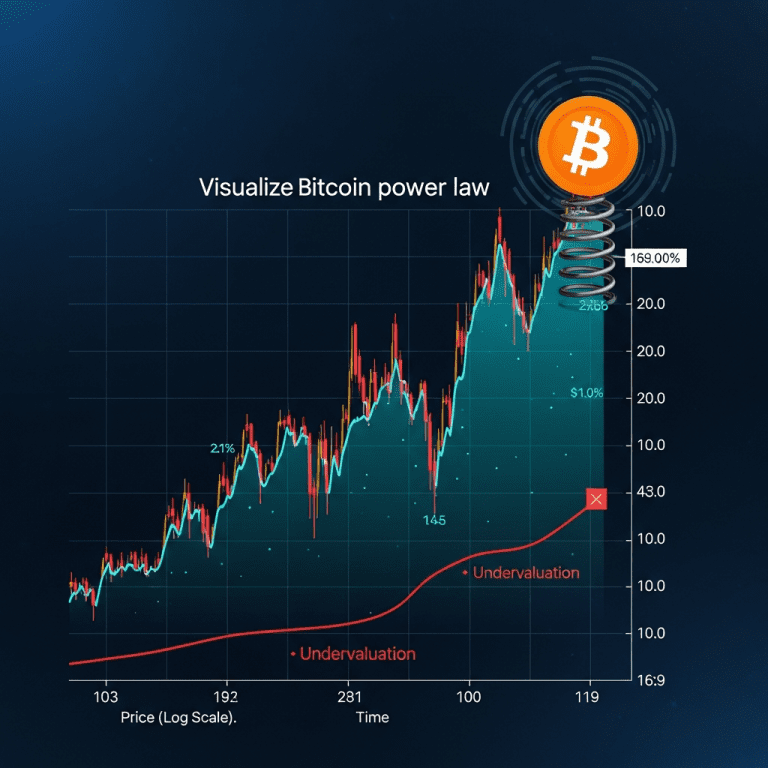

Bitcoin ($BTC) surged above $69,800 this week as an influential analyst revealed the Bitcoin power law signals a “coiled spring” ready to burst higher. This mathematical model’s unexpected divergence from price action now points to an imminent Bitcoin power law breakout that could reshape crypto market trends.

Bitcoin Power Law Divergence: BTC Nears All-Time High at $69,800

On November 8, Bitcoin ($BTC) traded at $69,800, marking a 3.9% gain over the past five trading days, according to CoinMarketCap. Glassnode data shows Bitcoin’s 30-day volatility dropped to just 2.2%—historically low compared to the 2021 cycle. Notably, analyst Harold Morris of Quant Research reported that Bitcoin’s price is now deviating from its long-standing power law trendline by 18%, the most significant “undervaluation” since April 2020. This has fueled speculation that BTC could mirror its prior sharp rallies when similar discrepancies occurred. (Sources: CoinMarketCap, Glassnode, Quant Research 2024 report)

Crypto Market Faces Tighter Correlations Amid Bitcoin Breakout Signals

The broader cryptocurrency market is reacting to Bitcoin’s technical signals, with total crypto market capitalization hitting $2.74 trillion—up 6% month-to-date, based on TradingView data. Leading altcoins like Ethereum ($ETH) and Solana ($SOL) have advanced 4.1% and 6.8% respectively over the same period. Crypto correlation metrics from IntoTheBlock show that Bitcoin’s correlation with major altcoins increased to 0.81 in early November, suggesting that a pronounced Bitcoin move could ripple across digital assets. This pattern resembles cycles seen in late 2020 and March 2021, when Bitcoin rallies catalyzed wider altcoin gains. Regulatory stances, such as the SEC’s ongoing review of spot Bitcoin ETF applications, add further uncertainty and potential catalysts for sector-wide moves. (Sources: TradingView, IntoTheBlock, SEC public releases)

Portfolio Strategies: How Investors Can Navigate a Bitcoin Power Law Breakout

Investment strategists are advising both institutional and retail investors to monitor volatility and liquidity closely as technical models project substantial upside risk. Traders may consider scaling into BTC positions gradually, employing stop-losses below the $65,000 support—a level where over $780 million in open interest is concentrated, per Binance Futures data. Long-term holders focused on power law cycles should review allocations to maintain exposure ahead of potential historic surges, while short-term traders remain alert for false breakouts. Sector-focused portfolio managers might also adjust altcoin weights given the heightened correlations. For more detailed cryptocurrency market trends and expert-driven investment strategy, staying updated on macro and regulatory catalysts will be essential as this technical setup unfolds.

Analysts Debate Bitcoin’s Trajectory After Power Law Deviation

Market consensus among leading analysts suggests this prolonged deviation from the Bitcoin power law trendline raises the probability of renewed upside momentum. Industry analysts at Fidelity Digital Assets and Galaxy Research, as cited in their 2024 outlooks, note previous power law divergences preceded 2–4x BTC price expansions within 6–18 months. However, some point to the risk of macroeconomic headwinds and regulatory surprises. As of November 2025, most professional observers agree that the technical and on-chain setup invites significant two-way volatility in coming weeks.

Bitcoin Power Law Breakout Signals New Cycle for Crypto Investors

The divergence in Bitcoin’s power law trendline and recent low volatility suggests a Bitcoin power law breakout could set a decisive tone for digital assets into 2026. Investors should closely track technical signals, macro policy, and on-chain flows as volatility returns. With a “coiled spring” scenario in play, preparedness and agility will differentiate performance through the next phase of the crypto market cycle.

Tags: Bitcoin, BTC, crypto analysis, power law breakout, cryptocurrency