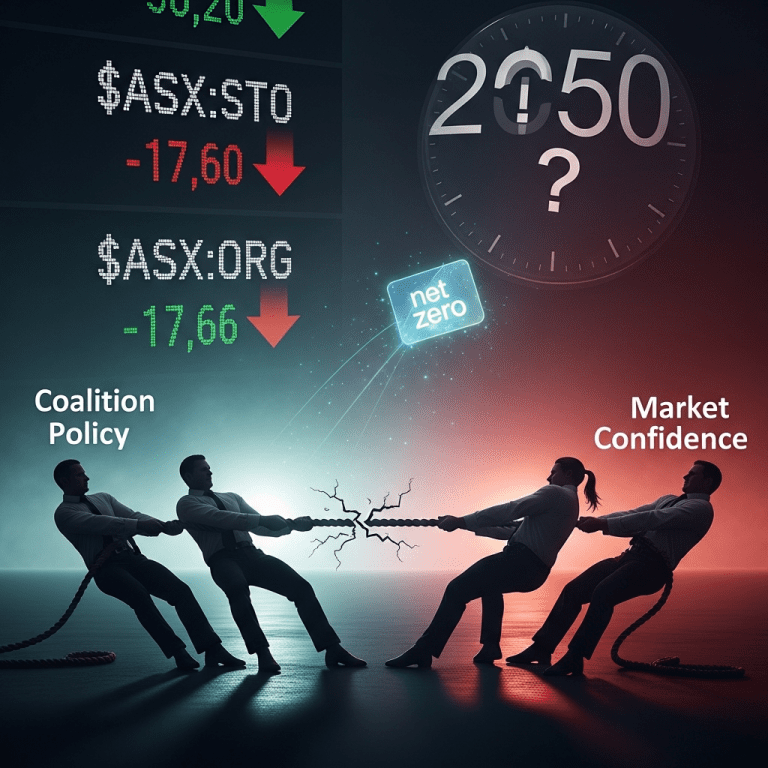

Energy sector shares retreated sharply as the Coalition’s internal brawl over the 2050 net zero emissions target ($ASX:STO, $ASX:ORG) rattled investor confidence, with the focus keyphrase Coalition net zero emissions target dominating market chatter. The unexpectedly intense political infighting triggered broad volatility, raising fresh questions for energy portfolios in late 2025.

Coalition Infighting Over 2050 Target Slashes Energy Stocks 3.9%

Major listed energy companies including Santos ($ASX:STO) and Origin Energy ($ASX:ORG) posted steep declines as Coalition lawmakers publicly split on Australia’s 2050 net zero emissions target. Santos fell 3.9% to A$6.27, while Origin tumbled 2.8% to A$7.14 at market close on November 11, per ASX data. Trading volumes were up 34% against the 30-day moving average, signaling outsized institutional repositioning. The abrupt drop followed outspoken opposition from Nationals MPs and high-profile Coalition figures, with Reuters reporting “record fracturing” within the party coalition over climate policy direction. Recent polling from Essential Media (October 2025) shows 65% of surveyed Australians support the 2050 net zero target, contrasting sharply with internal Coalition dissent. Meanwhile, the S&P/ASX 200 Energy Index lost 2.7% in a single session, its sharpest daily decline since June 2025.

How Political Uncertainty Impacts Energy Sector Performance

The sudden volatility in energy equities highlights the close link between political risk and sector performance in Australia. Energy investments have remained highly sensitive to regulatory and policy shifts: since 2019, policy disputes have coincided with sector underperformance versus the wider S&P/ASX 200 index by 6-9 percentage points, according to Bloomberg data. The ongoing net zero debate revives memories of past market corrections—most notably following the May 2022 federal election, when sector stocks saw a 4.3% single-session plunge after coalition party infighting emerged. Wellspring Advisory’s September 2025 sector note observed that “regulatory ambiguity inhibits capex, delays project FIDs, and caps near-term valuations.” In addition, forward contracts for electricity futures on the Australian Energy Market Operator (AEMO) showed a 3.1% increase in implied volatility this week, reflecting broader market unease. This dynamic has reinforced the energy sector’s reputation as one of the ASX’s most policy-exposed plays. For background analysis of broader market reactions to policy events, see stock market analysis.

Investor Response: Rotation, Hedging, and Risk Assessment in Energy

Active investors have begun rotating away from pure-play fossil fuel assets amid policy uncertainty, favoring defensive exposures and integrated utilities such as AGL Energy ($ASX:AGL), which slipped just 1.1% on the day. Portfolio managers are increasing short-term hedges in energy and bulk commodity names, as per trader feedback gathered by the Australian Financial Review late last week. Relative options volume in energy ETFs doubled this week per ASX exchange data, with implied put premiums up 18% since November 1. Multi-asset strategists are recommending a barbell approach—retaining select large-cap exposures with visible renewables pipelines, while trimming overweights in high policy-risk hydrocarbons. Passive investors may see further NAV drag in sector-tracking funds if the net zero debate stretches into 2026. Investors tracking the interaction of policy and financial news should monitor latest financial news releases and seek sector-specific updates at investment strategy.

Expert Analysis: Why Analysts See Prolonged Energy Market Volatility

Market consensus suggests Australia’s energy sector is heading into a period of extended volatility as policy direction remains clouded. Major brokerages including Morgan Stanley and CLSA note that persistent uncertainty over Australia’s climate roadmap could delay new investments and increase the cost of capital for local producers. Industry analysts observe that long-duration infrastructure projects may face lengthier final investment decision (FID) timelines, with equity risk premiums rising 50-110 basis points since early October 2025. These developments signal continued caution from institutional investors until political clarity returns.

Net Zero Emissions Target Debate Signals New Era for Energy Investors

Fresh turbulence around the Coalition net zero emissions target underscores how pivotal policy credibility is for Australia’s energy market. Investors should expect sustained volatility absent clear cross-party consensus, making risk management and sector rotation strategies crucial into 2026. Watch for regulatory statements and polling momentum as key catalysts shaping portfolios in this unpredictable landscape.

Tags: Coalition net zero, energy sector, $ASX:STO, regulatory risk, Australia politics