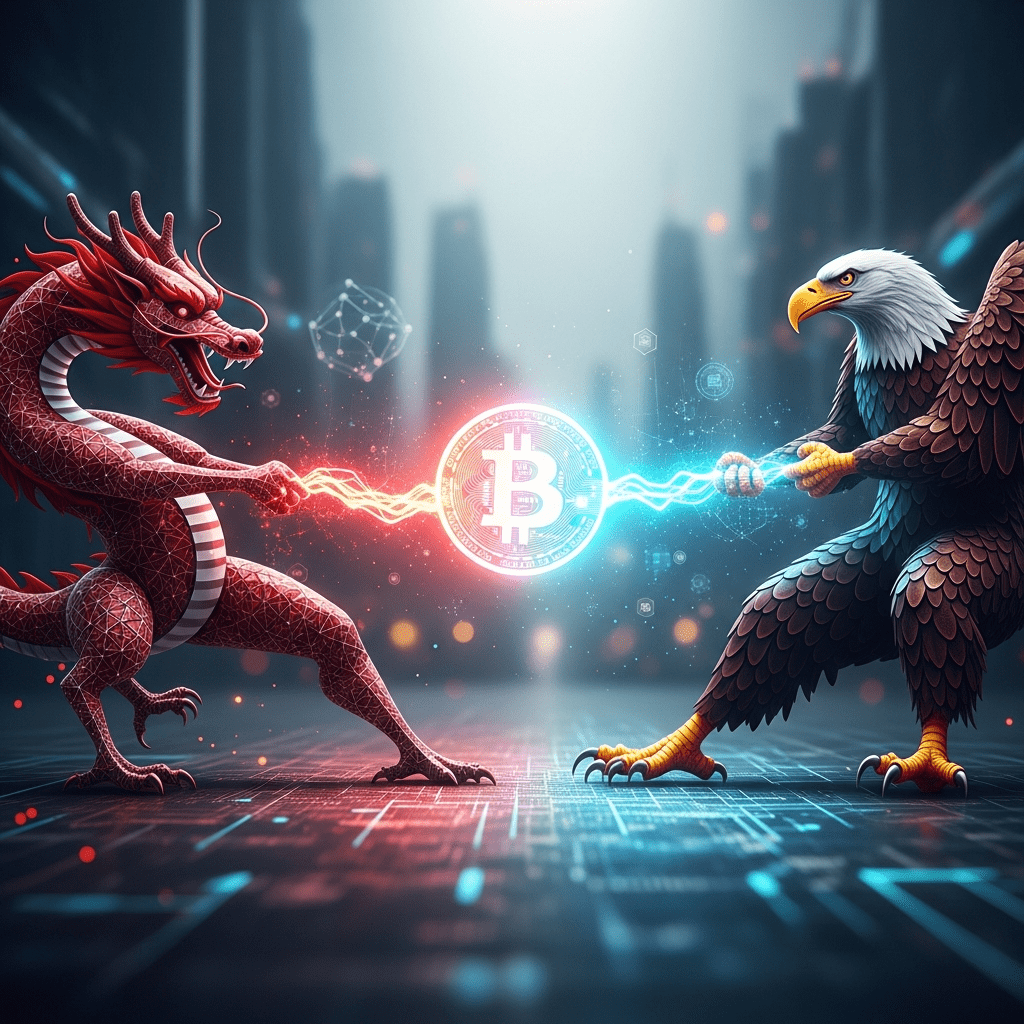

China’s Ministry of Foreign Affairs revealed explosive claims that the United States ($USD) has seized 127,426 Bitcoin valued at $13 billion in a high-stakes legal dispute. The China accuses U.S. of Bitcoin theft headlines sent shockwaves through global cryptocurrency and geopolitical circles, prompting urgent questions about digital asset security and sovereignty.

China Says U.S. Seized 127,426 Bitcoin Worth $13 Billion

On November 12, 2025, China’s foreign ministry directly accused U.S. authorities of unlawfully confiscating 127,426 BTC—roughly 0.65% of Bitcoin’s total circulating supply—from wallet addresses allegedly tied to Chinese nationals. This unprecedented figure amounts to approximately $13 billion at today’s BTC price of $102,100, according to CoinMarketCap data reported on November 11. The dispute follows a series of seizures by the U.S. Department of Justice (DOJ) in 2024 and 2025 relating to illicit crypto proceeds, but this is the first public challenge by a foreign government at this scale. Official Chinese statements demanded “immediate and transparent” disclosure of all seized digital assets, while U.S. officials have so far declined public comment (Reuters, 2025-11-12).

Geopolitical Tensions Fuel Cryptocurrency Market Volatility

The escalating tensions between China and the U.S.—the world’s two largest economies—have amplified volatility across the broader digital asset sector. Bitcoin prices fell nearly 2.7% within hours of the news, slipping from $104,850 to $102,100, and Ether ($ETH) retreated 3.1% to $5,320 (CoinMarketCap, 2025-11-12). Industry analysts note that regulatory and geopolitical risks now increasingly shape crypto price action, with similar disruptions observed after prior major government seizures in 2022 and 2023. The China-U.S. standoff also reignited debate over jurisdictional authority in decentralized markets, just as global crypto adoption surpasses 540 million users (Chainalysis, 2025 Global Crypto Adoption Index).

Investor Strategies as Bitcoin Faces Legal, Political Headwinds

For institutional and individual investors alike, the threat of further asset freezes and international legal disputes underscores the importance of risk-adjusted strategies. Portfolio managers are increasingly diversifying into exchanges and wallets with robust compliance records amid growing regulatory scrutiny. Bitcoin and altcoins with lower exposure to U.S. enforcement action, such as Binance Coin ($BNB), have seen relatively stable flows in the aftermath. Meanwhile, investors active in decentralized finance (DeFi) are weighing additional hedging via derivatives, reflecting caution reminiscent of 2022’s enforcement waves. For ongoing developments and sector analysis, see cryptocurrency market trends and investment strategy updates. As always, staying abreast of latest financial news is critical for navigating turbulent times.

Analysts Highlight Risks and Uncertainties in Cross-Border Crypto

Market strategists emphasize the singularity of China’s claim and the lack of established precedence for international Bitcoin seizures on this scale. Industry watchers at Galaxy Digital observe that uncertainty surrounding jurisdictional claims—especially between superpowers—may result in extended legal disputes with unknown market consequences. According to data compiled by Bloomberg Intelligence through October 2025, multi-sovereign disputes tend to depress crypto sector inflows by up to 4% over subsequent quarters, though many digital assets recover on resolution.

China Accuses U.S. of Bitcoin Theft: What Investors Should Watch Next

The China accuses U.S. of Bitcoin theft saga marks a new chapter in the fight over digital asset sovereignty, with $13 billion in BTC now at the heart of a historic standoff. Investors should closely monitor regulatory developments, potential cross-border asset freezes, and upcoming court disclosures. Any material action could shift crypto market dynamics significantly—highlighting the need for careful risk management in digital asset portfolios.

Tags: Bitcoin, BTC, China, U.S., crypto regulation