Bitcoin ($BTC) abruptly plunged to $94,000 overnight, shaking crypto markets as it marked a new six-month low. The scale and speed of the Bitcoin price crash surprised traders and analysts, prompting urgent questions about underlying causes. What drove this dramatic downturn, and where could the market head next?

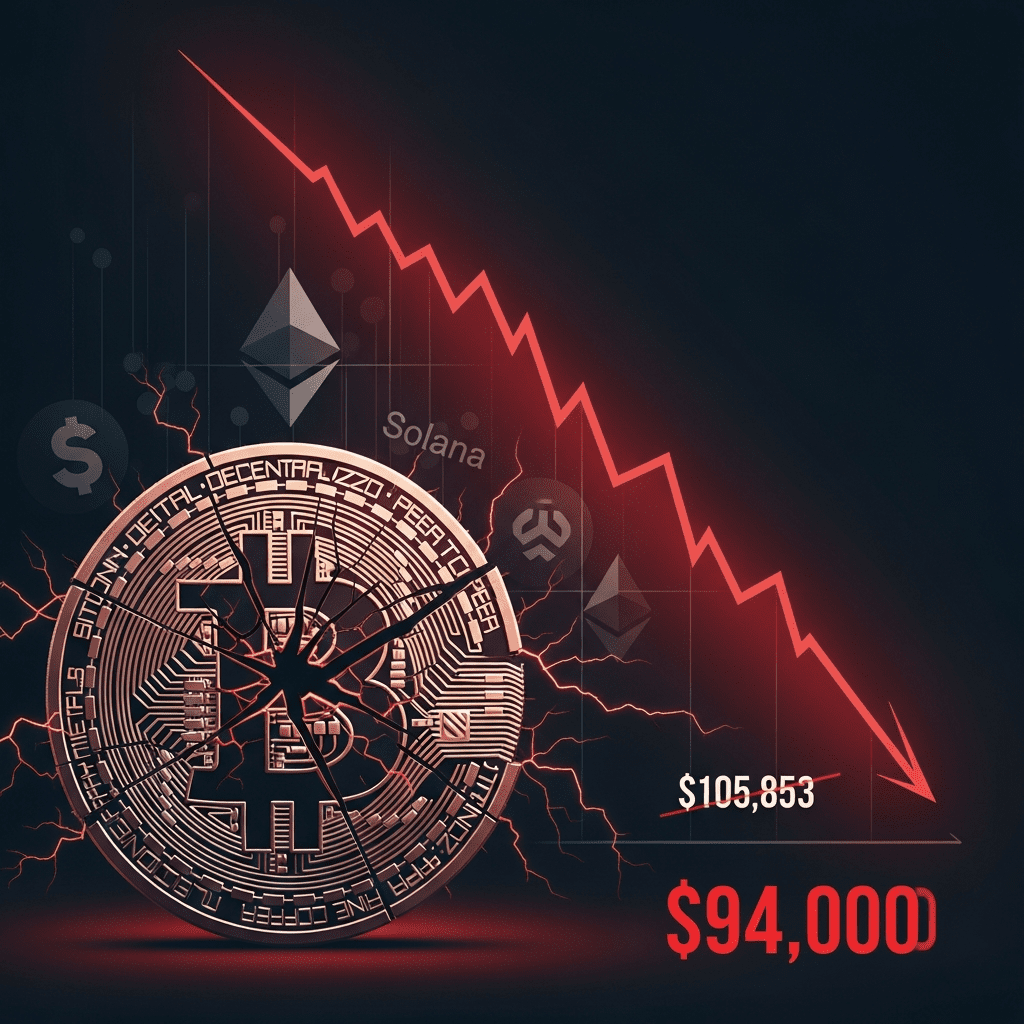

Bitcoin Price Drops 11% Overnight to $94,000 in Sharp Selloff

Bitcoin ($BTC) has tumbled 11.2% in the last 24 hours, falling from $105,853 to $94,000, its lowest mark since May 2025, according to CoinMarketCap data as of November 16, 2025. Trading volume soared to over $68 billion, a 38% increase from the previous day, signaling panic-driven selling. The rout erased $209 billion in Bitcoin’s total market capitalization, now standing at $1.85 trillion. The most acute slide began after 01:30 UTC, with cascading liquidations totaling $2.3 billion across major derivatives exchanges, per Coinglass data.

How the Bitcoin Crash Impacts the Cryptocurrency Market

The bitcoin price crash to $94,000 triggered broad declines across the digital asset sector. Ether ($ETH) fell nearly 9% to $4,820, while Solana ($SOL) dropped 12.7% to $165, leading sharp drawdowns among major altcoins. According to Bloomberg, the total crypto market capitalization has dropped by $420 billion since the start of the week. This selloff comes amid heightened global risk aversion, with the U.S. Dollar Index (DXY) rising to 108.2 and the 10-year Treasury yield climbing above 5.0%, signaling investors’ flight to safety. Historically, sudden Bitcoin declines of this magnitude tend to trigger widespread deleveraging and heightened volatility across risk assets.

How Investors Can Navigate Crypto Volatility After the Selloff

Long-term holders who weathered past drawdowns may view the Bitcoin price crash as an opportunity to accumulate at discounted levels, while active traders face heightened liquidation risk amid extreme volatility. Portfolio managers are likely to rebalance exposure, shifting allocations toward cash or less volatile assets in the near term. Crypto-focused funds could implement tighter risk controls and demand higher margin requirements after the surge in forced liquidations. For those tracking cryptocurrency market trends, watching liquidity levels and institutional flows will be key to identifying stabilization points. Investors seeking broader investment strategy insights should monitor technical support levels and regulatory headlines before re-entering aggressively.

Why Experts Warn of Further Volatility in Crypto Markets

Industry analysts observe that structural fragility remains in the crypto market, with elevated leverage and thin order books magnifying price swings. Market consensus suggests persistent uncertainty tied to regulatory developments and macroeconomic headwinds could prolong volatility. According to digital asset strategists at Matrixport (November 2025), continued outflows from spot bitcoin ETFs and speculative derivatives usage amplify downside risk, especially during periods of shrinking liquidity and tightening financial conditions.

What the Bitcoin Price Crash to $94,000 Means for 2025 Investors

The bitcoin price crash to $94,000 signals a renewed era of turbulence for crypto investors in 2025. With sharp corrections often followed by volatile rebounds, monitoring market structure and regulatory cues will be critical. Investors should exercise caution, prioritize risk management, and watch for confirmation of sustained buying before increasing exposure to digital assets.

Tags: Bitcoin, BTC, cryptocurrency, market crash, crypto volatility