China’s official factory activity index surprised markets as it contracted for a third straight month, prompting renewed stimulus calls despite Beijing’s recent US trade truce. Industrial output at China National Offshore Oil Corp ($CNOOC) stalled, raising concerns over the depth of the China factory slump October 2025 and its global impact.

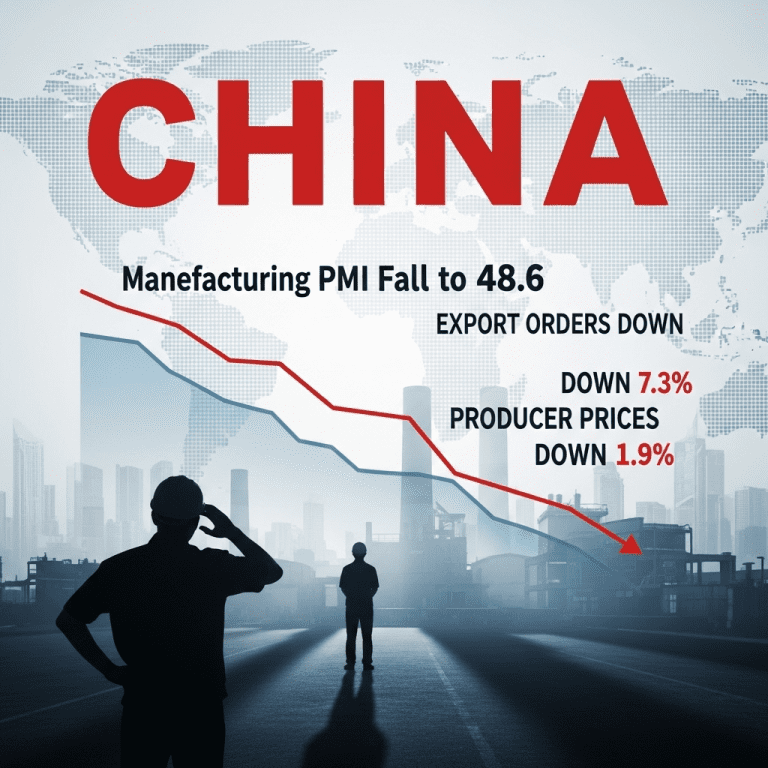

China’s October Manufacturing PMI Falls to 48.6, Deepening Slowdown

The official Manufacturing Purchasing Managers’ Index (PMI) for China dropped to 48.6 in October 2025, marking the largest contraction since April, according to the National Bureau of Statistics. This figure undershoots market expectations of 49.8 and follows a 49.2 reading in September. Shares of China National Offshore Oil Corp ($CNOOC) slipped 2.1% to 13.80 yuan after the PMI release on October 30. Concurrently, export orders declined by 7.3% year-on-year while producer prices fell 1.9%, reflecting persistent deflationary pressures (source: Reuters, National Bureau of Statistics data as of 2025-10-30).

Global Markets on Edge as China Factory Slump Spreads to Asian Exports

The contraction in China’s manufacturing sector is reverberating throughout Asia Pacific equity and commodity markets. The Hang Seng Index lost 1.5% in morning trade October 31, while Japan’s Nikkei 225 shed 0.8% amid worries about weaker regional demand. Copper futures dipped below $7,900 per metric ton on the London Metal Exchange, their lowest since July 2025. HSBC’s regional export tracker reports a 6.1% year-on-year decrease in South Korean chip shipments for October, underscoring China’s central role as an Asian supply-chain hub. Analysts note that weaker Chinese output often signals ripple effects for global supply chains and commodities pricing (stock market analysis).

Investor Exposure: Managing Risks Amid China Slowdown Pressures

Investors holding Asian equities, especially sectors tied to manufacturing and basic materials, are facing renewed scrutiny of portfolio allocations. Companies like Baosteel ($SSE:600019) and Semiconductor Manufacturing International Corp ($HKG:0981) each fell over 2% in Hong Kong trading, following the negative data. Currency markets saw the yuan weaken past 7.35 to the US dollar. As policymakers debate targeted fiscal support, short-term traders are closely monitoring Chinese credit impulse figures and monthly trade balances for further signals. Diversification into less cyclical assets—such as consumer staples and healthcare—remains a favored defensive play. For those seeking macro context, latest financial news on China’s policy response and global demand trends offers real-time insights, while increased volatility could benefit forex trading insights focused on Asia-related FX pairs.

Analysts Predict More Targeted Stimulus as Downturn Persists

Industry analysts observe that continued factory contraction raises the likelihood of additional stimulus, even amidst the recent US-China trade détente. Morgan Stanley economists warn that consumption-led recovery has stalled and that Beijing may boost infrastructure spending or further ease credit controls in November. Market consensus suggests monetary easing alone is unlikely to reverse deflation and restore factory momentum without deeper structural reforms.

China Factory Slump October 2025 Signals Shifting Investment Landscape

Ongoing China factory slump October 2025 points to heightened uncertainty for global investors, with stimulus policies and trade flows now under sharper scrutiny. Watch for upcoming People’s Bank of China actions and official guidance ahead of the December manufacturing data. Investors should remain vigilant, evaluate regional exposures, and consider defensive allocations as the effects of China’s industrial slowdown unfold.

Tags: China, CNOOC, manufacturing, stimulus, Asia equities