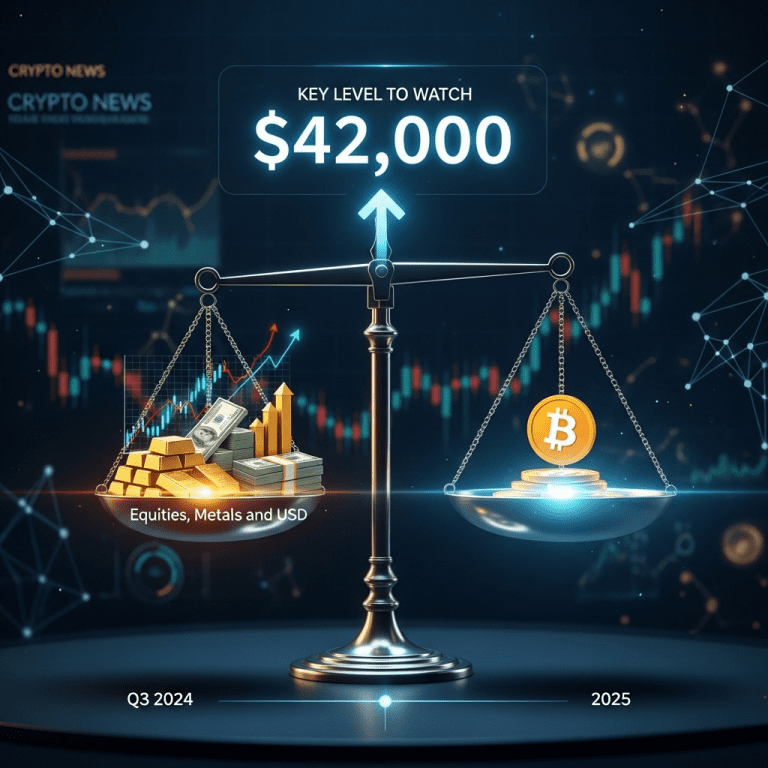

The phrase “Bitcoin trails equities, metals, and USD in Q3” has quickly become a focal point for traders and analysts as the digital asset’s performance lagged noticeably behind traditional markets during the third quarter of 2024. As we transition into 2025, attention is now squarely fixed on a critical price level that could dictate Bitcoin’s next significant move, shaping strategy for both seasoned investors and newcomers alike.

Understanding Why Bitcoin Trails Equities, Metals, and USD in Q3

Bitcoin’s underperformance, when compared to equities, precious metals, and the U.S. dollar index in Q3, marks a contrast to its usual position as an uncorrelated asset. This development highlights evolving macroeconomic conditions—ranging from monetary policy to shifting investor sentiment—that have placed greater emphasis on legacy safe havens and equity gains.

In the past quarter, the S&P 500 notched steady advances amid optimism around AI and technological innovation. Gold and silver, supported by persistent inflationary pressures and geopolitical uncertainty, attracted extended capital flows. The U.S. dollar, buoyed by hawkish Federal Reserve commentary and global capital seeking safe haven, surged to its highest marks in months. Against this backdrop, Bitcoin’s sideways consolidation and slightly negative returns stood out.

The Broader Crypto Landscape in Q3 2024

While Bitcoin stumbled, the wider crypto market faced a cooling period characterized by decreased trading volumes and tepid institutional inflows. Several prominent altcoins followed Bitcoin’s lead, with ETH, BNB, and SOL all lagging behind major macro assets.

According to recent data from ThinkInvest.org, capital rotated out of high-volatility crypto assets in favor of stability amid fears of stricter regulations and global economic uncertainty. The narrative that “Bitcoin trails equities, metals, and USD in Q3” was reinforced by this broader risk-off approach.

Key Level to Watch for Bitcoin’s Next Move

For traders and investors eyeing the next inflection point, technical and on-chain analysis pinpoint the $42,000 level as a linchpin for Bitcoin’s near-term direction. This price region features layered confluence from previous support and resistance zones, elevated on-chain volume, and an alignment with key moving averages.

Why $42,000 Matters

The $42,000 level holds significance for several reasons:

- Historical Pivot: Q2 and early Q3 price action repeatedly found support and resistance near this threshold, marking it as a battleground for bulls and bears.

- Options Expiry Gravity: Data shows significant open interest on options contracts centered around the $42K strike, increasing its psychological weight.

- On-Chain Activity: Large transaction volume clusters and coin age bands suggest this area has been pivotal for whale accumulation and distribution.

A strong weekly close above $42,000 could spark renewed momentum, while failure to reclaim this line may cascade into lower supports near $38,500.

Factors Influencing Bitcoin’s Recovery Prospects

Macro Environment in 2025

Looking forward, Bitcoin’s prospects remain closely tied to macroeconomic trends. Key influences include:

- Global Interest Rates: Shifts in Fed and ECB policy could impact risk appetite for both crypto and traditional assets.

- Institutional Adoption: Recent statements from asset managers and ETF issuers point to a potential resurgence of institutional inflow, contingent on regulatory clarity.

- Geopolitical Stress: Ongoing conflicts and trade disputes often influence capital allocation, with possible spillovers into digital assets.

Comprehensive market outlooks available at ThinkInvest.org forecast that a sustained close above the $42,000 threshold could set the stage for a recovery that realigns Bitcoin’s narrative with growth-oriented assets.

Investor Sentiment and On-Chain Insights

Blockchain analytics reveal a tentative optimism among long-term holders, with the Bitcoin supply last active over 18 months nearing all-time highs. However, short-term holders are more cautious, mirroring the broader “wait and see” sentiment pervasive since the underwhelming Q3. Social signals and exchange open interest continue to point toward range-bound trading unless a decisive breakout materializes.

Meanwhile, trading strategies in the current phase focus on strict risk management, with many advocating for the use of stop-losses and the careful sizing of positions around key technical levels such as $42,000. Educational resources from ThinkInvest.org provide further guidance on the implementation of these tactics in choppy markets.

Conclusion: Watching for the Next Move

As “Bitcoin trails equities, metals, and USD in Q3,” the digital asset enters 2025 at a crossroads. The $42,000 price level stands out as the decisive point that could usher in either a return to bullish momentum or further consolidation. Investors should monitor macro trends, regulatory shifts, and on-chain signals to anticipate Bitcoin’s next move, keeping in mind both potential risks and the promise that a breakout above this critical level could bring.