D.R. Horton ($DHI) shares edged down 1.7% to $107.35 on Thursday after Jim Cramer declared that lower rates are essential to reignite business, catching investors off guard. The focus keyphrase ‘Jim Cramer D.R. Horton rates’ dominated trading floors as the homebuilder faces renewed pressure in a tough rate environment. Will this signal a shift ahead of 2025’s rate decisions?

Jim Cramer Urges Rate Cuts as D.R. Horton Stock Falls 1.7%

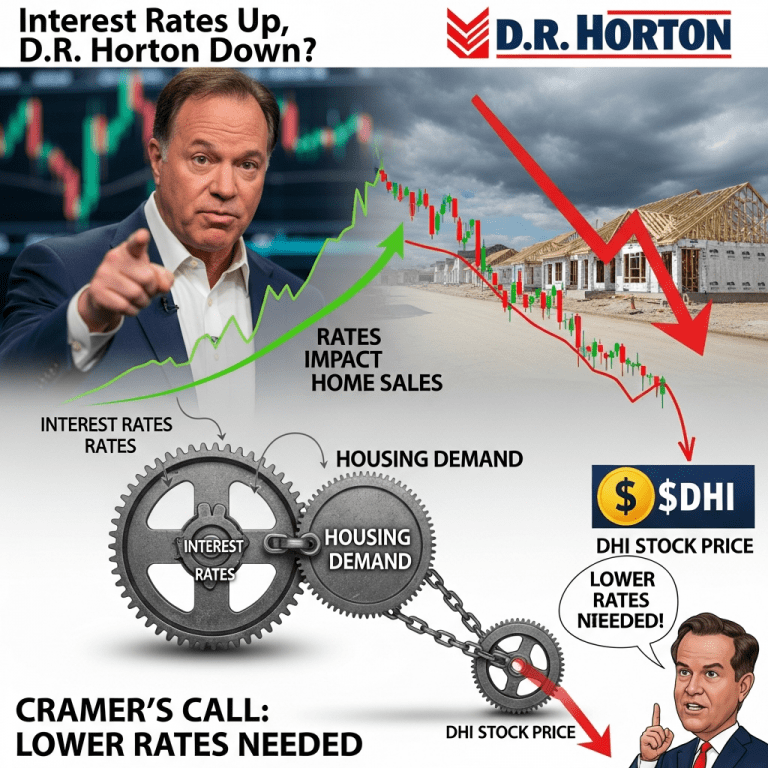

Jim Cramer, host of CNBC’s “Mad Money,” revealed on October 31 that D.R. Horton ($DHI) “needs lower rates to get business reignited,” following a 1.7% slide in the homebuilder’s share price to $107.35. The stock is now down nearly 12% from its 2025 high of $121.75 set in May, according to Nasdaq market data. D.R. Horton reported a 5% year-over-year decline in net sales orders for the fiscal fourth quarter ended September 30, 2025, per its most recent SEC filing. Trading volume spiked to 3.8 million shares versus the 30-day average of 2.4 million, indicating investors are reacting sharply to rate-sensitive commentary.

Why Homebuilder Stocks Are Stalling Amid Persistent High Rates

The pronounced reaction to Cramer’s comments highlights investor apprehension about elevated borrowing costs across the U.S. homebuilding sector. According to Freddie Mac, the average 30-year fixed mortgage rate hovered around 7.65% in late October 2025—up from 6.85% just twelve months prior. This sharp rise has dampened affordability and weighed on new home sales, which fell 4.4% year-over-year in September. The SPDR S&P Homebuilders ETF ($XHB), which tracks leading builders, has retreated more than 8% from its August highs, reflecting broad-based sector anxiety. Persistent policy uncertainty around the Federal Reserve’s next move continues to unsettle market sentiment, especially for rate-sensitive industries.

How Investors Should Adjust Portfolios Facing Higher Mortgage Rates

With borrowing costs unlikely to fall quickly, investors holding D.R. Horton ($DHI) and other homebuilder stocks face heightened volatility. Those with longer-term horizons may look toward defensive sectors or diversify via real estate investment trusts (REITs) less dependent on new builds. Active traders could view earnings releases or Federal Reserve statements as catalysts for sharp price swings, while sector ETF investors may adjust allocations based on stock market analysis. Monitoring macroeconomic trends and upcoming latest financial news can help assess risks as fiscal policy evolves. The interplay between rates, consumer demand, and construction input costs remains pivotal for portfolio rebalancing through late 2025 and beyond.

What Analysts Expect Next for D.R. Horton and the Housing Market

Industry analysts observe that homebuilder sentiment has weakened in consecutive monthly surveys, with the National Association of Home Builders/Wells Fargo Index falling to 46 in October, well below the neutral level of 50. Market consensus suggests the Federal Reserve may hold rates steady into early 2026, prolonging downward pressure on the sector. Strategists at Goldman Sachs noted in a September research note that affordability is the single largest hurdle for new home demand, and that a sustained rate decline is required before stocks like D.R. Horton ($DHI) can reaccelerate.

Why Jim Cramer D.R. Horton Rates Comments Matter for 2025 Investors

Jim Cramer’s spotlight on D.R. Horton underscores how acutely sensitive the sector is to monetary policy shifts and rate speculation in 2025. As “Jim Cramer D.R. Horton rates” becomes a focal point for market watchers, investors should watch for upcoming Fed meetings and housing data releases through Q4. Those agile enough to adapt to evolving rate expectations will be best positioned for emerging opportunities—and risks—across U.S. homebuilding stocks.

Tags: D.R. Horton, DHI, Jim Cramer, homebuilder stocks, interest rates