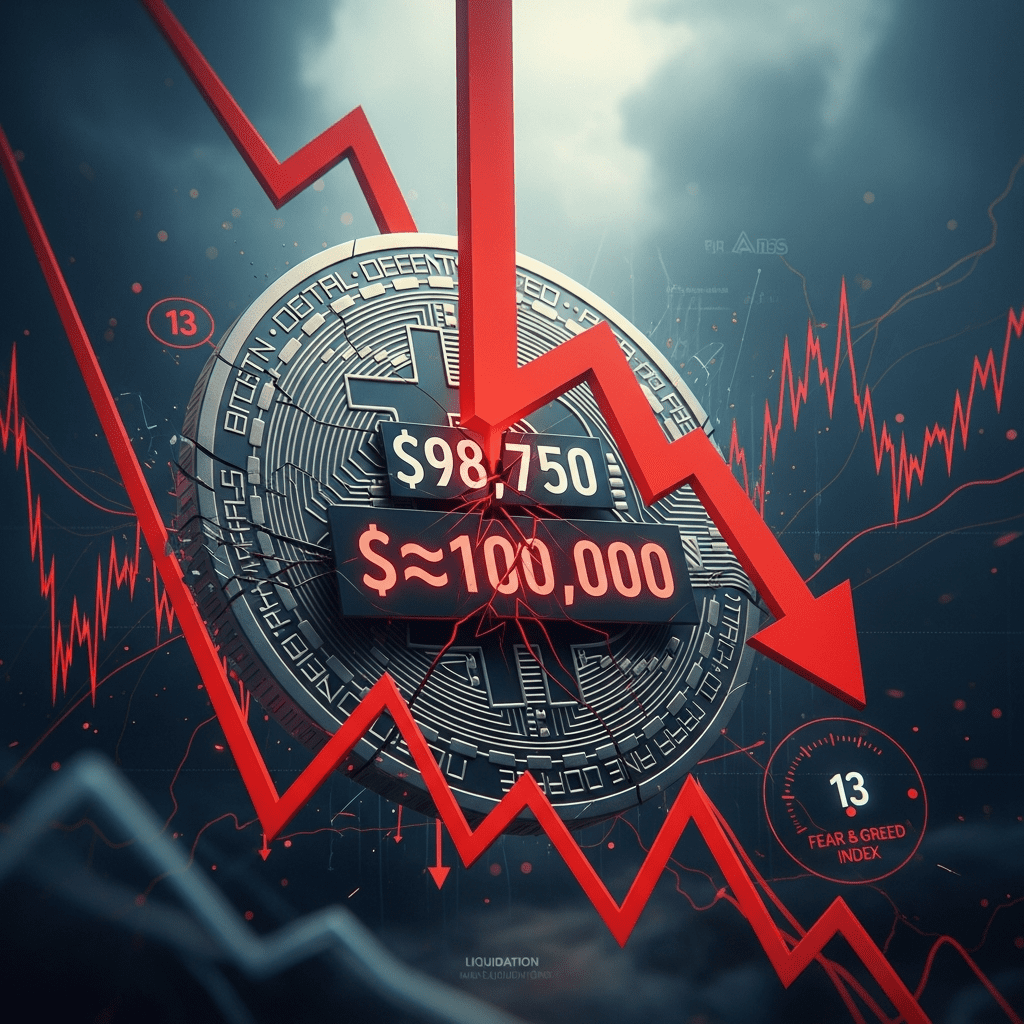

Bitcoin ($BTC) stunned markets by plunging below $100,000 overnight, fueling extreme fear and record liquidations amid surging volatility. The sharp decline has intensified uncertainty, making ‘Bitcoin price plunges below $100,000’ the phrase on every crypto investor’s mind.

Bitcoin Falls 13% in 24 Hours, Dipping Below $100,000 Threshold

Bitcoin ($BTC) tumbled to $98,750 on November 4, 2025, representing a 13.2% drop from its previous day’s close of $113,800, according to CoinMarketCap data. Trading volumes soared past $76 billion in 24 hours, the highest since March 2025. Open interest in Bitcoin futures saw a drastic $2.3 billion reduction as long positions were force-liquidated across major exchanges, per Coinglass metrics. This sudden price shock marked the steepest single-day decline for Bitcoin since May 2023.

Crypto Market Sentiment Sours as Liquidations Hit Two-Year Highs

Broader cryptocurrency markets echoed Bitcoin’s plunge, with the total crypto market capitalization contracting by $250 billion to $2.57 trillion, based on CoinGecko figures. The Crypto Fear & Greed Index sank to 13—its lowest reading since the FTX collapse in November 2022—signaling pervasive “extreme fear.” Major altcoins like Ethereum ($ETH) and Solana ($SOL) slid 10% and 16.5%, respectively, intensifying industry-wide sell-offs. Escalating regulatory speculation and delayed U.S. Bitcoin ETF approvals contributed further to market unease, with Reuters reporting heightened withdrawal activity from centralized exchanges as investors sought safety.

How Investors Can Navigate Bitcoin Volatility After the Crash

With Bitcoin’s volatility peaking, investors face tough portfolio decisions. Long-term holders are weighing whether to average down amid price disruption, while short-term traders tactically manage stop-losses and cash allocations. Risk-sensitive assets such as DeFi tokens saw amplified losses, highlighting the need for diversified crypto exposure. Meanwhile, some institutional players reportedly added exposure on the dip, per a summary analysis of fund flows by Bloomberg. For ongoing updates and deeper context, explore cryptocurrency market trends and investment strategy resources on ThinkInvest.

What Analysts Expect Next for Bitcoin and Crypto Markets

Industry analysts observe that uncertainty will likely persist, with technical support zones clustered at $96,000 and $92,500. Market consensus suggests continued turbulence until regulatory clarity emerges and leverage resets. Investment strategists at multiple firms note that macro factors—such as shifting Fed policy and global liquidity conditions—remain pivotal to Bitcoin’s near-term recovery prospects. Many emphasize watching for stabilization in on-chain activity and sentiment indicators as potential reversal signals.

Bitcoin Price Plunges Below $100,000 Signals New Era for Investors

The latest ‘Bitcoin price plunges below $100,000’ episode underscores the asset’s volatility and the heightened role sentiment plays in crypto markets. Investors should monitor regulatory news, ETF developments, and technical support levels for signs of reversal. Staying nimble and diversified is essential as the market enters a period of heightened risk—and potential opportunity.

Tags: Bitcoin, BTC, cryptocurrency, market volatility, crypto news