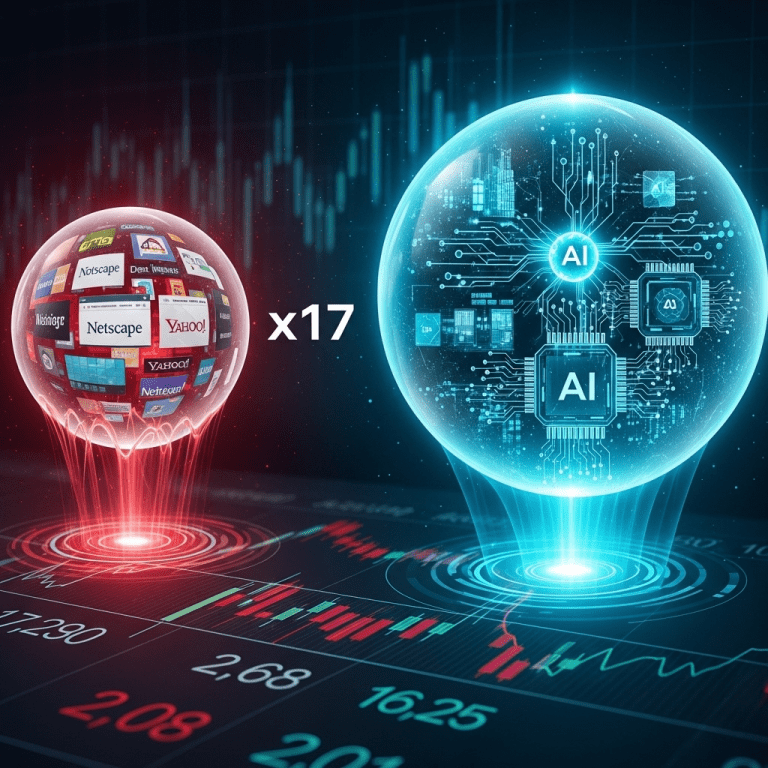

In 2025, one explosive claim dominates stock market discourse: The AI bubble is 17 times the size of the dot-com frenzy, according to a leading market analyst. As artificial intelligence drives record-breaking stock valuations, investors and analysts are scrambling to understand the potential consequences for global markets. Could history be repeating itself—on a grander scale?

The AI Bubble is 17 Times the Size of the Dot-Com Frenzy: How Did We Get Here?

Artificial intelligence has captivated market participants with its promise to revolutionize every sector, from healthcare to finance. Unlike the internet boom of the late 1990s, today’s AI wave is fueled by vast improvements in computational power, Big Data, and machine learning algorithms. Companies at the forefront, such as chipmakers and cloud computing giants, have reported gains in market value unmatched even by tech leaders of the Web 1.0 era.

The analyst’s dramatic assertion that the AI bubble is 17 times the size of the dot-com frenzy is based on metrics like aggregate market capitalization, valuations relative to underlying earnings, and the sheer volume of speculative investment flowing into AI start-ups and established players alike. This comparison stirs concern—and excitement—among investors worldwide.

What Defines a Financial Bubble?

Before diving deeper, it’s crucial to understand what a financial bubble actually is. In essence, a bubble occurs when asset prices rise far above their intrinsic value, primarily driven by exuberant market sentiment rather than fundamentals. Eventually, bubbles pop, triggering widespread sell-offs and potential recessions.

The dot-com bubble famously burst in 2000, causing the NASDAQ to fall nearly 80% from its peak and erasing trillions from global markets. Are we destined for a similar fate with today’s AI boom?

Comparing the AI Surges to Past Market Manias

Market Capitalization and Growth

During the late 1990s, internet stocks soared as investors clamored to get in on the ground floor of the digital revolution. Yet, recent data shows that AI-focused equities have dwarfed their predecessors, with some indices reporting growth rates and valuations that are historically unprecedented.

Major institutions and retail investors alike are funneling money into companies with little more than an AI vision, echoing the unchecked enthusiasm of the dot-com era. The difference? The current scale is exponentially larger, encompassing more sectors and more capital than ever before.

Investor Behavior and FOMO

The contemporary AI craze has triggered widespread FOMO (fear of missing out), with investors rushing to ride the next wave of technological innovation. Many cite the runaway success of companies like NVIDIA, which recently surpassed $3 trillion in market cap, as proof that this time, the fundamentals can justify the sky-high multiples. However, the analyst behind the ’17-times’ claim warns that valuation discipline is historically lacking when speculative bubbles inflate.

The Risks and Opportunities for Investors

While the magnitude of the AI bubble is 17 times the size of the dot-com frenzy may sound alarming, it also highlights potentially transformative opportunities and risks in the stock market. Investors need to distinguish between high-quality AI companies with genuine market advantages and speculative plays built on hype.

Warning Signs of a Bubble’s Peak

- Skyrocketing price-to-earnings (P/E) ratios, far above long-term historical averages

- New IPOs with little revenue but multi-billion-dollar valuations

- Retail investors pouring into AI stocks without understanding underlying risks

- Repeated claims that “this time is different”

When these signals align, historical precedent suggests caution is warranted.

Lessons from the Dot-Com Crash

While some dot-com era darlings vanished, others like Amazon and Google survived and now dominate global commerce. Likewise, a shakeout in the AI sector could weed out the pretenders and reward companies with real-world impact and sustainable cash flows.

Staying informed from authoritative sources such as investment research hubs is crucial, particularly as economic headwinds or interest rate shifts could quickly change investor sentiment.

Preparing Your Portfolio for AI-Era Volatility

With such extreme valuations, prudent investors are diversifying their holdings, using hedging strategies, and keeping long-term goals in focus. Watching regulatory changes, geopolitical events, and technological milestones will provide valuable early warnings for market shifts.

Ultimately, while the assertion that the AI bubble is 17 times the size of the dot-com frenzy is provocative, it’s a reminder to approach fast-moving markets with both optimism and caution. By understanding the lessons of history and focusing on fundamentals, investors can navigate the AI revolution—no matter what happens next.