Bank of Korea Governor Rhee Chang-yong ($BOK) revealed that all policy moves—including rate cuts or hikes—will directly depend on incoming economic data, leaving analysts divided. The focus keyphrase signals a more dynamic approach, upending prior rate guidance and keeping markets on alert for policy pivots.

BOK Holds Base Rate at 3.50% as Data-Driven Approach Surprises Markets

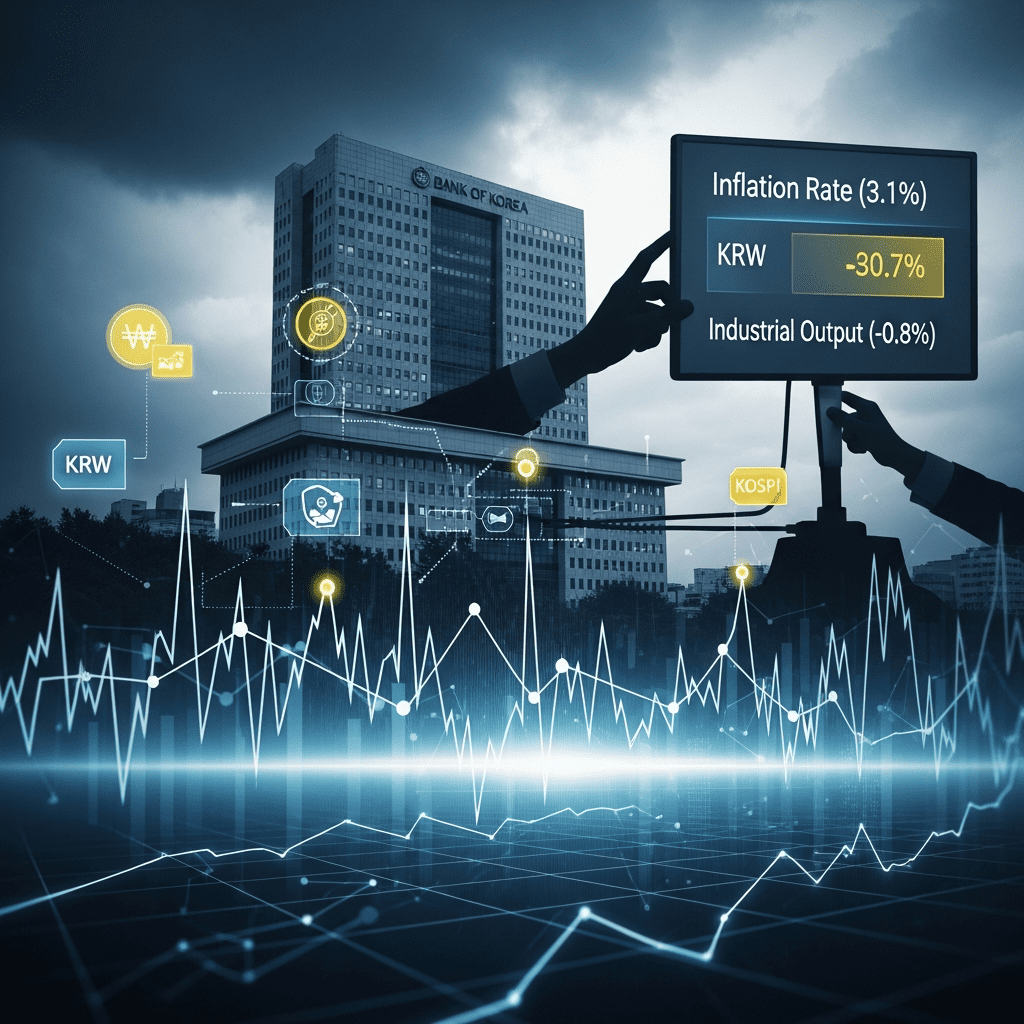

The Bank of Korea ($BOK) held its base rate steady at 3.50% for the seventh consecutive meeting on November 12, 2025, defying some analyst expectations for a dovish shift. Rhee stated, “Our monetary policy direction, including when to change, will be entirely responsive to new economic data,” according to a statement released after the meeting. Recent inflation data showed consumer prices rising 3.1% year-on-year in October 2025—slightly higher than the 2.9% forecast by Bloomberg. The South Korean won (KRW) initially climbed 0.4% against the US dollar after the announcement, while the KOSPI index slipped 0.7% by the close (latest financial news).

Why BOK’s Data-First Policy Shifts South Korea’s Economic Landscape

BOK’s decision to directly tie policy moves to evolving data raises volatility across South Korea’s financial sector. The central bank’s tone contrasts with signals from the US Federal Reserve and European Central Bank, which have delivered clearer forward guidance in recent months. Industrial output in South Korea declined 0.8% month-on-month in September 2025, the third straight monthly fall, per Statistics Korea. This ongoing weakness clouds economic recovery prospects and increases sensitivity to BOK policy surprises. Investors now monitor macroeconomic indicators more closely, as the BOK has signaled any deviation in inflation or growth could immediately alter its policy path.

How Investors Should Rebalance Portfolios Amid BOK’s Data-Driven Moves

Investors exposed to South Korean equities and fixed income face greater uncertainty as the BOK’s guidance shifts. Short-term traders may find opportunity in increased won volatility, while long-term investors monitoring domestic companies such as Samsung Electronics ($005930.KS) will need to watch for interest rate–sensitive earnings revisions. The seven-meeting hold is now explicitly conditional, and any upside surprise in inflation or downside miss in GDP could prompt rapid BOK action. As a result, maintaining diversification and hedging exposure to currency swings is prudent. For further stock market analysis or to track forex trading insights amid BOK policy changes, regular review of portfolio allocation is advised.

What Analysts Expect Next for BOK Policy and Korea’s Markets

Industry analysts observe that the BOK’s willingness to alter course based on incoming data increases both risk and agility in monetary policy. Goldman Sachs and Nomura Holdings have signaled that any substantial uptick in inflation or external shocks could prompt a policy change before year-end, though consensus remains for a hold barring dramatic surprises. Market consensus suggests monthly inflation, trade balance, and labor figures will dictate the timing of any shift. Heightened data sensitivity puts added emphasis on timely, reliable economic releases in shaping policy expectations.

BOK Policy Moves Depend on Data: New Uncertainty or Smart Strategy?

BOK’s signal that all future policy moves depend on data amplifies both unpredictability and responsiveness in Korean markets. The focus keyphrase reflects a shift to real-time decision-making, with inflation and output releases now acting as potential catalysts. Investors should closely watch for economic surprises and be ready to adjust exposure as policy pivots may occur on shorter notice than in past cycles.

Tags: BOK, monetary policy, South Korea, KOSPI, interest rates