Columbus Realtors ($PRIVATE) and technology platform Rayse have launched a new initiative to quantify agent impact in the $120 billion housing market. The Columbus Realtors Rayse agent value partnership introduces data-driven benchmarks to measure agent performance, a move designed to help brokerages navigate tightening margins nationwide.

Columbus Realtors and Rayse Launch Agent Value Measurement Program

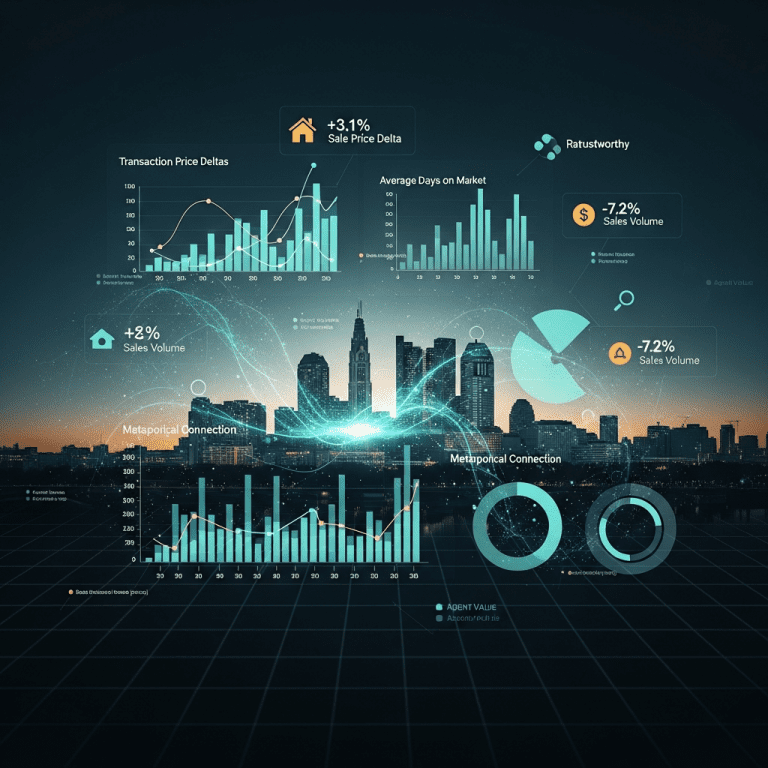

Representing over 10,000 real estate professionals in Central Ohio, Columbus Realtors ($PRIVATE) has partnered with Rayse to roll out a proprietary dashboard that tracks agent performance metrics, including transaction price deltas, days on market, client satisfaction, and deal volume per agent. In Q3 2025, Columbus agents closed 8,740 transactions totaling $2.95 billion in sales, a 4.3% increase year-over-year. Early analyses show the median agent generated a 3.1% higher sale price compared with for-sale-by-owner listings, based on MLS and Rayse pilot data from 2024. The program aims to bolster agent differentiation as regulatory scrutiny and commission pressures reshape the market. (latest financial news)

Why the Real Estate Sector Views Data as Critical

The initiative comes as real estate brokerages face increasing disruption. Since early 2024, average U.S. agent commissions fell from 5.5% to 5.0%, and national transaction volumes dropped 7.2% year-over-year by September 2025 (NAR, Redfin Research). Across markets like Austin and Boston, data-driven agent benchmarking programs have emerged to justify commissions and improve client trust. By measuring tangible agent ROI, Columbus Realtors signals a broader trend: brokerages are increasingly turning to analytics to maintain competitive advantage and reduce informational asymmetry. (stock market analysis)

Investor Implications: Positioning for the Real Estate Analytics Shift

Investors in real estate services and proptech should monitor the growing adoption of agent performance analytics. Brokerages embracing transparent metrics may capture greater market share, while firms relying solely on reputation risk margin erosion. Companies like Zillow Group ($ZG) and Redfin ($RDFN) integrated agent performance ratings in 2024, resulting in projected 9–11% traffic conversion improvements (Evercore ISI, June 2025). For ETFs like the S&P Real Estate Select Sector ($XLRE), increased data adoption may favor scalable, tech-driven platforms. Portfolio managers should track new launches, partnerships, and industry consolidation trends as analytics reshape brokerage dynamics. (investment strategy)

Analyst Outlook on the Columbus Realtors Rayse Initiative

Industry analysts view the Columbus Realtors Rayse agent value program as a bellwether for nationwide trends in agent validation. Swanepoel Trends Report (2025) finds that 70% of brokerages anticipate advanced agent-level reporting will become standard within three years. Zelman & Associates highlights that regional associations leading in transparency could set benchmarks for national adoption, particularly amid ongoing legal and regulatory scrutiny of commission practices. Firms implementing robust analytics pipelines may see higher client retention and improved gross margins.

Columbus Realtors Rayse Agent Value Partnership Signals Market Transformation

The Columbus Realtors Rayse agent value initiative represents a shift toward data-driven competitive advantage in real estate. Early dashboard adoption and productivity metrics should be closely monitored as leading indicators of nationwide implementation. As investor attention on real estate efficiency intensifies in 2026, this partnership is poised to become a market-defining reference for agent benchmarking across the U.S.

Tags: Columbus Realtors, Rayse, agent value, real estate analytics, commission trends