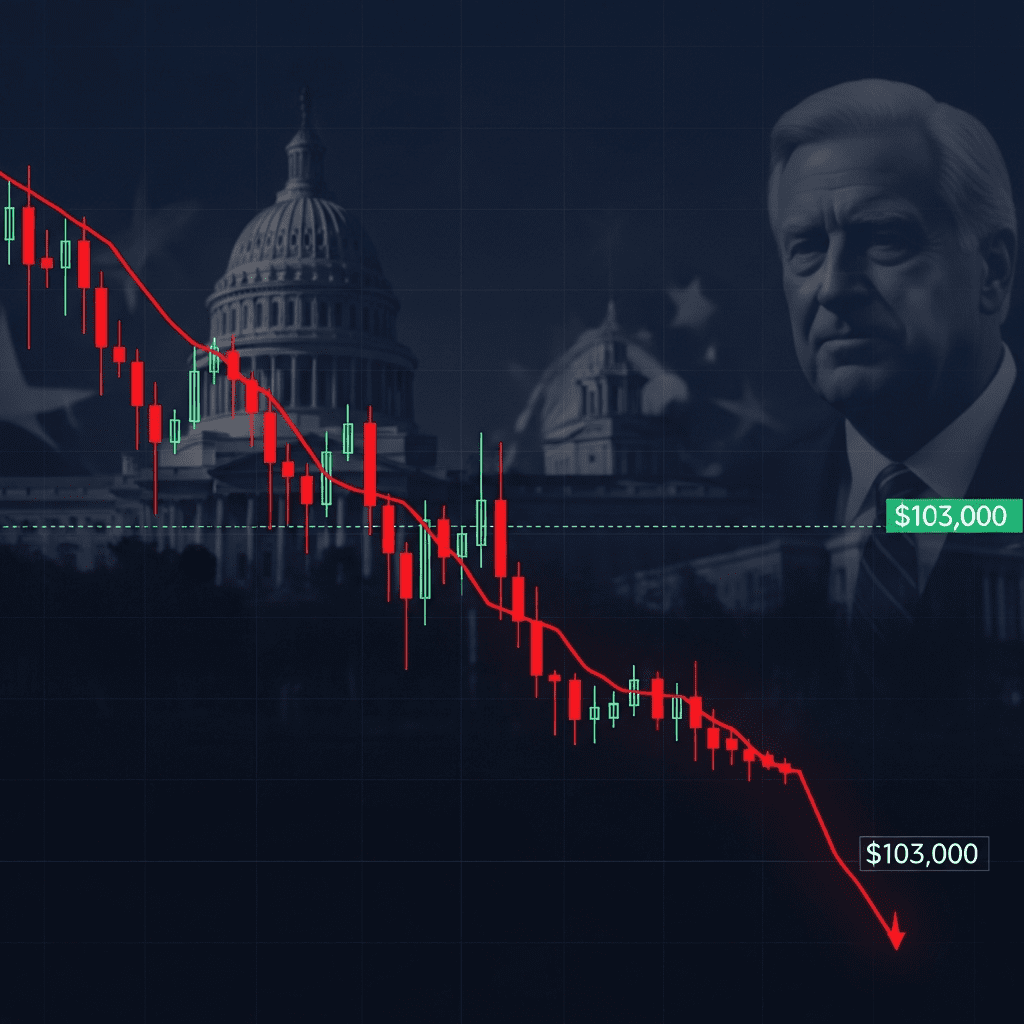

Bitcoin ($BTC) plunged to $103,000 in early Asian trading as the U.S. government reopened and former President Donald Trump weighed new tariff checks, shifting the focus keyphrase “Bitcoin price falls to $103,000” into the global spotlight. The speed and magnitude of the drop have surprised traders and analysts, putting crypto markets on alert.

Bitcoin Price Falls to $103,000 Amid Sudden Market Whiplash

Bitcoin ($BTC) traded down 7.8% overnight, sinking from $111,700 at 21:00 UTC on November 11 to $103,000 by 05:30 UTC, according to CoinMarketCap data. The 24-hour trading volume surged to $87.2 billion, up 41% from the previous day as liquidation cascades hit leveraged positions. This decline comes immediately after the U.S. government resolved its month-long shutdown, with the reopening bill passed in Congress late on November 11. CME bitcoin futures also showed a sharp discount, with the November contract trading $1,300 below spot, per CME Group data.

How U.S. Government Reopening and Tariff Uncertainty Impact Crypto

The rapid policy shifts from Washington are amplifying volatility across risk assets. U.S. equity futures exhibited wide swings after the government reopening, with the S&P 500 e-mini futures down 1.3% pre-market. Former President Trump’s public consideration of “tariff checks” on imported goods, discussed during a news conference on November 11, fueled new worries about global trade tensions and their disruptive effect on the digital asset ecosystem. After the 2023 U.S. banking mini-crisis, bitcoin and other cryptocurrencies had benefited from safe-haven flows, but the renewed policy unpredictability appears to be driving some traders to reduce exposure, per Bloomberg analysis published November 11.

Actionable Strategies for Crypto Investors amid Bitcoin Decline

Investors navigating this period of heightened volatility face critical portfolio decisions. Short-term traders are rebalancing, with spot crypto exchanges such as Binance and Coinbase ($COIN) reporting a 36% increase in bitcoin-to-stablecoin swaps compared to the previous week, according to the exchanges’ end-of-day summaries from November 11. Long-term holders are watching key technical support levels near $100,000. Sector ETFs, including the ProShares Bitcoin Strategy ETF ($BITO), fell 6.1% in after-hours trading, highlighting spillover risks to traditional financial instruments linked to crypto. For more guidance on cryptocurrency market trends and adaptive portfolio tactics, see investment strategy insights and our coverage of latest financial news.

What Analysts Expect Next for Bitcoin After Historic Drop

Industry analysts observe that bitcoin’s correlation to major U.S. equity indices has tightened in recent months, increasing its sensitivity to political and economic surprises. According to market strategists at Galaxy Digital (November 2025 commentary), liquidity shocks—particularly near large technical levels—are likely to persist until fiscal and trade uncertainties settle. Market consensus suggests that volatility could remain elevated through the coming quarter as traders react to shifting policy rhetoric.

Bitcoin Price Falls to $103,000 Signals New Market Regime in 2025

With bitcoin price falls to $103,000 jolting investors, attention turns to upcoming Federal Reserve decisions, U.S. trade policy moves, and global liquidity trends. Crypto investors should prepare for continued fast-moving markets and monitor developments that could signal renewed inflows or deeper corrections. This episode reinforces the need for disciplined risk management and flexible allocation strategies.

Tags: Bitcoin, BTC, crypto volatility, US policy, $BITO