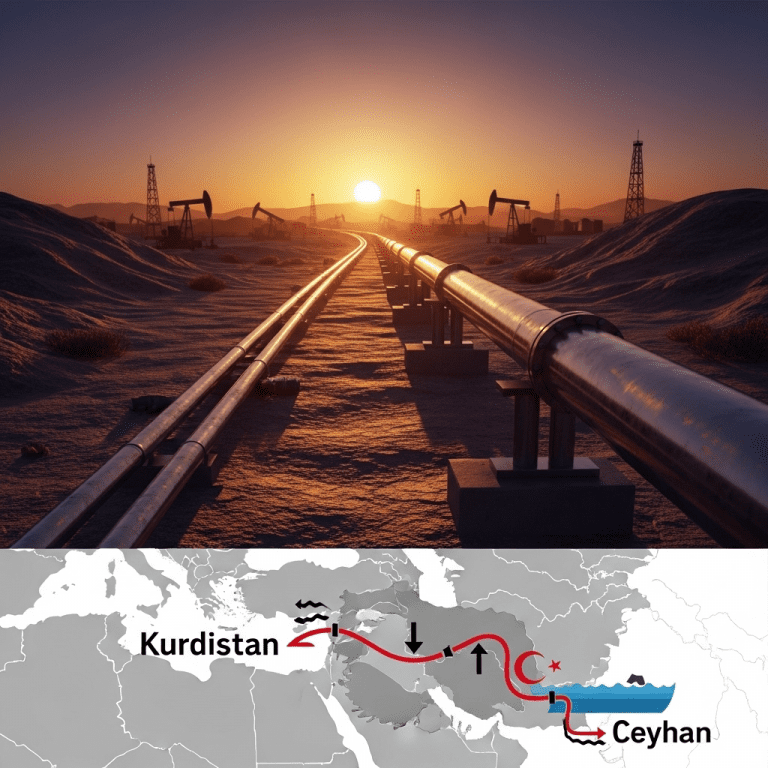

Kurdistan, a semi-autonomous region in northern Iraq, is endowed with substantial oil reserves, making energy exports a cornerstone of its economy. Historically, oil from Kurdistan has been exported via a key pipeline that stretches from its oilfields to the Turkish port of Ceyhan. However, intermittent shutdowns due to political disputes, security concerns, and technical malfunctions have challenged consistent export revenue.

Kurdistan Oil Exports Surge After Pipeline Restart

After months of halted exports and diplomatic deadlock, the restart of the major export pipeline in early 2025 has led to a dramatic increase in Kurdistan’s oil shipments. According to local sources and industry analysts, daily export volumes have surpassed pre-shutdown levels, with flows averaging nearly 500,000 barrels per day within weeks of operations resuming.

This surge in oil exports has invigorated the region’s economic outlook, providing vital revenue for public salaries, infrastructure development, and social programs. In the first quarter of the year, energy sales accounted for more than 80% of Kurdistan’s government budget, highlighting the pipeline’s significance.

Economic Benefits Fuel Regional Growth

The renewed export activity catalyzes broader economic benefits across Kurdistan and Iraq. Oil companies operating in Kurdistan—both local and international—are ramping up production, investing in field expansions, and hiring local talent, which has lowered unemployment rates and increased household income.

With energy revenues flowing again, the Kurdistan Regional Government (KRG) has prioritized funding for healthcare, education, and public infrastructure—key pillars for sustainable development in the region. The stabilization of cash flows also strengthens the KRG’s ability to honor fiscal agreements with the Iraqi federal government, potentially easing political tensions.

Supply Chain Boost and Investor Confidence

Beyond direct revenues, the upturn in oil exports has stimulated secondary industries, including transport, logistics, and construction. International investors have taken note, with several major exploration and service contracts newly signed or renewed in 2025. These activities are expected to support job creation and increase regional GDP growth throughout the year.

Geopolitical Dynamics: A Delicate Balance

Yet, the Kurdistan oil exports surge after pipeline restart comes amid ongoing regional complexities. The pipeline traverses both Kurdish and Turkish territory—requiring delicate negotiations not only between Erbil and Baghdad, but also with Ankara. The resumption agreement reportedly includes new revenue-sharing formulas and transparency measures intended to reassure all stakeholders.

The increased export volumes contribute to Iraq’s broader OPEC commitments, which may affect upstream production quotas and Middle East energy diplomacy. Furthermore, the flow of Kurdish oil to international buyers helps to diversify supply sources for European and Asian consumers, subtly shifting global energy dynamics in 2025. For investors, understanding these geopolitical implications is crucial for risk management and long-term planning.

Challenges and Forward Outlook

Despite the optimistic figures and renewed confidence, key challenges persist. Technical vulnerabilities, regional security issues, and fluctuating oil prices remain sources of potential disruption. The KRG and its partners are investing in pipeline upgrades and digitized monitoring systems to minimize operational risks.

Additionally, ongoing discussions with the central government in Baghdad over oil revenue allocation, legal status of production-sharing contracts, and resource management must be managed carefully to ensure continued export momentum. The potential for political unrest or policy shifts in Turkey or Iraq also represents a variable for future stability.

Global Market Impact and Sustainable Solutions

On the global stage, the surge in Kurdistan’s oil exports may ease some market supply pressures following recent output cuts elsewhere, providing a balancing effect on prices. Looking further ahead, both the KRG and its international partners are examining opportunities for alternative energy development and broader economic diversification to reduce reliance on oil in the coming decades.

Conclusion: Kurdistan’s Path Forward in the Energy Landscape

The Kurdistan oil exports surge after pipeline restart has firmly positioned the region as a vital player in Middle Eastern and global oil markets for 2025 and beyond. With strengthened infrastructure, improved political agreements, and robust investor engagement, Kurdistan stands to reap substantial benefits—provided it can navigate the complex interplay of technical, political, and market forces. For stakeholders seeking to understand or participate in this revitalized sector, staying informed through reputable industry news sources and independent energy analysis remains key.