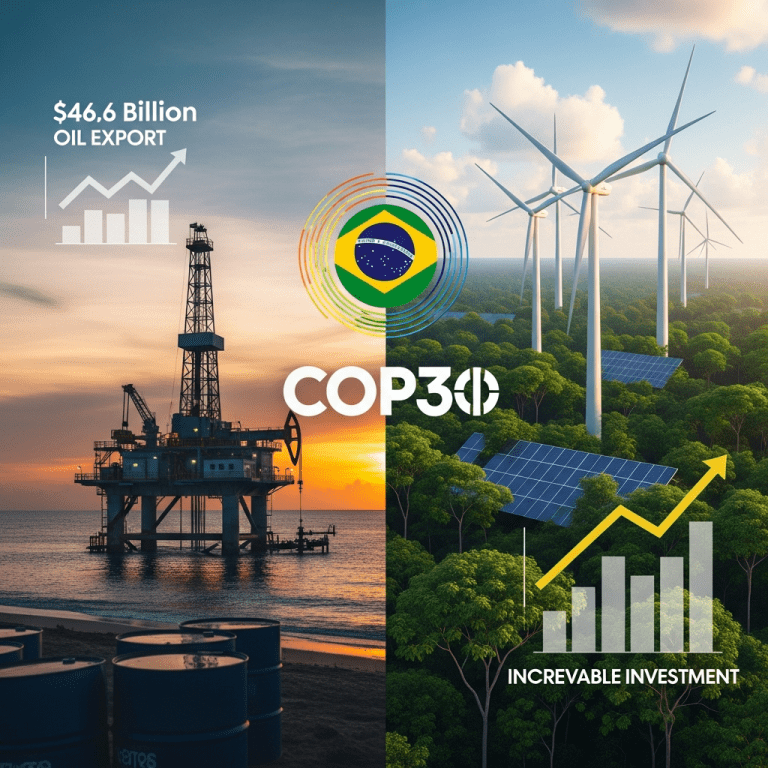

Brazil’s leading energy minister urged nations to endorse a fossil fuel phaseout roadmap at Cop30 ($EWZ), heightening market anticipation for a policy shift. The call for a binding transition surprised investors given Brazil’s oil exports hit $46.6 billion in 2024. Will global policymakers commit to faster decarbonization this time?

Brazil Demands Concrete Fossil Fuel Phaseout at Cop30 With $46B Oil Exports at Stake

On November 18, Brazil’s Minister of Environment and Climate Change Marina Silva formally called for negotiators at Cop30 to “have the courage” to set a clear timeline for a global fossil fuel phaseout. The statement follows a 15% year-over-year increase in Brazil’s crude oil exports, reaching $46.6 billion USD in 2024 according to Comex Stat data.

This bold stance comes as Brazil, representing a major emerging market economy and Latin America’s largest oil producer, surprised markets by proposing proactive fossil fuel curbs despite its $80 billion energy sector GDP contribution (World Bank, 2024). Cop30, set for Belém in 2025, is seen as a flashpoint for global policy change, with more than 190 countries and over 50,000 delegates expected to attend, per UNFCCC estimates.

Why Energy Markets Face Volatility Amid Cop30 Climate Negotiations

The Brazilian initiative intensifies scrutiny on energy markets already grappling with post-pandemic demand and tightening supply. International benchmark Brent crude futures ($BZ:COM) have fluctuated between $81 and $94 per barrel in Q3–Q4 2024, reflecting heightened geopolitical and policy risk (Bloomberg, October 2024).

Major fossil fuel exporters like Saudi Arabia and Russia have publicly resisted stringent phaseout schedules, citing national budget reliance on hydrocarbons—oil accounted for over 70% of Saudi export revenue last year according to OPEC.

Meanwhile, renewables attracted $490 billion in global investment during 2024, up 11% year-over-year (IEA World Energy Investment 2024 report). Whether Cop30 catalyzes further capital rotation from hydrocarbons to green energy assets will be keenly watched on global stock markets.

How Investors Can Position for Cop30 Energy Transition Policy Risks

Investors exposed to Brazilian energy stocks, such as Petrobras ($PBR), and international oil majors may face near-term volatility as Cop30 approaches. Regulatory risk could resurface for fossil fuel-linked ETFs and sovereign bonds from energy-reliant economies if phaseout mechanisms gain traction.

Forward-looking investors are already shifting toward low-carbon portfolios. Clean energy ETFs, such as iShares Global Clean Energy ETF ($ICLN), saw inflows of $2.7 billion in the first three quarters of 2024 (ETF.com). Traditional energy equities in the MSCI Emerging Markets Index underperformed clean energy peers by 8% YTD.

Adapting portfolios to balance cyclical energy exposure with alternative assets is crucial. The upcoming financial news cycle around Cop30 may present re-pricing opportunities for both fossil fuel and renewable equities. Monitor investment strategy trends as institutional allocators draft their Cop30 scenarios.

What Analysts Expect: Cop30 Could Accelerate Energy Sector Decarbonization

Analysts at major investment banks note that policy momentum has decisively shifted toward emissions reduction since Cop28 failed to deliver binding fossil exit timelines in 2023. Industry strategists at Morgan Stanley and UBS (2024 reports) estimate that a Cop30-endorsed phaseout framework could erode $500 billion in fossil fuel producer market cap over the next decade while boosting renewables’ share of global electricity to 44% by 2030.

Market consensus suggests a more defined global fossil fuel phaseout—if achieved at Cop30—would drive increased sector divergence and investment rotation into clean technology, carbon credits, and green infrastructure.

Fossil Fuel Phaseout Roadmap at Cop30 Could Reshape Energy Investing in 2025

The push for a fossil fuel phaseout roadmap at Cop30 puts decarbonization at the center of energy investing debates. Investors will watch for diplomatic signals and draft agreements as Brazil’s policy leverages its $46.6 billion oil market for climate influence. The focus keyphrase, fossil fuel phaseout roadmap Cop30, will define near-term strategy: Actively monitoring policy language and sector flows could prove decisive as a new regulatory era emerges post-Cop30.

Tags: fossil fuel phaseout, Cop30, brazil energy policy, clean energy investing, $PBR