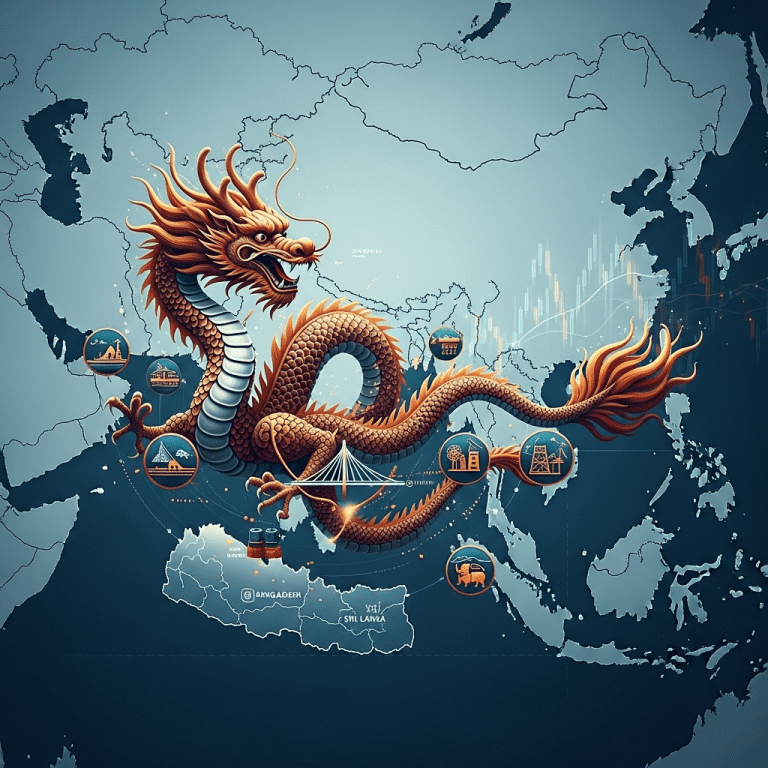

In 2025, China’s charm offensive in India’s backyard is redefining South Asia’s economic and geopolitical landscape. From Nepal to Sri Lanka, Beijing is leveraging trade, investment, and infrastructure projects to deepen ties, creating both opportunities and challenges for India and its neighbors.

Understanding China’s Charm Offensive in India’s Backyard

China’s charm offensive in India’s backyard describes Beijing’s strategic economic and diplomatic outreach to South Asian nations bordering India, including Bangladesh, Sri Lanka, Nepal, Bhutan, and the Maldives. This initiative focuses on building influence through generous investments, concessional loans, and soft power measures, shifting the regional balance of power.

The Economic Playbook: Investments and Trade Growth

Belt and Road Initiative Transformations

Central to China’s strategy is the Belt and Road Initiative (BRI), which has poured billions into South Asian infrastructure—ports in Sri Lanka, roads in Nepal, and power plants in Bangladesh. These projects promise to enhance connectivity and unlock economic growth, but also bind recipient countries closer to China’s economic orbit.

Trade Partnerships and Market Integration

Chinese goods now dominate South Asian markets, outpacing local and Indian products due to competitive pricing and government-backed trade agreements. In Bangladesh, China has become the largest trading partner, while Nepali imports of Chinese technology have soared. This growing trade dependence can present vulnerabilities but also offers smaller nations access to affordable goods and technology.

India’s Response to Rising Chinese Influence

India is keenly aware of the risks posed by China’s expanding presence in its neighborhood. New Delhi has responded with its own investment pledges, diplomatic engagements, and strengthened regional forums like BIMSTEC and the BBIN initiative. India’s goal has been to reaffirm its status as the region’s natural partner while promoting sustainable, transparent development.

Geopolitical Implications for the Region

- Sri Lanka: The handing over of Hambantota port on a long-term lease to China has alarmed security experts about increased Chinese leverage and possible military use.

- Nepal and Bhutan: Nepal welcomes Chinese investment in transport and hydropower projects, seeing it as leverage in diplomatic dealings with India. Bhutan remains cautious, balancing its economic interests with close ties to India.

- Maldives: Chinese infrastructure loans have modernized Maldivian airports and ports, but debt sustainability remains a concern.

Economic Opportunities versus Dependence

The influx of Chinese investment has catalyzed job creation, improved infrastructure, and lifted local economies. However, there are warnings about rising debt levels, reduced policy autonomy, and potential ‘debt trap’ scenarios, as seen in Sri Lanka.

Policy Shifts and Regional Cooperation

To balance Chinese influence, South Asian nations are increasingly seeking diversified partnerships, inviting investments from Japan, the European Union, and the United States. India’s own investment arm is focusing on digital connectivity, green energy, and sustainable development to present an attractive alternative to China’s loan-driven model.

Looking Ahead: South Asia’s Economic Future

The trajectory of China’s charm offensive in India’s backyard hinges on transparent policies, prudent borrowing, and stronger regional cooperation. With 2025 ushering in greater digital integration, the competition to lead South Asia’s economic narrative is expected to intensify, with China, India, and other actors vying for influence.

Opportunities for Investors and Policy Makers

For international investors and policy makers, understanding the interplay between Chinese investments and local economies is key to future growth. South Asia’s evolving infrastructure and digital connectivity landscape offer both promises and pitfalls, and analytical insights from sources like economic forums remain invaluable for strategic decision-making.

Conclusion: Navigating the Charm Offensive

China’s charm offensive in India’s backyard is a defining trend in 2025, shaping trade routes, investment flows, and regional alliances. While opportunities abound, managing economic dependence and maintaining regional autonomy will be essential for lasting, inclusive development in South Asia.