Dara Invoice by Sagent ($SAGT) revealed its much-anticipated launch during November Demo Day, spotlighting new digitized invoicing solutions for the real estate sector. The focus keyphrase, Dara Invoice by Sagent, dominated industry chatter, as investors questioned how this technology could shift sector profitability. Will this demo accelerate proptech innovation faster than expected?

Dara Invoice by Sagent Launches Paperless Platform at $3.9B Real Estate Summit

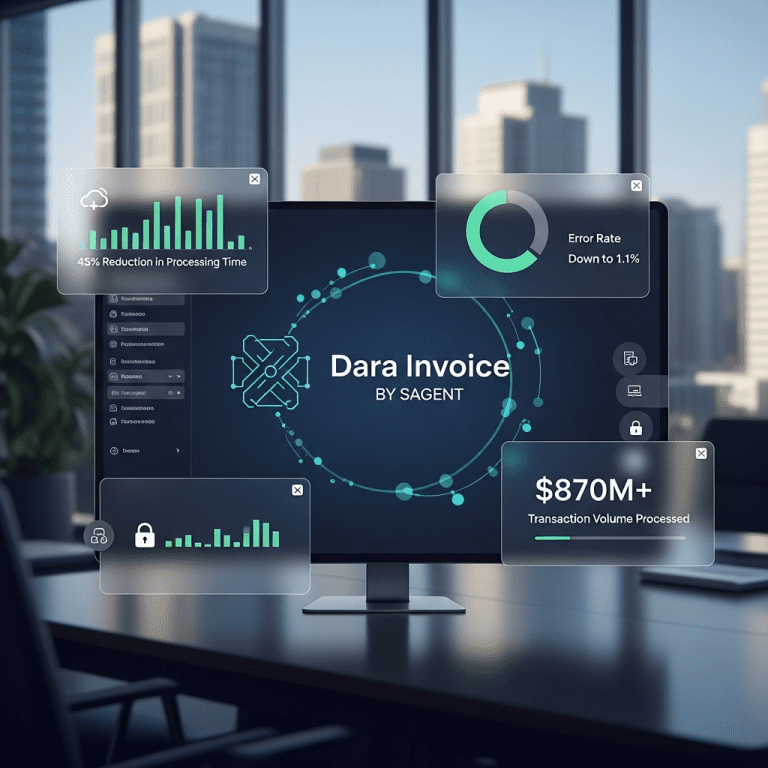

Sagent ($SAGT) introduced Dara Invoice at the annual November Demo Day, presenting its cloud-based, automated invoicing platform to over 1,200 real estate professionals from firms managing $3.9 billion in assets. Early pilot customer data, shared by Sagent in its October 2025 release, showed reductions in manual invoice processing times by 45% and a decrease in error rates from 7.2% to 1.1% over a six-month period. According to the company, more than 250,000 invoices — representing upward of $870 million in transaction volume — have already been processed through Dara Invoice since Q2 2025. (Source: Sagent company statement, October 2025; sector survey, CRETech)

Why Digitized Invoicing Reshapes Real Estate Sector Workflow

The rise of platforms like Dara Invoice by Sagent arrives amid a historic push to streamline commercial real estate operations. According to the Urban Land Institute, administrative costs accounted for roughly 12% of gross property expenses in 2024, while the entire proptech sector drew record venture investment of $19.8 billion (JLL Global PropTech Report, 2024). Industry data suggest that manual billing and reconciliation remain among the slowest—and most error-prone—points in property management workflows. By automating these functions, platforms such as Dara Invoice could enable portfolio operators to reallocate up to 15% of back-office labor hours to higher-value activities, aligning with a broader industry shift towards digital transformation. Economic headwinds—including persistent interest rates near 5.4% (per Federal Reserve September 2025 data)—are pushing firms to pursue efficiency wherever possible.

How Investors Can Leverage Proptech Disruption After Sagent’s Launch

Investors focused on real estate technology stocks may find renewed momentum in the wake of Sagent’s ($SAGT) product demo. Companies enabling digitalization—such as Procore Technologies ($PCOR) and RealPage ($RP)—have outperformed broader real estate indices; the NASDAQ PropTech Index is up 9.3% year to date, compared to just 3.8% for the S&P 500 Real Estate Sector (Bloomberg, as of October 31, 2025). For tactical investors, Sagent’s launch could catalyze similar adoption across competitor platforms, presenting short- and mid-term trading opportunities. However, market participants should monitor regulatory responses and cybersecurity risks as digital invoicing platforms increase data exposure. For more insight into sector dynamics, traders can review recent stock market analysis or follow the latest financial news for up-to-date market signals. Institutional investors might also look to investment strategy resources for long-term proptech allocation frameworks.

What Analysts Expect for Proptech Growth and Real Estate Returns

Industry analysts observe that platforms like Dara Invoice by Sagent may accelerate operational efficiencies across the real estate sector, particularly as firms face pressure to improve margins in a high-rate environment. According to proptech investment strategists, increasing digitization could raise average property net operating income by 2-3% within 18-24 months if adoption rates match early pilot benchmarks. However, market consensus suggests further upside may depend on broader macroeconomic stability and continued capital inflows into proptech. (Urban Land Institute, CRETech, Federal Reserve, JLL Global PropTech Report 2024)

Dara Invoice by Sagent Signals New Era for Real Estate Investors

Dara Invoice by Sagent has ignited a technological shift in real estate, offering investors, portfolio managers, and sector analysts a critical point to reassess digital transformation’s trajectory. Those tracking the focus keyphrase should monitor adoption and compliance trends, as upcoming policy changes or sector partnerships could drive near-term volatility. Sagent’s momentum offers a new lens on how rapidly proptech can impact market structure.

Tags: Dara Invoice, Sagent, real estate technology, proptech, $SAGT