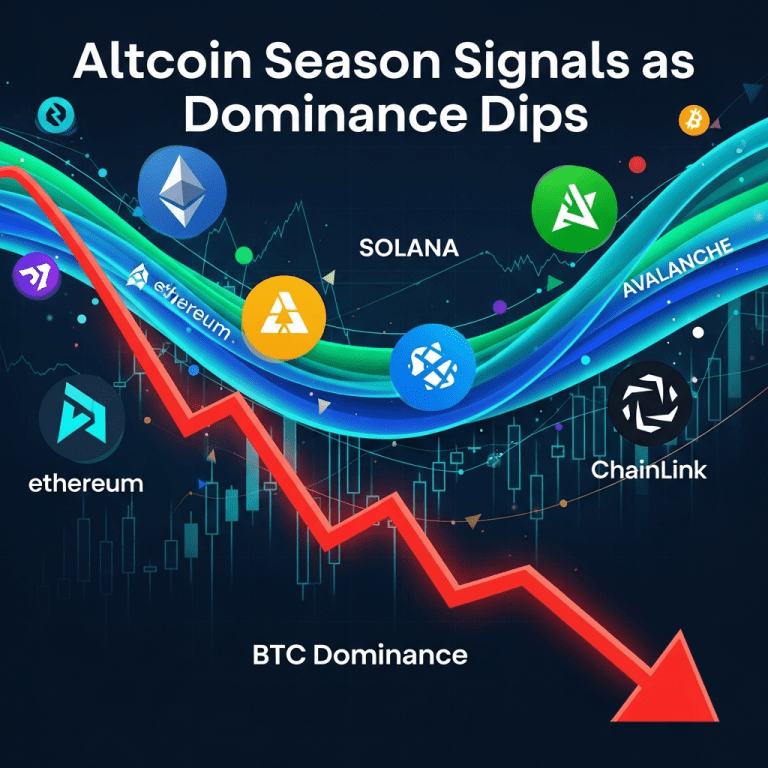

Analysts revealed altcoin season signals are surfacing as Bitcoin ($BTC) dominance charts stay stuck in bearish territory for the tenth consecutive week. Altcoin gains remain hidden within short-term market volatility, igniting speculation among traders searching for the altcoin season signals BTC dominance has historically foreshadowed. But is the trend change as imminent as some suggest?

Bitcoin Dominance Slides to 47.2%: Altcoin Season Signal?

Bitcoin ($BTC) market dominance continues to decline, reaching a six-month low of 47.2% as of November 8, 2025, according to CoinMarketCap data. This marks a sharp reversal from the April 2025 peak near 54%, and it represents a prolonged bearish stretch not seen since mid-2022. Trading volumes for Ethereum ($ETH) and Solana ($SOL) surged 21% and 39% week-over-week, respectively, as investors rotated capital into non-BTC assets. Analyst Chris Burniske notes, “Multi-week BTC dominance downtrends have historically preceded robust altcoin rallies, but the current cycle displays unique characteristics” (source: Bloomberg, November 2025).

Why Crypto Markets are Watching Bitcoin Dominance Slump

The sustained drop in Bitcoin dominance signals a shifting landscape for digital asset investors, with altcoins commanding increasing inflows. Historically, when BTC dominance dips below the 48% threshold, altcoin market capitalizations accelerate—a pattern observed in both the 2021 and late 2017 cycles (source: Coin Metrics). Recent macro factors, including persistent U.S. inflation near 3.2% (U.S. Bureau of Labor Statistics, October 2025) and a cautious Federal Reserve policy, add to risk-on appetite for secondary crypto assets. Sector-wide, total altcoin market cap rose from $722 billion to $789 billion (+9.3%) over four weeks, compared to Bitcoin’s 2.1% decline in the same span.

How Investors Are Positioning for Altcoin Season Rotation

Investors are recalibrating portfolios in response to these cryptocurrency market trends, with increased allocation to Layer-1 smart contract platforms and decentralized finance (DeFi) tokens. Ethereum ($ETH) and Solana ($SOL) are leading the charge, but mid-cap tokens like Avalanche ($AVAX) and Chainlink ($LINK) have also seen trading volumes double month-over-month. While long-term holders remain cautious amid ongoing regulatory scrutiny, short-term traders are leveraging the volatility for tactical gains, according to investment strategy insights from industry analysts. Still, risks persist: recent SEC enforcement actions and patchy liquidity on minor altcoins warrant added vigilance for investors rotating into this sector, as outlined in recent latest financial news coverage.

What Analysts Expect Next for Bitcoin, Ethereum, and Altcoins

Industry analysts observe that while multi-week BTC dominance drops often set the stage for altcoin rallies, timing remains uncertain. According to a Q3 2025 MLIV Pulse survey, 55% of professional crypto investors expect Ethereum, Solana, and DeFi tokens to outperform BTC by Q1 2026, but stress remains on macro headwinds and liquidity risk. Market consensus suggests the next quarter will be pivotal, with key technical resistance at 45% and 43% BTC dominance levels now in focus.

Altcoin Season Signals BTC Dominance Shift for Crypto in 2025

As altcoin season signals tied to BTC dominance continue flashing, investors should monitor capital flows, regulatory updates, and upcoming network upgrades. The persistence of Bitcoin’s bearish dominance trend could catalyze a more pronounced altcoin rally if historical correlations hold. In 2025, tracking the altcoin season signals BTC dominance provides will remain crucial for both tactical and strategic crypto allocation decisions.

Tags: altcoin season, BTC dominance, ETH, crypto market, SOL