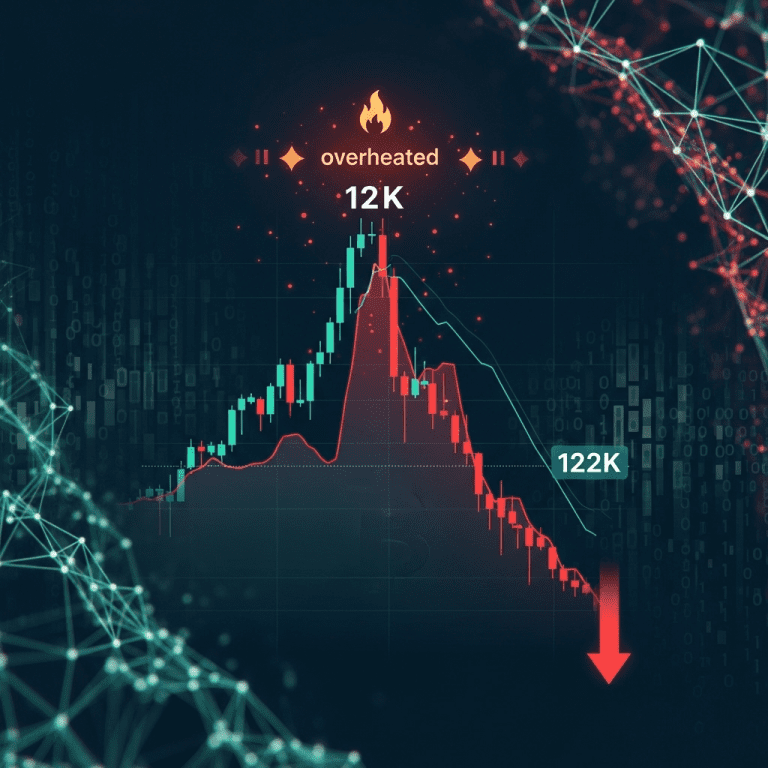

The news that Bitcoin dips to $122K as crypto rally gets overheated has sent shockwaves through the cryptocurrency market. After a period of parabolic gains in digital assets, this retracement raises important questions: Has the rally peaked, and what lies ahead for Bitcoin and the broader crypto ecosystem in 2025?

Bitcoin Dips to $122K as Crypto Rally Gets Overheated: The Story So Far

Bitcoin’s journey to $122,000, after reaching new all-time highs in the first half of 2025, was seen by many as a testament to the growing mainstream acceptance of digital currencies. Substantial institutional inflows, the launch of next-generation spot Bitcoin ETFs, and renewed retail enthusiasm all drove price acceleration throughout late 2024 and early 2025. However, with coin liquidity thinning out and leveraged positions surging, analysts began warning of “overheated” market conditions.

In early June 2025, a confluence of factors—profit-taking, macroeconomic uncertainty, and regulatory signals—triggered a sharp correction. Bitcoin slid from its record highs down to $122K, reflecting a roughly 18% pullback within days. This sudden dip rippled across altcoins, with the broader crypto market giving up hundreds of billions in value almost overnight.

Why Did This Correction Happen?

1. Overextended Bullish Sentiment

After sustained upward movement, technical indicators like the Relative Strength Index (RSI) and extreme funding rates hinted that the rally had become overextended. Sentiment analysis showed euphoric retail optimism, often a classic contrarian signal suggesting a correction was imminent.

2. Profit-Taking and Leverage Unwind

Many institutional and sophisticated investors had accumulated positions at much lower levels; as Bitcoin soared past $140K, profit-taking intensified. Simultaneously, leveraged derivatives positions started unwinding, amplifying downward pressure. Large liquidations on major exchanges triggered automatic sell-offs that contributed to the rapid drop to $122K.

3. Macro and Regulatory Headwinds

As global interest rates remained elevated and central banks signaled caution, risk assets, including crypto, experienced exacerbated volatility. Concerns about pending regulatory actions—particularly regarding crypto taxes and stablecoin frameworks—added uncertainty, causing short-term sentiment to sour.

How Is the Crypto Market Reacting?

The immediate effect of the correction was a wave of panic selling among newer investors. However, veteran market watchers pointed out that pullbacks of 15-30% are not unusual in Bitcoin bull cycles, and can serve as healthy resets. Several market analysts now anticipate that this dip could set the stage for a more stable, sustainable uptrend if key support levels hold.

Crypto Fundamentals in 2025 Remain Strong

Unlike past bear markets, the current crypto cycle in 2025 is marked by robust underlying fundamentals: expanding adoption, increasing on-chain activity, and the integration of blockchain technology into mainstream financial tools. Institutions continue to signal commitment through product launches and significant investments. Financial leaders have underlined the role of Bitcoin as a portfolio hedge amid ongoing economic uncertainty.

What Comes Next for Bitcoin and Crypto Investors?

Short-Term Scenarios

Market participants are watching the $120K-$122K zone as a crucial support level. A decisive bounce could see Bitcoin reclaim momentum, while further weakness might lead to retesting lower levels seen earlier this year. Volatility is likely to remain elevated in the near term, especially as macro news and regulatory updates unfold. Investors should prepare for sharp price swings as the market digests recent gains.

Mid- to Long-Term Outlook

For those focused on the big picture, the long-term trajectory of Bitcoin and the crypto market appears intact. Many top strategists project that, after cooling off, Bitcoin could consolidate before making another attempt at new highs later in 2025. Adoption drivers like tokenized assets, mainstream payment integrations, and enhanced regulatory clarity are expected to create new tailwinds. The latest dip may, in hindsight, present a strategic entry point for long-term believers in digital assets.

Strategies to Consider Amidst Volatility

- Avoid Panic Selling: Emotional decisions have historically led to subpar outcomes in crypto markets. Seasoned investors recommend reviewing long-term theses before reacting impulsively.

- Diversification: Allocating across multiple crypto and traditional asset classes can cushion portfolio volatility. Keep allocation sizes in check relative to risk tolerance.

- Dollar-Cost Averaging: For those unsure of market timing, gradually accumulating positions over weeks or months can reduce the risk of buying tops and capitalize on dips.

- Monitor Regulatory Developments: Stay updated with the latest crypto policy news, as new regulations can quickly impact sentiment and prices.

New entrants should utilize trusted research and investment tools, like those available on professional crypto platforms, to navigate fast-moving markets with confidence.

Conclusion: Opportunity Amidst the Dip

As Bitcoin dips to $122K as crypto rally gets overheated, it is a timely reminder that volatility is an unavoidable feature of crypto asset cycles—even in bullish environments. While corrections can be unnerving, they also offer vital breathing room for the market to reset and build for the next phase of growth. Whether Bitcoin quickly rebounds or consolidates for an extended period, the tools, strategies, and overall market maturity of 2025 suggest investors are better equipped than ever to seize opportunities in crypto’s evolution.