Bessent names Fed Chair finalists ahead of the anticipated year-end decision, providing early clarity for markets as the Federal Reserve approaches a pivotal leadership transition. This announcement outlines the candidates who may steer monetary policy in 2025 and beyond, directly influencing market expectations and investor strategy.

What Happened

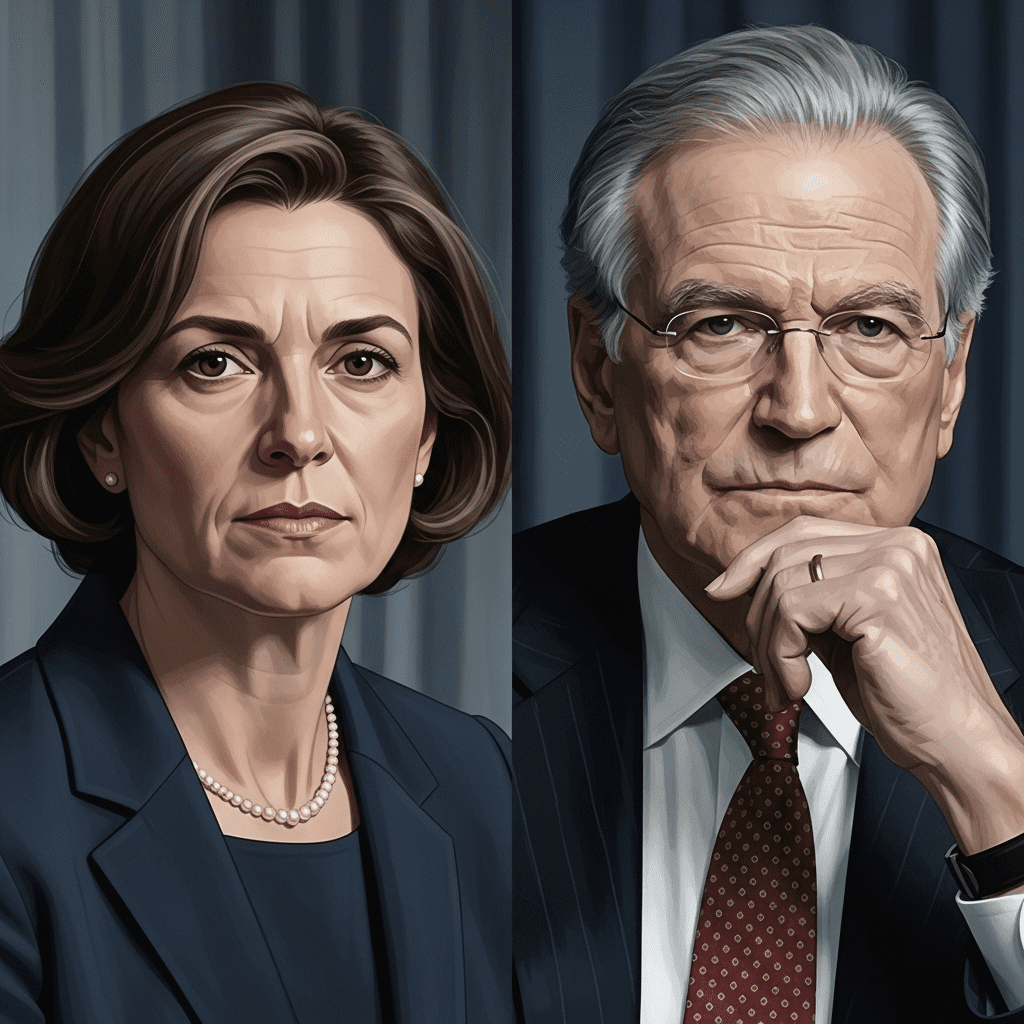

In a move closely tracked by market participants, Bessent named Fed Chair finalists this week, narrowing the field to three candidates as the Federal Reserve’s leadership transition approaches year-end. Citing sources reported by Bloomberg (June 2025), the finalists include current Vice Chair Lael Brainard, former Treasury official Sarah Bloom Raskin, and regional Fed President John Williams. The announcement comes amid elevated market anticipation, with S&P 500 volatility measures rising 7% month-over-month (CBOE Volatility Index, June 2025), as investors prepare for potential shifts in monetary policy leadership. Bessent emphasized the need for “continuity and credibility,” stating: “Our finalists each bring a unique blend of experience and vision essential for steering monetary policy in an uncertain global landscape.” The final selection is expected to be announced by late December, according to official Federal Reserve communications.

Why It Matters

The decision to name Fed Chair finalists early underscores the critical role Fed leadership plays in economic stability, inflation management, and investor confidence. With inflation moderating to 2.4% year-over-year (U.S. CPI, May 2025) but economic headwinds persisting, the next Chair will shape policies on rate cuts, balance sheet runoff, and digital currency integration. As noted in recent investment insights, the last leadership transition in 2018 triggered notable market reshuffling—underscoring how even small signals from Fed leadership can influence yields, equity valuations, and global capital flows. Market consensus now views the upcoming appointment as a key inflection point for both U.S. and global policy direction into 2025.

Impact on Investors

For investors, the announcement that Bessent names Fed Chair finalists creates both risk and opportunity across asset classes. Rate-sensitive sectors—including financials (SPY), real estate (VNQ), and technology (XLK)—are particularly reactive to perceptions of policy continuity versus a potential pivot. Yields on 10-year U.S. Treasuries edged higher to 3.45% following the finalists’ announcement, reflecting heightened market focus on the future policy stance (Reuters, June 2025). “Markets are reassessing rate path projections, with the finalists representing varied approaches to inflation and liquidity,” said Morgan Weiss, chief strategist at Riverton Asset Management. “Active positioning is essential as investors weigh likely guidance style and long-term policy leanings.” For actionable guidance, investors can monitor key data releases and candidate comments—while utilizing resources like ThinkInvest’s market analysis to track changing sentiment.

Expert Take

Analysts note that the early shortlist narrows uncertainty, providing a focal point for market expectations. Market strategists suggest that whoever is selected will face a delicate balance between supporting growth and maintaining inflation credibility, making the next Fed Chair’s policy guidance critical to risk asset pricing.

The Bottom Line

Bessent naming Fed Chair finalists ahead of the year-end decision offers rare visibility into an event with deep implications for monetary policy and capital markets. As investors position portfolios for 2025, the leadership choice will be a key variable shaping interest rates, equity volatility, and cross-asset flows. Staying informed on the latest developments—as covered in ThinkInvest’s real-time economic outlook—is crucial as the market adapts to this leadership crossroads.

Tags: Federal Reserve, monetary policy, Fed Chair finalists, investor outlook, 2025 economy.