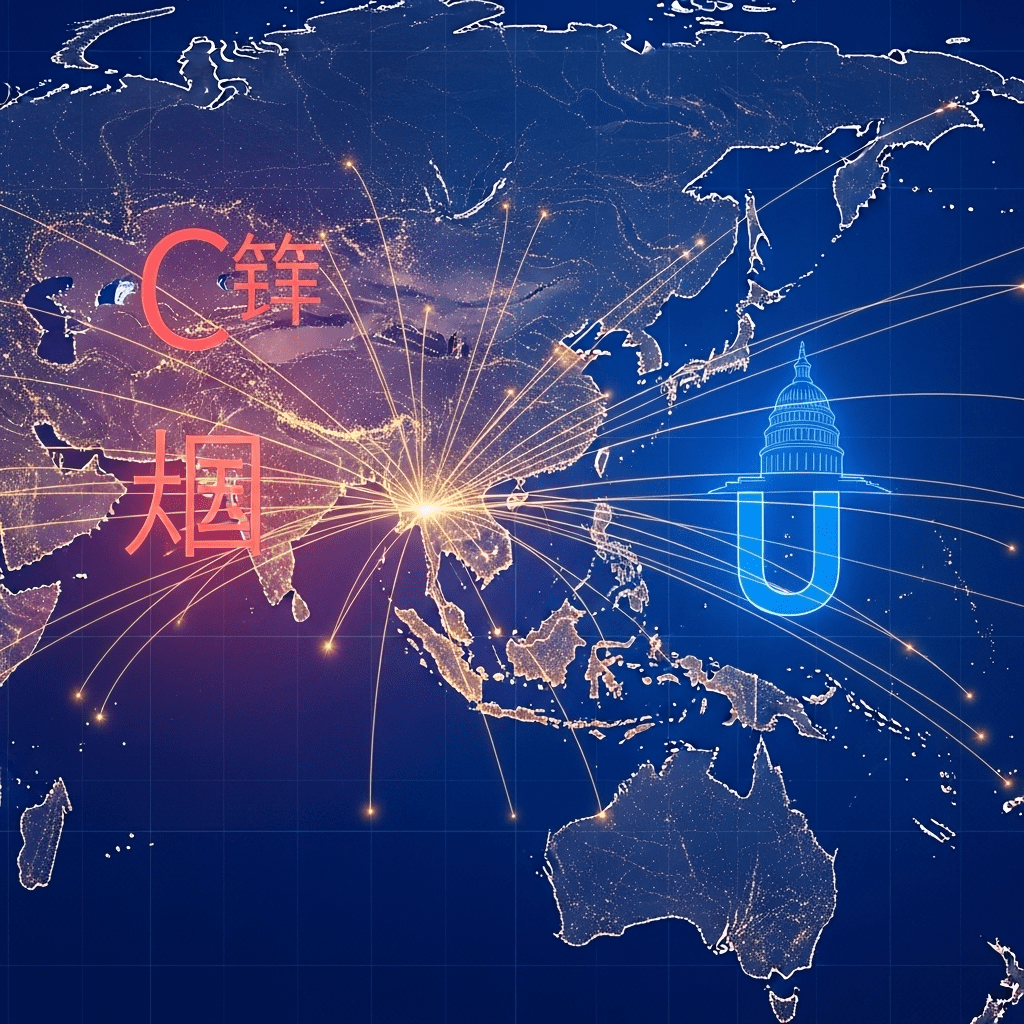

China expands trade pact with Asian economies courted by Trump, redefining the balance of economic power in the Asia-Pacific as both nations vie for regional influence. The expansion signals shifting alliances and new market opportunities, affecting investors and global trade flows in 2025.

What Happened

In June 2025, China formally expanded its Regional Comprehensive Economic Partnership (RCEP), forging deeper trade pacts with key Southeast Asian economies—including Vietnam, Indonesia, and the Philippines—that had also been actively courted by the Trump campaign for alternative U.S.-led agreements. According to Bloomberg, RCEP members now account for roughly 30% of global GDP, reinforcing Asia’s role as a growth engine amid volatile global markets.

China’s Ministry of Commerce stated, “The upgraded RCEP protocols will further lower tariffs, expand digital trade cooperation, and foster cross-border investment flows.” This expansion comes as former President Donald Trump, now leading a renewed 2024 campaign, has proposed bilateral trade deals with many of the same Asian nations—marking a competitive overlap in regional diplomacy.

Data from the Asian Development Bank points to a 5.4% increase in intra-Asia trade volumes since the original RCEP took effect in 2022. The new provisions target e-commerce, logistics, and sustainability, responding to post-pandemic supply chain shifts and growing demand for green infrastructure.

Why It Matters

The competition between China and a resurgent U.S. for influence in the Asia-Pacific signals a critical juncture for global supply chains, trade policy, and emerging market risk. History shows that past trade pivots—such as TPP negotiations in the 2010s—have profoundly shaped sectoral winners and losers.

Analysts highlight that the expanded RCEP framework may accelerate China’s ambition to become the dominant trade partner for ASEAN economies, a position traditionally eyed by U.S. policymakers. The race to secure market access and technology standards raises pressing questions for companies weighing where to build regional bases or supply routes.

This move also bolsters China’s leverage as Western economies seek to rebalance China exposure, highlighting a dynamic already tracked in emerging market analysis and global investment risk research.

Impact on Investors

For investors, China’s expanded trade pact with Asian economies courted by Trump reshapes core sectors, from logistics (CNI, 02899.HK) to technology (Tencent, TCEHY; Alibaba, BABA) and industrial goods (Caterpillar, CAT). Regional ETFs and emerging market funds may see heightened flows as investors reposition in response to shifting tariff structures and the rise of digital trade.

Currency volatility between the yuan and Southeast Asian currencies should be monitored amid potential U.S. retaliatory tariffs. “This realignment is a double-edged sword: while it opens new consumer markets for Asian corporates, it may revive U.S.-China trade tensions and regulatory risk,” said Ellen Wu, chief Asia strategist at BlueBay Asset Management.

Given the macro backdrop, monitoring economic indicators across Asia—such as PMI trends and foreign direct investment inflows—will be critical in the coming quarters. U.S. stocks with Asia exposure may also experience increased volatility as trade dynamics evolve.

Expert Take

Market strategists suggest that China’s RCEP expansion, set against Trump’s revived regional diplomacy, is likely to trigger “competitive dealmaking and standard-setting in Asia for years to come.” Analysts note that the focus on digital trade is poised to benefit companies agile enough to adapt across both U.S. and Chinese regulatory frameworks.

The Bottom Line

China expands trade pact with Asian economies courted by Trump at a moment of global trade recalibration, amplifying both opportunity and complexity for investors. As competing visions for Asian integration unfold, portfolio strategies will depend on navigating evolving tariff risks, growth sectors, and regulatory landscapes. Staying informed through reliable investment insights remains vital for capitalizing on these shifts in 2025.

Tags: China trade pact, Asian economies, RCEP, Trump trade policy, emerging markets.