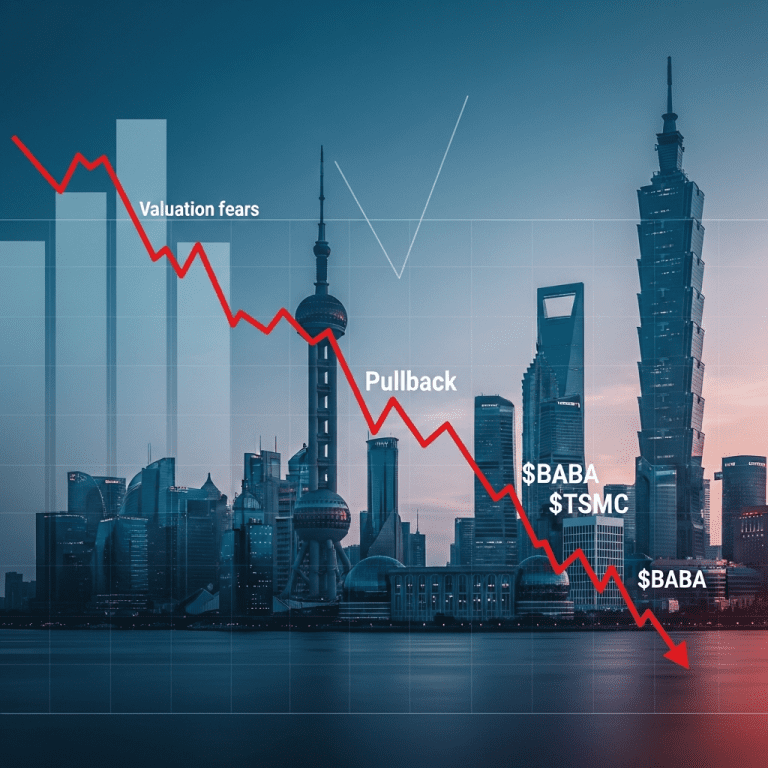

Asian stocks pulled back Wednesday as tech valuation fears triggered a sharp sell-off, sending Alibaba Group ($BABA) down 4.7% and TSMC ($TSMC) tumbling 3.2%. The Asian stocks pull back tech valuation debate surprises investors as regional benchmarks erode recent gains amid sector rotation.

Alibaba Slides 4.7%, TSMC Drops 3.2% as Tech Sector Leads Declines

Alibaba Group ($BABA) shares plunge 4.7% to HK$74.35 in Hong Kong trading, erasing $13.6 billion in market capitalization within hours. Taiwan Semiconductor Manufacturing Co. ($TSMC) declines 3.2% to NT$570 on the Taipei Exchange, while Japan’s Nikkei 225 falls 1.9% to 36,812. Tech-heavy Hang Seng Tech Index drops 3.4%, posting its steepest one-day loss since July 2025. According to data from Bloomberg as of November 5, 2025, over $56 billion in tech market value is wiped out regionally as investors digest weaker-than-expected quarterly guidance and a pronounced dip in chipmaker order books.

Chinese Tech Volatility Spurs Broader Asian Market Caution

Sharp price swings in Chinese and Taiwanese tech names ripple through broader Asian markets, reigniting old fears regarding elevated valuation multiples for the sector. The MSCI Asia ex-Japan Index is down 1.8%, registering its third consecutive session loss—its longest such streak since April 2025, per Refinitiv data. Economic headwinds remain pronounced: China’s October Caixin manufacturing PMI barely inches to 50.1, narrowly avoiding contraction, while South Korea’s semiconductor exports fell 5.5% year-over-year in October, signaling persistent sector softness (Korea Customs Service). These factors are steering investors toward defensive sectors like utilities, with the S&P/ASX 200 Utilities Index rising 0.6%, bucking the regional downtrend.

Portfolio Strategies: Reducing Exposure to Overpriced Tech Stocks

Investors holding large-cap technology stocks across Asia may reconsider their allocations amid the valuation-driven correction, particularly after the Nasdaq Golden Dragon China Index declined 2.9% overnight. Short-term traders are increasing put option volume on both Alibaba ($BABA) and Meituan ($3690.HK), reflecting rising demand for portfolio hedges. Major regional ETFs like the iShares MSCI China ETF ($MCHI) experience outflows of $420 million over three days, as reported by FactSet. For active managers, rotating into sectors resilient to global interest rate uncertainties—such as financials or utilities—is gaining momentum, according to recent stock market analysis. Investors are also watching for policy cues from China’s next economic plenary session, a potential catalyst discussed in the latest financial news.

Analysts Warn of Extended Volatility for Asian Tech Shares

Industry analysts at Nomura and Morgan Stanley note that high-growth Asian tech stocks are liable to remain volatile as global rate expectations shift and earnings momentum stalls. Market consensus suggests valuation corrections are likely to persist until earnings forecasts stabilize or Beijing signals fresh industry support. Investment strategists observe that sharp outflows from tech-focused funds could pressure valuations through year-end, especially if U.S. bond yields remain elevated.

Asian Stocks Pull Back Tech Valuation Signals New Risks Ahead

The tech-led Asian stocks pull back tech valuation trend underscores new risks for investors in 2025, especially with ongoing macro headwinds and sector re-rating. Watch for upcoming earnings releases and policy shifts that could reset sentiment. Investors should exercise caution and focus on diversified exposure while tracking key data points and forward-looking indicators.

Tags: Asian stocks, technology sector, Alibaba, TSMC, stock market volatility