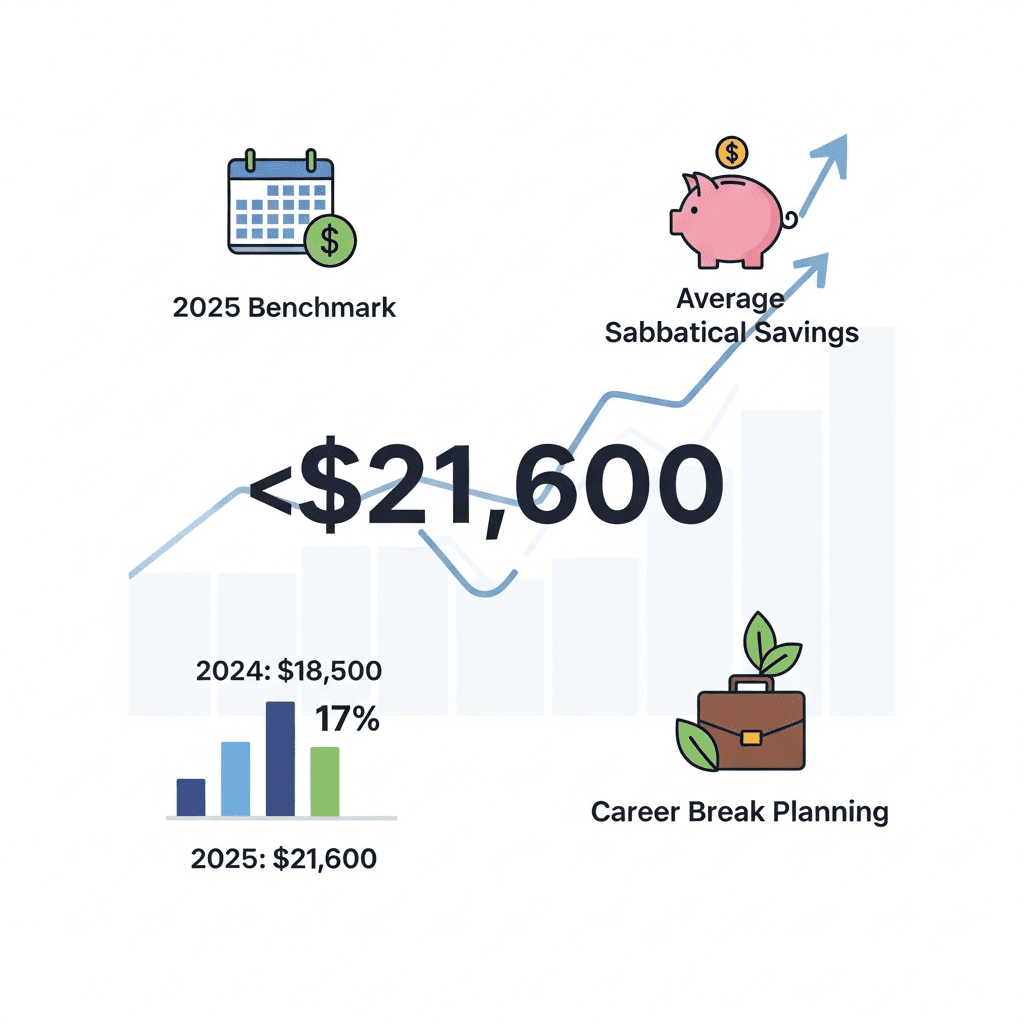

Fidelity Investments ($FNF) revealed that the average savings for sabbatical seekers in 2025 hit $21,600, marking a 17% increase over last year. The focus keyphrase, average savings for sabbatical, spotlights a trend: more professionals are preparing larger financial cushions than ever before. Why is this number surprising amid a cost-conscious economy?

Fidelity Reports 17% Surge: 2025 Average Sabbatical Savings Hits $21,600

Fidelity Investments ($FNF) announced that U.S. professionals taking career breaks in 2025 report an average sabbatical savings of $21,600, up from $18,500 in 2024—a 17% year-over-year increase (Fidelity 2025 Financial Planning Study). Notably, 62% of survey respondents indicated they set aside a dedicated sabbatical fund, compared to 54% the previous year. The analysis found the median cash reserve for sabbaticals stood at $16,800, showing wide variation based on age, industry, and geography.

The data, collected between January and September 2025, also highlighted that Millennials (ages 28-42) led all cohorts, averaging $24,200 in savings for their planned leave. In contrast, Gen Z trailed at $14,900. Demand for extended breaks is highest in tech and healthcare, aligning with burnout trends cited by the American Psychological Association (April 2025 Report).

Why Rising Sabbatical Savings Reflect Shifting Workforce Trends

The sharp rise in average savings for sabbatical reflects broader trends in the labor market and personal finance. U.S. workers faced increased living costs in 2025, as the Consumer Price Index grew by 3.8% year-over-year (U.S. Bureau of Labor Statistics, September 2025). With job market volatility and high inflation, professionals are prioritizing larger emergency funds before career breaks. Historically, median sabbatical savings hovered near $14,000 in 2020, according to Morningstar, demonstrating a significant five-year growth as financial caution prevails.

Industry shifts—especially among knowledge workers in technology, finance, and healthcare—are amplifying demand for time off, with Fortune 500 companies expanding unpaid leave benefits. Corporate wellness policies are also influencing this trend, as more firms add flexible sabbatical options to combat attrition. For employers and employees alike, robust sabbatical funds signal a focus on sustainability over short-term spending—a theme echoed across latest financial news coverage.

How Investors and Savers Can Strategize for Sabbatical Planning

Investors considering a sabbatical in 2025 should assess their liquidity and time horizon, particularly with the average savings for sabbatical trending upward. Financial advisors recommend a multi-tiered approach: earmark 6–12 months of living expenses in liquid accounts; maintain investment portfolios for long-term growth; and review employer benefits for paid or protected leave. Risk-averse individuals may want to increase allocations to high-yield savings accounts (currently averaging 4.1% APY as of October 2025, per Bankrate), while more aggressive savers might consider laddering short-term Treasury bills to balance access and yield.

With U.S. equities demonstrating above-average volatility—S&P 500 realized volatility reached 17.2% in Q3 2025 (Bloomberg)—savvy planners are reevaluating drawdown strategies before pausing work. Those in high-burnout fields, particularly tech (see stock market analysis for sector insights), often coordinate planned selling of vested equity or bonuses ahead of leave. Investors on the fence should monitor policy changes and inflation metrics, as these factors will affect cashflow and the sizing of sabbatical reserves. Detailed insights can be found in investment strategy resources for those planning a career break.

What Experts Say About Future Sabbatical Savings Requirements

Analysts at Bank of America and independent financial planners agree that the upward trajectory in average savings for sabbatical is likely to persist into 2026, citing ongoing inflation and persistent workplace burnout (Bank of America Trends Report, July 2025). Industry analysts observe that more employees are proactively negotiating sabbatical clauses and building longer cash runways. With interest rates projected to remain stable in the near term, experts expect cautious savings behavior to remain the norm for aspiring sabbatical-takers.

Average Savings for Sabbatical Signals New Bar for 2025 Professionals

Mounting evidence shows that average savings for sabbatical now set a higher threshold for Americans considering a meaningful break. Looking ahead, experts recommend tracking inflation and employer benefit changes, as both could alter the financial calculus for time off. For investors and professionals alike, building a tailored cash reserve is crucial as sabbatical norms continue to evolve in 2025 and beyond.

Tags: average savings for sabbatical, financial planning, Fidelity ($FNF), career break, US labor market