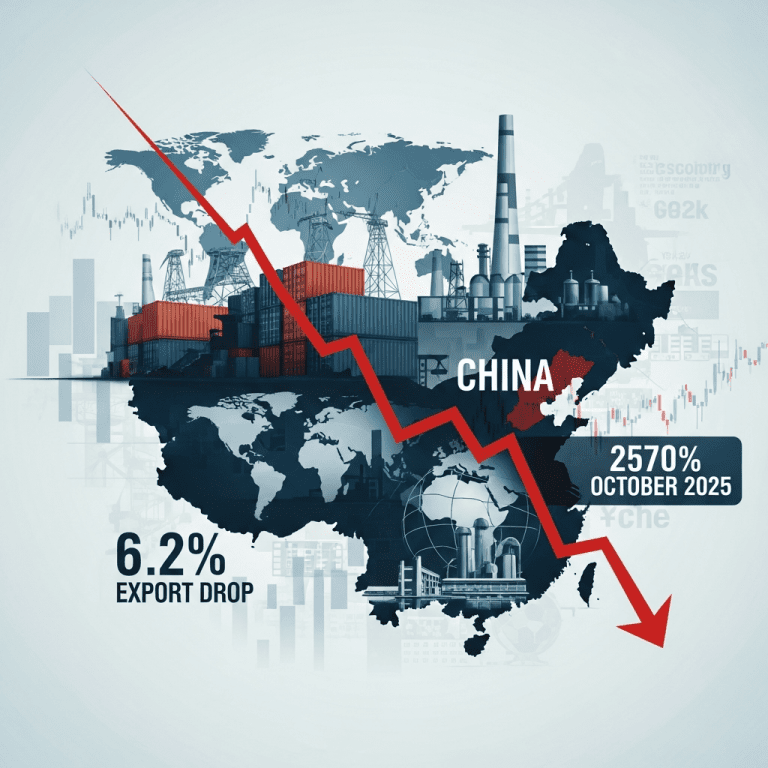

China ($SSE) revealed a 6.2% drop in exports for October 2025, marking the first contraction since February and surprising markets expecting continued growth. The Chinese exports slump October 2025 unsettled economists as trade data signals wider economic pressure. What triggered this unexpected downturn?

China Export Volumes Fall 6.2% in October as Trade Tensions Bite

China’s General Administration of Customs reported on November 7 that exports declined 6.2% year-on-year in October to $298.3 billion, reversing a seven-month streak of growth (Reuters, 2025-11-07). Exports to the U.S. fell a sharp 9.7%, while shipments to the European Union dropped 8.1%. Imports dipped 1.4% to $218.6 billion, resulting in a narrower monthly trade surplus of $79.7 billion. Analysts had expected a modest 1% export drop, making this the steepest fall since late 2023 (Bloomberg, 2025-11-07).

How China’s Export Downturn Impacts Global Markets and Supply Chains

The sudden contraction in Chinese exports reverberates through global markets. Key indices like the Hang Seng Index fell 1.5% at the open following the data release, reflecting concerns over weakening demand (Hong Kong Exchange, 2025-11-07). Analysts note the downturn comes amid persistent U.S.-China trade tensions, shifting consumer demand in Western economies, and uneven recovery in Chinese manufacturing. According to the World Bank’s June 2025 report, China accounts for over 13% of global exports; any disruption to its trade can ripple worldwide, affecting sectors such as electronics, automotive, and raw materials.

Investor Strategies After China’s Export Slump: Risks and Opportunities

Investors holding shares in export-driven Chinese firms like BYD ($BYDDF) and Alibaba ($BABA) may face elevated volatility as earnings forecasts adjust to lower trade volumes. Currency traders have already seen the yuan weaken to 7.31 per U.S. dollar—a two-month low—impacting forex trading insights and portfolio hedging strategies. Emerging market fund managers may consider diversifying exposure, while global supply chain disruptions could elevate logistics and shipping stocks. For those following broader stock market analysis, attention shifts to consumer staples and domestic China growth sectors less exposed to export pressures. Staying updated with the latest financial news will be critical as new trade policies and tariffs develop.

What Analysts Expect Next After China’s October Export Decline

Industry analysts observe that ongoing geopolitical risks and a slow recovery in consumer demand could weigh on Chinese exports into 2026. Market consensus suggests additional stimulus may be considered if export weakness persists into the holiday season. Some strategists highlight recent government efforts to stabilize trade, but caution that future export growth depends on global inflation, U.S. policy, and recovering demand in the EU and Southeast Asia (Bloomberg, 2025-10-30).

Chinese Exports Slump October 2025 Signals Shifting Growth Priorities

The Chinese exports slump October 2025 underscores a pivot point for investors tracking Asia and emerging markets. Watch for policy support signals from Beijing, evolving trade agreements, and rebalancing towards domestic demand. Investors should carefully assess exposure to export-reliant sectors and look for signs of stabilization as the global trade landscape evolves.

Tags: Chinese exports, SSE, trade slump, global markets, export stocks