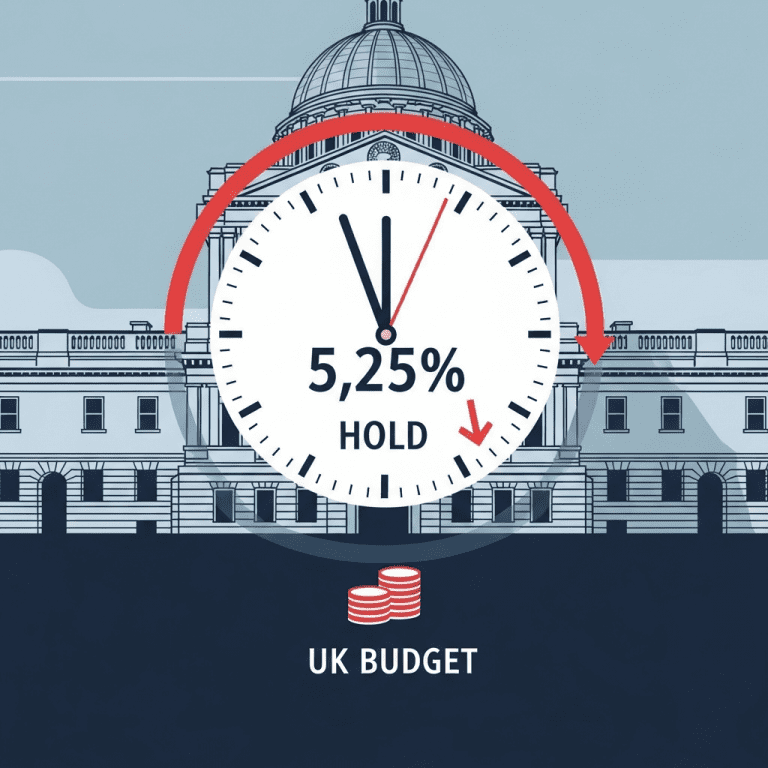

The Bank of England ($BOE) maintained its policy rate at 5.25% as policymakers weighed renewed inflation pressures and the looming UK budget. The decision on the BOE holds rates UK budget comes just days before new fiscal measures, igniting debate over the central bank’s next move.

BOE Keeps Interest Rates Steady Ahead of UK Budget Release

The Bank of England ($BOE) votes 6-3 to hold its main rate at 5.25% on November 2, matching market expectations but leaving investors divided on the outlook. The rate remains at its highest since 2008, after 14 consecutive increases between December 2021 and August 2023 took it from 0.10% up to its current level. Governor Andrew Bailey reiterated in a statement that “inflation risks remain elevated,” pointing to CPI at 4.3% year-over-year in September 2025, while wage growth last quarter topped 6.1% according to the Office for National Statistics. Market probability of another rate hike by Q1 2026, as tracked by Bloomberg, now hovers at 35% following the announcement.

Why High Rates and Budget Uncertainty Weigh on UK Markets

The BOE’s decision echoes broader concerns across UK financial markets, where persistent inflation and tight policy have driven FTSE 100 ($UKX) to shed 1.9% in October, its worst month since March 2023 per LSE data. Sterling traded near $1.2250, down 2% from mid-September as forex traders price in higher-for-longer rates and fiscal ambiguity. Historic comparisons highlight the challenge: core inflation remains well above the BOE’s 2% target, and gilt yields recently climbed to 4.7%, their highest since late 2023. The upcoming UK budget, set for November 6, could either reinforce or undermine monetary tightening depending on the scale of fiscal measures targeting inflation or growth. Analysts warn that potential government spending or tax relief packages may force the BOE to resume tightening despite current cautious signals.

How Investors Should Position As BOE Holds Rates Steady

Investors balancing portfolios amid the BOE holds rates UK budget conundrum face unique opportunities and risks. UK banking stocks, such as Lloyds Banking Group ($LLOY) and Barclays PLC ($BARC), may benefit from ongoing high net interest margins if rates persist but could see pressure if credit demand softens. Export-driven sectors on the FTSE 250 stand to gain should sterling weakness continue. Meanwhile, rising gilt yields attract income-seeking investors but also signal capital risk if debt markets overreact to fiscal signals. For those seeking further market analysis, stock market analysis and insights on forex trading can help investors navigate volatility triggered by both monetary and fiscal changes.

What Analysts Expect Next After BOE and Budget Announcements

According to analysts at HSBC and Oxford Economics, the BOE’s wait-and-see stance reflects uncertainty over how fiscal support in the budget might stoke inflation or trigger policy recalibration. Market consensus suggests further rate hikes are unlikely in the near term unless inflation expectations worsen or wage growth accelerates unexpectedly. Industry observers emphasize that any surprise in the November budget could quickly change the monetary policy narrative and investor sentiment.

BOE Holds Rates UK Budget: Key Signals for Investors in 2025

The BOE holds rates UK budget dynamic spotlights the critical interplay between monetary policy and fiscal actions for UK investors. Watch for post-budget inflation forecasts and signals from the Monetary Policy Committee in upcoming speeches. Investors should stay vigilant as both government measures and central bank guidance remain potent drivers of risk and return over the coming months.

Tags: BOE, interest rates, UK budget, FTSE 100, monetary policy